TL;DR

- President Trump signed the first-ever crypto-related law, exempting DeFi platforms from IRS reporting requirements and overturning a controversial rule set to launch in 2027.

- The bipartisan-backed legislation is hailed as a win for privacy advocates and the crypto industry, fostering innovation and reducing compliance burdens.

- This historic move positions the U.S. as a leader in digital asset innovation, aligning with the administration’s deregulatory approach to emerging technologies.

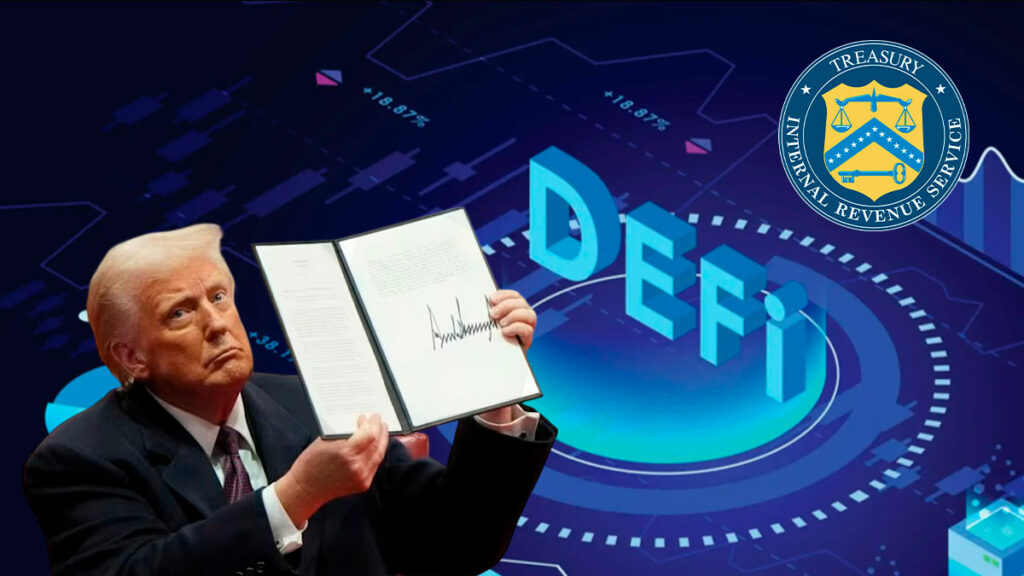

President Donald Trump has signed a bill that exempts decentralized finance (DeFi) platforms from stringent IRS reporting requirements. This marks the first crypto-related legislation in U.S. history, signaling a significant shift in the regulatory landscape for digital assets. The new law overturns a controversial IRS rule introduced during the previous administration.

The rule had expanded the definition of “broker” to include DeFi platforms. Critics argued that the decentralized nature of these platforms made compliance nearly impossible, stifling innovation and raising privacy concerns.

Set to launch in 2027, the IRS DeFi broker regulation is designed to strengthen the oversight of DeFi platforms. The plan? To extend existing tax reporting requirements, forcing these platforms to reveal gross proceeds from crypto sales and even disclose details about the taxpayers involved.

But in a historic move, Trump put an end to it. On April 10, he officially signed off on a resolution that scrapped the measure entirely—making history as the first-ever crypto bill to be signed into law.

Bipartisan Support and Industry Backing

The legislation, introduced by Senator Ted Cruz and Representative Mike Carey, garnered strong bipartisan support in Congress. The Senate passed the bill with a decisive 70–28 vote, followed by approval in the House. The measure was a victory for both privacy advocates and the burgeoning crypto industry.

Industry leaders have praised the repeal as a win for innovation and a step toward fostering a more crypto-friendly regulatory environment. By removing the IRS’s oversight, the law aims to encourage growth in the DeFi sector while addressing concerns about taxpayer privacy.

Implications for the Future of DeFi

The enactment of this law is expected to have far-reaching implications for the DeFi ecosystem. By eliminating the reporting requirements, the legislation reduces compliance burdens that many viewed as impractical.

This move is likely to attract more developers and investors to the space, bolstering the U.S.’s position as a global leader in digital asset innovation. President Trump’s decision aligns with his administration’s broader deregulatory stance, particularly toward emerging technologies.