The cryptocurrency trading market experienced a wild ride that led to the liquidation of approximately $143 million within 24 hours. This significant event has sent shockwaves through the cryptocurrency trading community, highlighting the volatile nature of digital currencies.

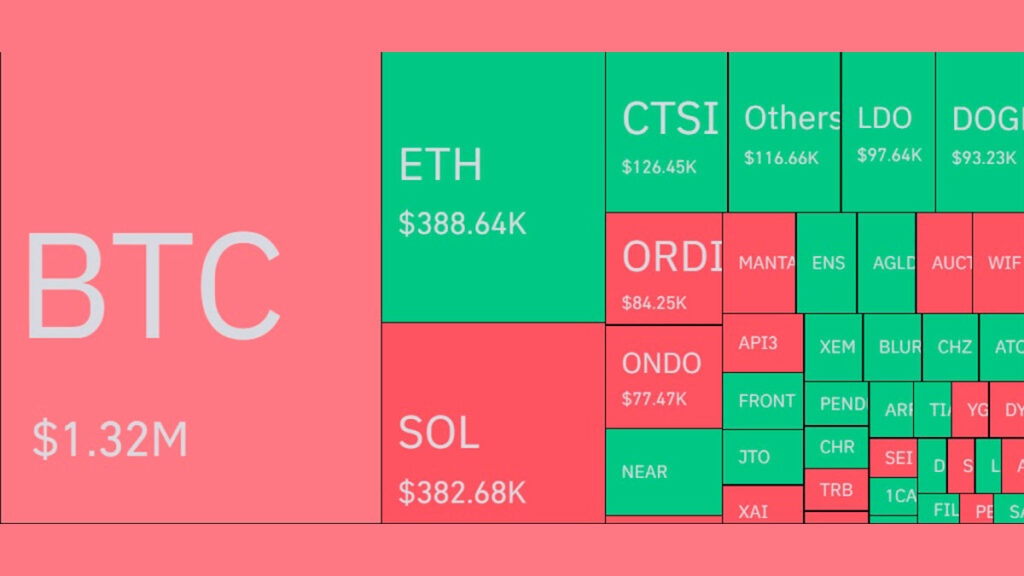

According to data from Coinglass, the bulk of the liquidations were tied to long positions, resulting in a loss exceeding $120 million. In contrast, short positions accounted for a relatively minor portion, contributing approximately $18 million to the total liquidations.

The value of Bitcoin, the leading cryptocurrency in terms of market capitalization, has experienced a decline of over 2.5% within the past 24 hours, pushing its price below the $41,000 threshold. Currently, Bitcoin is trading at $40,865.

The liquidation event was not limited to Bitcoin alone. Ether, the second-largest cryptocurrency by market capitalization, also saw significant liquidations. The combined liquidations of Bitcoin and Ether accounted for a substantial portion of the total liquidation amount. The sudden market volatility caught many traders off-guard, leading to the liquidation of their positions.

The Market’s Impact on Crypto Exchanges and Platforms

This event underscores the inherent risks associated with crypto trading, particularly in leveraged positions. Cryptocurrency exchanges were not spared from the impact of this market volatility. Binance, the world’s largest crypto exchange by trading volume, saw significant losses. Other major exchanges like OKX and HTX also reported substantial liquidations.

This wild ride in the crypto market serves as a stark reminder of the potential risks and rewards associated with digital currency trading. While the prospect of high returns can be enticing, the possibility of sudden market shifts leading to significant liquidations is a reality that traders must be prepared to face.

As the dust settles from this event, the crypto trading community is left to reflect on the lessons learned. The importance of risk management and careful market analysis has been brought to the forefront. Despite the challenges, the resilience of the crypto market continues to shine through, demonstrating its potential to bounce back from such circumstances.

In conclusion, the recent liquidation event serves as a testament to the dynamic and unpredictable nature of the cryptocurrency market. It underscores the need for traders to exercise caution and implement robust risk management strategies to navigate the turbulent waters of digital currency trading.