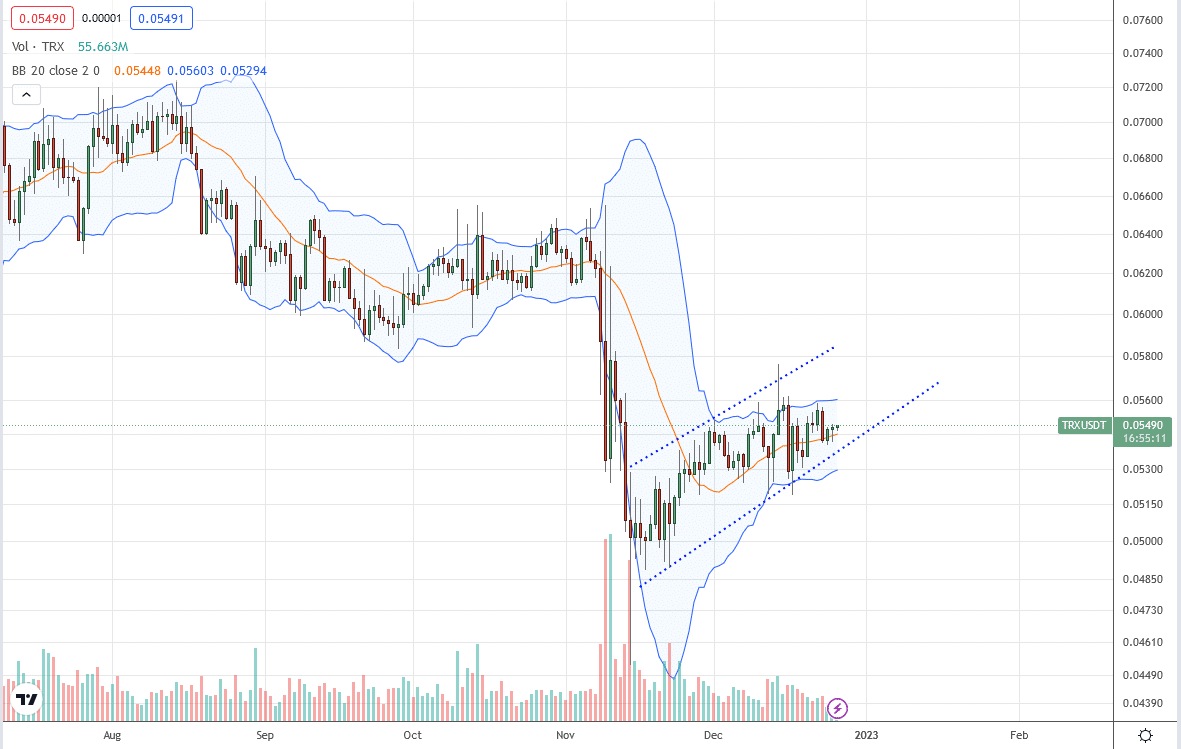

Tron price action remains choppy and bearish from a top-down preview but has been bullish in the past few trading weeks. From the daily chart, TRX is inside an ascending channel. In the short term, the coin is inside a bearish engulfing bear bar of December 20.

Therefore, while the odds of TRX exploding above $0.057 remain high, sellers have a top-down preview.

Traders can wait for a clear trend definition in the days or weeks ahead. That means a break above or below the current rising channel could determine the short-term trend of Tron.

Justin Sun’s Position in Valkyrie

Amid the FTX and Alameda Research fallout, recent news shows that Tron’s co-founder, Justin Sun, was one of the largest asset holders in Valkyrie. By August 2022, Justin had around $585 million of BTC in the U.S.-based crypto asset manager, accounting for more than 90 percent of funds.

Fighting Scams

Meanwhile, to fight scams and secure crypto users, the Tron development team passed a proposal to introduce a 1 TRX fee for memo collection. The blockchain will effectively block malicious users’ dissipation of “fake” memos by charging a fee. This step is necessary because TRC-10 transfers are free, and there is no way for the network to distinguish valid from fake ones.

Tron Price Analysis

Tron prices are firm at spot rates. Notably, in the daily chart, there is an attempted squeeze as the Bollinger Bands narrow, pointing to low activity and volatility in the past few trading days.

There are lower lows relative to the upper BB, indicating fading upside momentum. Besides, TRX prices are inside the bear candlestick of December 20, meaning sellers are in control from an effort versus results perspective.

TRX is moving higher, adding roughly 12 percent from November lows, within an ascending channel. The immediate resistance level lies at $0.057 while support is at $0.052, flashing with the bearish engulfing bar’s lows of December 20.

Traders can wait for a clean breakout in either direction before riding the emerging trend. A close above $0.057 may see TRX soar to November highs of $0.065. Conversely, sharp, high-volume losses below $0.052 may see TRX drop to $0.050 in a bear continuation formation.

Technical charts courtesy of Trading View.

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Tron news.