TL;DR

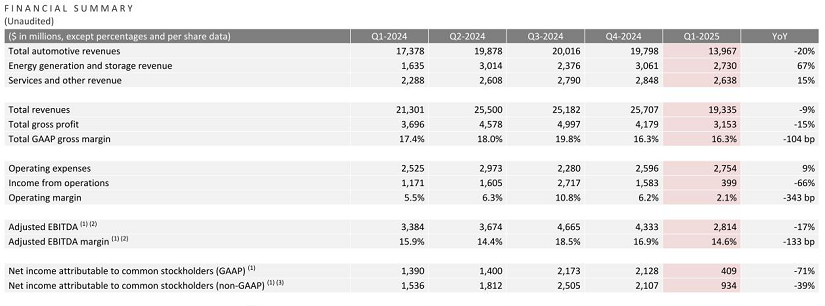

- Tesla did not meet its revenue targets in the first quarter of 2025, generating only $19.35 billion, more than $2 billion below expectations.

- Despite a 41% drop in its stock, it still maintains its reserve of 11,509 BTC, which has once again surpassed a value of $1 billion thanks to the Bitcoin rally.

- Tesla remains committed to its strategy of holding crypto assets under new accounting standards.

Tesla reported revenues of $19.35 billion during the first quarter of 2025, significantly below the $21.37 billion expected by the market. This decline is primarily due to a 13% drop in electric vehicle deliveries and a 16% reduction in production year-over-year. The company faced challenges in maintaining production efficiency amidst global supply chain issues, and its ability to meet delivery targets faltered. Additionally, Tesla’s stock price has fallen by 41% since the start of the year, amid controversies surrounding Elon Musk’s involvement in government affairs and labor protests.

However, what stands out for the crypto world is something else: Tesla continues to hold 11,509 Bitcoin, a number unchanged since its last sale in 2022. According to the “Bitcointreasuries.net” platform, as of March 31, 2025, its value was estimated at $951 million. But with Bitcoin’s recent surge to $93,000, that figure now exceeds $1 billion again. This confirms Tesla’s commitment to a HODL strategy, supported by the new “FASB” guidelines requiring crypto assets to be accounted for based on their market value each quarter. This new accounting approach provides greater transparency for investors and strengthens the narrative of Bitcoin as a strategic asset for major companies. Furthermore, it boosts confidence in the crypto sector, with expectations that more companies will adopt this vision over time.

Musk Shifts Focus and Strengthens Crypto Confidence

Elon Musk has announced that he will reduce his active involvement in projects like Dogecoin to refocus on Tesla. This shift could be crucial in addressing what some analysts, like Dan Ives from Wedbush, describe as a “code red” situation. Despite the pressure, the company has chosen not to sell its Bitcoin, aligning itself with giants such as MicroStrategy and Metaplanet, which also view Bitcoin as a long-term strategic store of value. This strategic decision could play a significant role in stabilizing the company’s future and aligning with market expectations.

Volatility in the crypto market is expected to persist until mid-May, but analysts project strong growth in the third quarter due to Bitcoin’s post-halving, increasing institutional adoption, and a potential clearer regulatory framework in the United States.