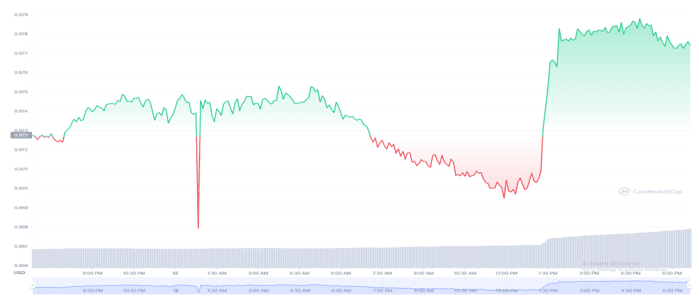

The effects of the FTX collapse are still looming over the crypto market. Therefore, Tron’s USDD is still actively searching for a stable US dollar peg. The stablecoin had to bid farewell to its 1:1 exchange rate. However, other stablecoins were affected too, but they managed to stabilize themselves soon enough. Not only did the collapse affect the stablecoins, but it even shook investor confidence.

On the other hand, it is worth mentioning that the continuous de-pegging of USDD can be linked directly to the stablecoins rising dominance. This dominance is mainly around the USDD/3CRV liquidity pools. These are based on the decentralized crypto exchange- Curve. At the time of writing, USDD stablecoin is trading for approximately $0.9775 and has a total market cap of $708.82 million. Just recently, USDD accounted for approximately 86% of the pool’s liquidity, totalling $34.5 million. However, based on the data from Nov 10, it became clear that users are rapidly swapping the stablecoin for the pools offered by other companies.

USDD is modelled around Terra’s defunct stablecoin, UST. Back in May this year, UST witnessed a massive crash and destroyed billions of investors’ wealth. UST’s total market cap back then was a whopping $18 billion. Based on these statistics, a possible USDD fallout may inevitably be less severe than its defunct counterpart. USDD can currently be described as the eighth largest stablecoin based on its market cap.

Preventing the USDD Slide- Justin Sun Steps In

Justin Sun recently announced that he took the step of swapping USDD worth nearly $773,000. Tron’s founder took it to Twitter and announced to brace for more capital deployment. The main reason for taking such an initiative was to considerably calm market nerves. Another reason for doing so was to defend USDD against current conditions. At the same time, Sun even mentioned that the stablecoin has a collateral ratio totalling up to almost 200%.

Deploying more capital – steady lads https://t.co/55pra5wQMi https://t.co/CexyaBy2hx

— H.E. Justin Sun🇬🇩🇩🇲🔥₮ (@justinsuntron) December 12, 2022

All assets with a combined value of more than $1.45 billion are responsible for greatly safeguarding USDD’s peg. Considering how the stablecoin is going down, many people took to Twitter to share their take on the situation. The stablecoin is currently failing to regain its peg, many believe that time’s actually up for the stablecoin. It is widely believed that the stablecoin might go further down in the coming days.