TL;DR

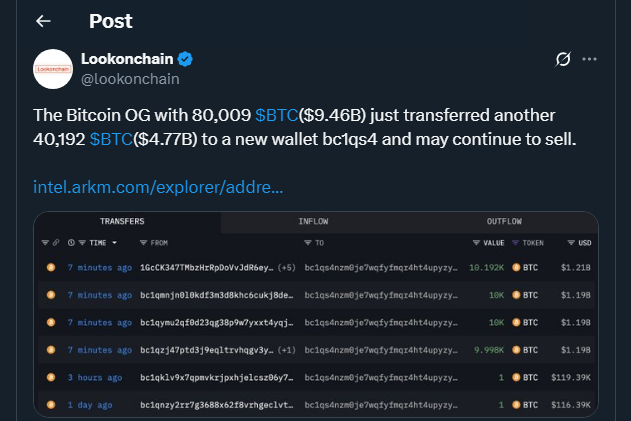

- A legendary Bitcoin wallet, untouched since 2011, has just moved another 40,192 BTC, worth about $4.77 billion, fueling new speculation about more large-scale sales.

- The coins were sent to a fresh address after previous transfers ended up with Galaxy Digital and possibly OKX.

- Despite fears of selling pressure, many see this as a sign of early holders cashing in responsibly while Bitcoin remains strong near $118,000.

Early Thursday, blockchain trackers flagged another massive transaction from an address inactive for over a decade. This old-school whale first made waves on July 4 when it shifted around 80,000 BTC in several tranches, surprising traders and analysts alike. Back then, 40,010 BTC found their way to Galaxy Digital, which specializes in helping institutional clients handle over-the-counter crypto trades securely and with minimal market impact for investors.

Some coins reportedly flowed to exchanges like OKX, sparking worries about downward price impact. However, Bitcoin’s price remains resilient above $118,000, showing the asset’s growing maturity and the depth of its liquidity. For many long-term supporters, this movement shows that big holders now trust professional crypto firms to handle large transactions discreetly instead of dumping them on open markets where panic could easily spread among retail investors worldwide.

OTC Trading Helps Absorb Large Moves

Galaxy Digital’s role highlights how sophisticated OTC services can ease the impact of whale-sized moves. Rather than flood public order books, these big transactions often find private buyers looking to accumulate significant positions. While it’s unclear exactly how much has been sold so far, this channel reduces volatility and offers legacy holders a structured exit when needed most by everyone.

Early Miner Cashing Out Or Strategic Rebalance

Industry experts suggest this whale is likely an early miner from Bitcoin’s infancy when mining rewards were fifty times higher than today. Over the years, a stash like this can grow into a massive fortune. Some insiders believe the owner might be diversifying part of their holdings or moving funds for better custody solutions. The fact that this wallet stayed dormant for 14 years and only awoke now signals confidence in Bitcoin’s current strength and its institutional ecosystem.

Though there may be more transfers ahead, many Bitcoin advocates argue that gradual, discreet selling demonstrates the asset’s unique liquidity compared to other markets. As Bitcoin continues to flirt with record highs, its ability to absorb billions in legacy coins without major disruption underscores why so many remain bullish on its future and see it as a true store of value worldwide, stronger than ever.