Updated – 23 December 2025

As the digital asset sector matures, investor attention is increasingly shifting from speculative narratives to projects that offer measurable utility, infrastructure, and sustainable token models.

This transition is especially visible within the artificial intelligence (AI) segment, where a new wave of crypto token sales aims to combine AI functionality with practical use cases.

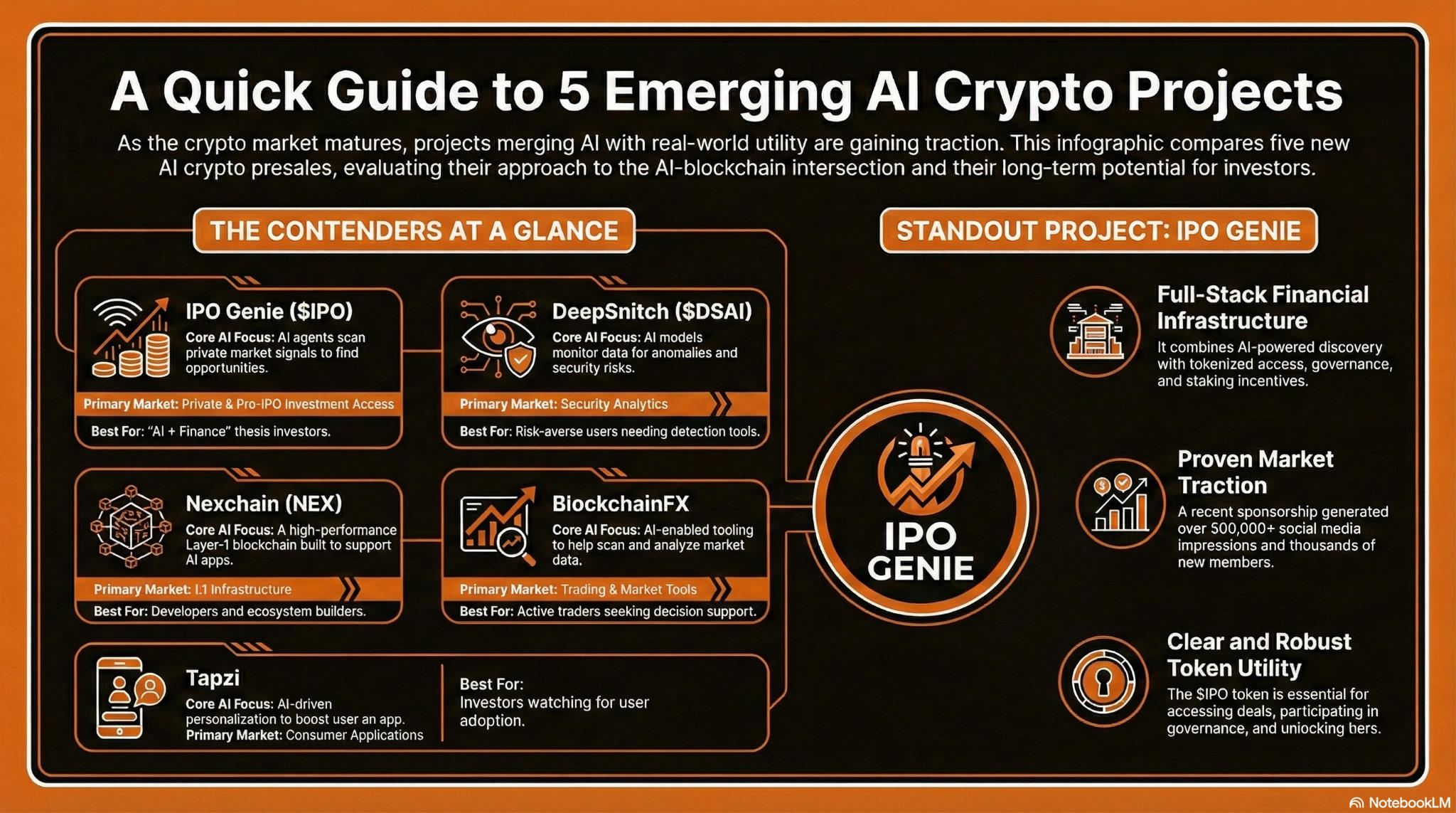

Against this backdrop, five AI token sales are gaining attention: IPO Genie, DeepSnitch AI, Nexchain, BlockchainFX, and Tapzi.

Each project approaches the AI–blockchain intersection differently, addressing markets ranging from private investment access and security analytics to trading tools and consumer applications.

This article evaluates these projects using six commonly applied criteria: the problem being addressed, the role of AI, token utility, early traction signals, infrastructure and compliance posture, and long-term positioning.

Key takeaways

- Utility over hype: Token sales tied to clear use cases and transparent token roles tend to attract more scrutiny and interest.

- IPO Genie positions itself as a platform combining access, governance, and staking mechanics with an AI discovery layer.

- Other projects are niche: Several offerings target narrower markets, which can increase adoption risk.

- Traction indicators: Project-reported visibility events and early-stage token sale activity are cited as indicators of early traction; these claims are project communications and are unverified.

Quick comparison: IPO Genie vs DeepSnitch AI vs Nexchain vs BlockchainFX vs Tapzi

| Project | Core AI focus | Primary market | Token utility | Best for / audience | Risk / dependency |

| IPO Genie ($IPO) | Sentient agents scanning venture/private-market signals | Private & pre-IPO access | Tiers, governance, staking incentives (as positioned) | Users seeking infrastructure-style access and governance mechanics | Deal quality, compliance, execution |

| DeepSnitch AI ($DSAI) | Monitoring / detection / anomaly intelligence | Security analytics | Feature access and participation (as positioned) | Specialized security users | Must demonstrate detection value; niche adoption risk |

| Nexchain (NEX) | AI-friendly L1 performance theme | L1 infrastructure | Network utility & incentives (as positioned) | Builders and protocol-focused developers | Developer adoption and sustained activity |

| BlockchainFX | AI-enabled trading / market tooling (as positioned) | Tooling & market access | Usage-based utility (as positioned) | Active traders and tooling users | Delivery and retention |

| Tapzi | Consumer AI utility / app ecosystem (as positioned) | Consumer growth | Engagement-based utility (as positioned) | App-growth observers and product-market fit watchers | Adoption and retention |

Five AI token sales gaining attention

- IPO Genie ($IPO) – AI-powered private market access (project-reported)

- DeepSnitch AI ($DSAI) – Security and anomaly detection (project-reported)

- Nexchain (NEX) – AI-focused Layer-1 infrastructure (project-reported)

- BlockchainFX – AI-enabled trading tools (project-reported)

- Tapzi – Consumer AI engagement platform (project-reported)

IPO Genie ($IPO): AI-driven private market access

The project is conducting an early-stage token sale; see the project website for details. https://ipogenie.ai

What it is

IPO Genie positions itself as a platform offering tokenized participation in curated private and pre-IPO opportunities. It aims to open a market that is typically gated.

What the AI actually does

Sentient Signal Agents are described as scanning venture and private-market signals (financials, traction, sentiment) to surface and monitor opportunities, acting as a filter rather than a price predictor, according to project materials.

Token utility (why the token exists)

- Access pathways to private / pre-IPO deals (as positioned)

- Governance participation (as positioned)

- Staking incentives and tier unlocks (as positioned)

Potential audience

Suitable for users seeking exposure to infrastructure-style access, governance mechanics, and participation frameworks rather than a standalone AI tool.

Analyst view (positioning)

Some analysts and the project materials describe IPO Genie as a multi-layer offering that combines AI discovery, access mechanics, governance, and staking. The project cites third-party services in its trust narrative (for example, CertiK, Fireblocks, Chainlink) in its public materials.

According to the project’s communications, it sponsored an event in Dubai and reported increased visibility and community growth; these outcomes are claims from the project and are not independently verified in this article.

DeepSnitch AI ($DSAI): Monitoring and detection intelligence

What it is

DeepSnitch AI frames itself as a security analytics offering focused on monitoring and anomaly detection for complex data streams.

What the AI actually does

Models are described as flagging irregular patterns and producing outputs such as alerts or risk scores (as positioned).

Token utility (why the token exists)

-

- Feature access (as positioned)

- Usage incentives (as positioned)

- Governance signals (as positioned)

Potential audience

Most relevant for users and organizations evaluating specialized detection products and able to assess their effectiveness directly.

Analyst view (positioning)

The project’s differentiation would depend on demonstrable detection value and repeat usage. Adoption ceiling can be constrained by niche focus.

Nexchain (NEX): AI-focused L1 performance play

What it is

Nexchain positions itself as an AI-focused Layer-1, emphasizing performance and throughput themes.

What the AI actually does

The AI thesis is indirect: the chain could matter if it enables AI-heavy applications and if developers choose to build there.

Token utility (why the token exists)

-

- Network fees / utility

- Incentive mechanisms (as positioned)

- Stage pricing mechanics (as positioned)

Potential audience

Relevant for ecosystem participants and investors comfortable with longer build cycles and developer-driven adoption.

Analyst view (positioning)

Success depends on developer adoption and sustained activity beyond incentive programs; performance characteristics alone may not be sufficient.

BlockchainFX: AI-enabled trading and market tooling

What it is

BlockchainFX is described as an AI-enabled market tool to help users scan, rank, and act on market information.

What the AI actually does

Reportedly, the system turns market data into outputs such as screening, alerts, ranking, and decision support to reduce information noise.

Token utility (why the token exists)

-

- Access to features (as positioned)

- Participation incentives (as positioned)

- Governance hooks (as positioned)

Potential audience

Intended for active traders who will judge the product on quality and day-to-day usefulness.

Analyst view (positioning)

Tooling tends to succeed when it achieves retention. Delivery quality and habit-forming utility are key dependencies.

Tapzi: Consumer-facing AI utility and app growth bet

What it is

Tapzi positions itself as a consumer AI utility or app ecosystem where growth and user retention are core drivers.

What the AI actually does

Consumer AI functions are described as personalization, recommendations, or automation intended to increase return usage.

Token utility (why the token exists)

-

- Engagement utility (as positioned)

- Retention incentives (as positioned)

- Governance elements (as positioned)

Potential audience

Most relevant for observers focused on adoption and retention signals rather than promotional narratives.

Analyst view (positioning)

The primary risk is adoption and retention: consumer products need habitual use to scale; otherwise, interest can dissipate.

How to evaluate AI token sales (a simple framework)

- AI function clarity (inputs / outputs)

- Token necessity and clearly described utility

- Distribution and vesting transparency

- Security audits and custody arrangements (if relevant)

- Adoption dependencies (integrations, users, developers)

Why IPO Genie is highlighted in this group

Across these five projects, a pattern emerges: offerings tend to be either tooling (market workflows and automation) or niche analytics (monitoring and detection). Both categories can succeed with strong product delivery, but they often rely on narrower adoption pathways.

IPO Genie is emphasized here because it is framed in project materials as combining financial infrastructure and private-market access with AI-supported discovery. The token is described as enabling access, governance, and staking incentives. These descriptions come from the project’s materials and communications.

That does not make the project risk-free. It remains subject to execution, regulatory, and market risks.

For further information, consult the projects’ official materials and verified channels rather than promotional summaries.

Official website, Twitter (X), Telegram

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.