The SEC shows no signs of stopping as it claws its grip around the crypto industry. In a recent development, the SEC has served a legal notice to Coinbase for an alleged violation of the securities law. The lawsuit by the SEC claims that Coinbase never registered itself as a broker, and has been operating illegally since 2019. Furthermore, the regulator claims that a bundle of cryptocurrencies offered by Coinbase are securities. Some of the tokens in the discussion here include Solana (SOL), Cardano (ADA), Polygon (MATIC), Axie Infinity (AXS), and so on.

Similarly, the SEC claims that the staking program of Coinbase includes a total of five stackable crypto assets, which inevitably make the staking program an investment contract, and in turn, a security. Previously, Coinbase had already been defending its staking services from the SEC by arguing that its staking products do not qualify as securities.

Tough Days Ahead for Coinbase

The SEC Chair, Gary Gensler, alleged that the crypto exchange robbed its customers of crucial protection that mitigates the risk of fraud and manipulation. Apart from that, Gensler stated that Coinbase also avoided proper disclosure and safeguards against conflict of interest.

He added,

“Coinbase’s alleged failures deprive investors of critical protections, including rulebooks that prevent fraud and manipulation, proper disclosure, safeguards against conflicts of interest, and routine inspection by the SEC.”

The lawsuit against Coinbase comes a day after the regulator charged Binance for violating securities law and commingling the funds of its users. Binance was charged with a total of 13 counts of violation, but the charges against Coinbase have confused many in the crypto space as the platform is publicly listed.

Paul Grewal, the Chief Legal Officer at Coinbase stated that the SEC’s reliance on an enforcement-only approach without proper clarity for the digital industry is only hurting the economic competitiveness of the US.

He also mentioned,

“The solution is legislation that allows fair rules for the road to be developed transparently and applied equally, not litigation. In the meantime, we’ll continue to operate our business as usual”

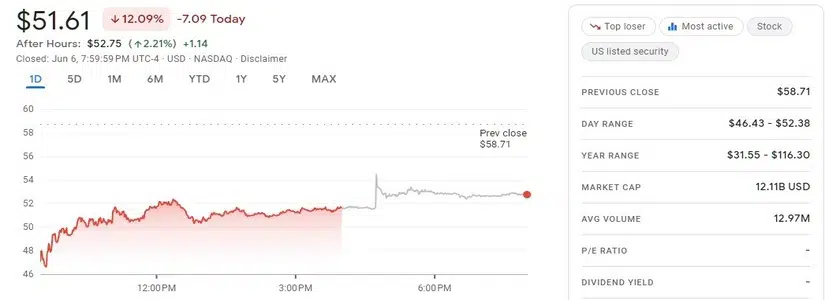

COIN Dips by 20% Following the SEC Suit

As a result of the aftermath of the lawsuit against the platform, the price of the shares witnessed a sharp decline. According to initial reports, the stock price dipped by almost 20%, with the lowest price being $46.43 per share. However, the price has improved as a share now costs $51.61. Yet the price of the share is still down by almost 12.09% as of today.

Back in April 2021, the Coinbase stock debuted on the Nasdaq exchange. However, the shares are currently down by a whopping 88% from their all-time high of almost $435, which was achieved during the day of Coinbase’s listing.