In the past few days, the markets were in for a wild ride as Silicon Valley Bank (SVB) officially crashed, leaving over $15 billion in potential debt. The biggest bank for tech startups, including the pioneering Web3 and crypto native brands, such as Circle, were affected.

The Decentralized Solution

According to a DappRadar report, as the rumors around SVB’s insolvency were confirmed, USDC, the second largest stablecoin, lost its peg as the fiat-based collateral was compromised. This phenomenon was all too reminiscent of the infamous 2022 crypto black swan events, such as the fall of Three Arrows Capital, the collapse of Terra Luna, and FTX.

As regulators scrambled to cover SVB’s debt, the price of USDC plummeted, causing widespread panic and uncertainty in the market. But fear not, as the resilient dapp and crypto industries have weathered stormy market conditions before.

Nevertheless, the crash of SVB proved that the industry remains highly correlated with macroeconomic events.

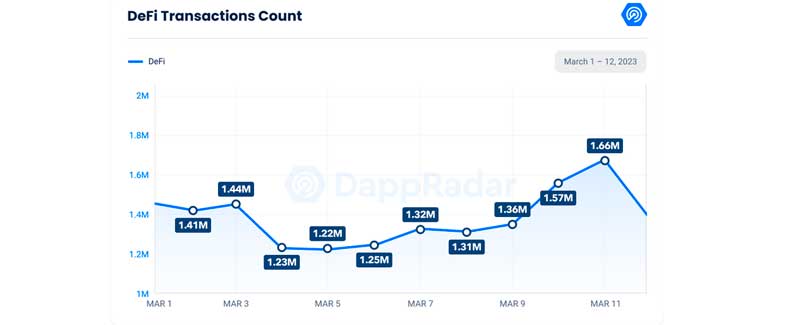

The collapse of SVB had a significant impact on the DeFi ecosystem, which is particularly susceptible to market crashes and uncertainty. Following the SVB crash and USDC depegging, the DeFi market saw a 9.6% drop in its TVL, leading to a considerable sell-off and a decrease in the TVL. The closure of SVB and Signature Bank had a further impact on market liquidity, leading to wild price swings and creating perfect conditions for volatile price moves.

However, the crypto industry has proven to be resilient, and market stability is gradually returning. The events of the past few weeks have underscored the need for the industry to become more self-sufficient and less reliant on traditional banking infrastructure.

The crypto industry must find alternative ways to manage liquidity and fiat on-ramps, especially in the absence of real-time payment networks, such as Silvergate’s Exchange Network and SigNet.

The crash of SVB and Signature Bank has had a significant impact on the crypto industry, particularly the dapp ecosystem. But the industry remains hopeful, and the recent events have provided an opportunity for innovation and self-sufficiency. The crypto industry will undoubtedly continue to evolve and adapt, even in the face of systemic challenges.

In conclusion, the tumultuous events of the past few weeks have underscored the importance of establishing a more resilient and self-sufficient crypto ecosystem. The collapse of Silicon Valley Bank and Signature Bank has exposed the vulnerability of the industry’s reliance on traditional banking infrastructure.

The real-time payment networks provided by Silvergate’s Exchange Network and SigNet have played a critical role in managing liquidity and enabling essential transactions such as OTC deals, arbitrage, and stablecoin redemptions.

As the industry moves forward, it must seek out alternative solutions to manage liquidity and fiat on-ramps to ensure its continued growth and stability in the face of potential market turmoil.