TL;DR

- Hybrid Financing Innovation: VanEck introduces BitBonds—a 10-year debt instrument combining 90% U.S. Treasury bonds with 10% Bitcoin exposure—to tackle the U.S. government’s $14 trillion refinancing need.

- Investor Upside with Controlled Risk: VanEck’s BitBonds offers investors shared gains if Bitcoin’s performance drives yields above a 4.5% cap, while the Treasury component helps mitigate downside risks.

- Bridging TradFi and Crypto: VanEck’s proposal paves the way for integrating traditional government borrowing with digital asset innovation, appealing to modern investors.

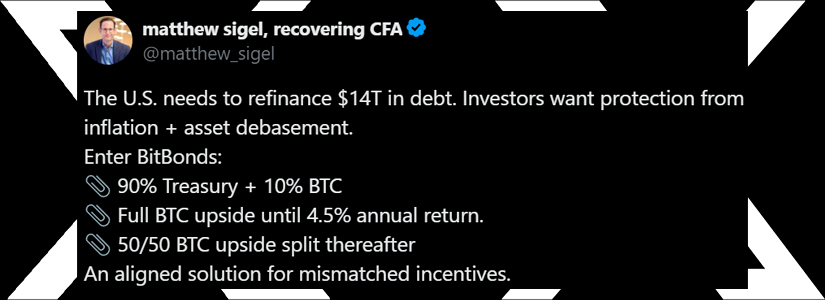

Asset management leader VanEck has introduced an ambitious plan to address the U.S. government’s significant $14 trillion refinancing need. Dubbed “BitBonds,” this inventive financial instrument is designed to blend the stability of traditional U.S. Treasury bonds with the growth potential of Bitcoin.

The hybrid instrument is structured as a 10-year debt security, allocating 90% of its value to low-risk Treasury securities while the remaining 10% is tied directly to Bitcoin exposure. This novel combination aims to provide the government with a fresh and cost-effective avenue to secure funds while appealing to modern investors seeking an inflation hedge and alternative yield sources.

How BitBonds Bridge TradFi and Crypto

BitBonds operates under a creative framework that aligns the interests of both the government and investors. Under this structure, funds raised through the bond issuance are partly used to purchase Bitcoin, allowing investors to benefit from any potential upside in the cryptocurrency’s value.

Should Bitcoin’s performance push the bond’s yield-to-maturity beyond a predetermined threshold, capped at 4.5%, any additional gains would be evenly split between investors and the government.

This mechanism offers investors a “convex bet” on the future of Bitcoin, capturing significant upside while mitigating downside risks. Even if Bitcoin fails to perform as hoped, the inherent safety of the Treasury component means that the overall instrument could still secure cheaper financing compared to standard bond offerings.

Potential Impact on National Finance

With the U.S. facing escalating debt levels and mounting refinancing challenges, the BitBonds proposal could represent a pivotal moment in public finance innovation. By introducing a product that marries the reliability of government bonds with the disruptive potential of digital assets, VanEck’s proposal is set to open up a new chapter for both fiscal management and cryptocurrency integration.

Investors stand to gain exposure to Bitcoin’s dynamic growth prospects without bearing its full volatility, while the government may benefit from lower interest costs. At the time of writing, Bitcoin is trading at around $84,000, dropping nearly 2% in the last 24 hours.

As policymakers and market participants explore this fresh approach, BitBonds could pave the way for more hybrid instruments that bridge the gap between traditional finance and the digital asset revolution.