The New York Federal Reserve has issued new rules for different counterparties hoping to use its money market balancer, creating uncertainty for Circle, the creator of the USDC stablecoin. Based on an announcement from April 25, the New York Federal Reserve plans to introduce new guidelines in hopes to determine which parties are eligible to participate in the reverse repurchase agreements.

The masses believe that the current move might obstruct the way of Circle in gaining access to the FED’s reverse repurchase program. The program can be defined as a process where the FED sells securities to eligible parties with an agreement to repurchase them at the time of maturity. Furthermore, the NY FED stated that such a system must be a natural extension of an already existing business model, and the counterparty must not be organized for the purpose of accessing RPP operations. It was also stated:

“SEC-registered 2a-7 funds that, in the sole judgment of the New York Fed, are organized for a single beneficial owner, or exhibit sufficient similarities to a fund so organized, generally will be deemed ineligible to access reverse repo operations.”

The Circle Reserve Fund is an example of the 2a-7 fund which is only available to Circle. Unfortunately for the firm, it might be deemed ineligible anytime in the upcoming future after the FED’s statement. At the same time, all regulations that govern 2a-7 government money market funds are bound to ensure that these funds are able to satisfy all potential redemptions by investors swiftly and conveniently.

Circle Blames US Regulators for Declining USDC Market Cap

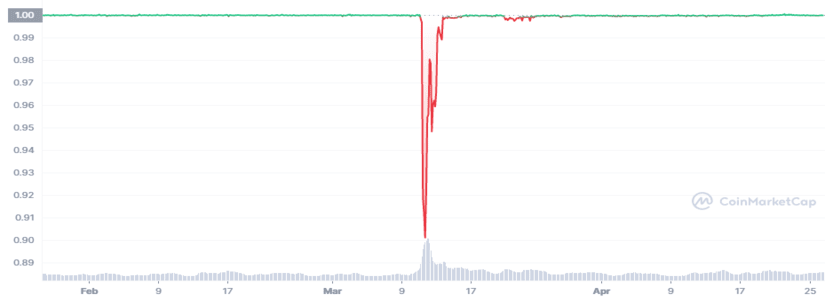

In other news, the CEO of Circle alleges that the prolonged and unending regulatory crackdowns by US regulators have been a major catalyst behind the declining market cap of the USDC stablecoin. Previously, USDC depegged from the US Dollar in March this year amid an unexpected US banking crisis.

USDC reserves worth approximately $3.3 billion of Circle were stuck at the Silicon Valley Bank, which was one of the three major crypto-friendly banks at the time. During the same time, Circle had to reassure its customers that it had the necessary support from investors to easily fill the gap, but the market was too quick to react to the news, eventually paving the way towards the depeg of USDC from the USD.

During its peak, USDC used to have a market cap of a whopping $56 billion, staying right behind USDT. However, since the crypto market fell victim to the uncertainty created by the banking sector crisis, the stablecoin’s market cap has been slashed in half, and now rests at the $30.7 billion mark.