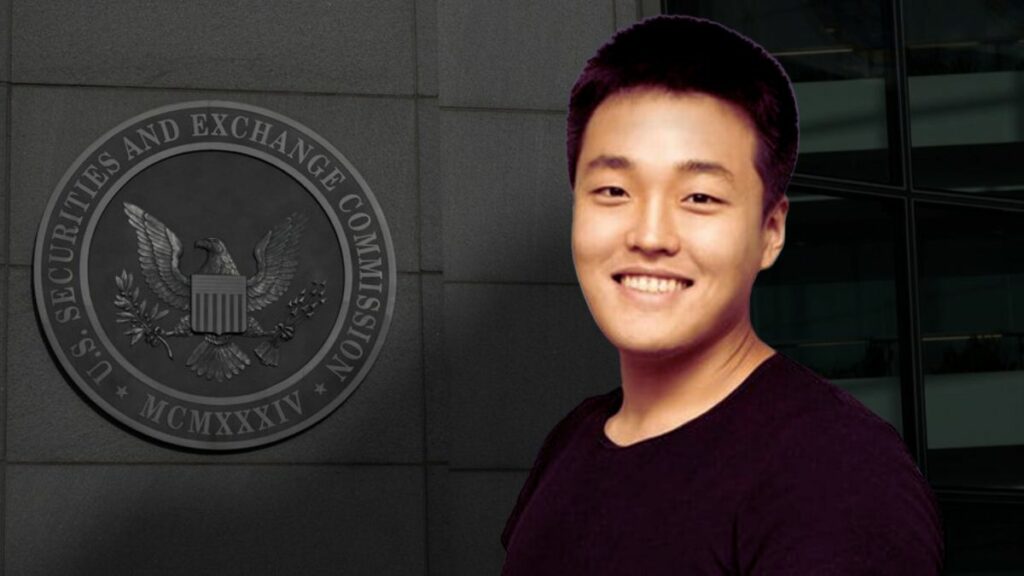

Do Kwon, the co-founder of the disgraced Korean blockchain company, TerraformLabs, remains locked in a legal battle with the United States Securities and Exchange Commission (SEC) over an extradition request.

However, the SEC’s request to depose Kwon in the United States before October 13, 2023, has been met with fierce opposition from Kwon’s legal team. They argue that this request is “impossible” as Kwon is currently detained in Montenegro with no scheduled release or extradition date in sight.

Kwon’s lawyers insist that compelling such an appearance serves no practical purpose and risks undermining judicial authority, stating categorically that,

“The motion should be denied because it would be impossible for Mr. Kwon to appear for such a deposition.”

The SEC Requests an Alternative Relief

In addition to the deposition request, the SEC has asked for alternative relief—an order that would prevent Terraform Labs from using a declaration from Kwon during summary judgment.

Kwon’s defense further argues that this request violates court rules as the SEC did not obtain permission to seek such an order, and neither party has filed a summary judgment motion, despite a looming deadline.

Crucially, Kwon’s defense emphasizes that he has not opposed deposition; instead, he has expressed willingness to comply, but under the condition that it takes place in Montenegro. This stipulation aligns with the terms of the Letter of Request (LOR) issued by the court. Notably, the discovery cut-off date in the SEC’s case against Kwon and Terraform Labs is October 13, 2023.

Adding complexity to the situation, a Montenegrin court has informally indicated that it may hold a hearing on October 13 or October 26, 2023, to ask Kwon the SEC’s questions. However, the SEC has raised concerns that this process might be “inadequate,” hinting at a potential pursuit of another deposition after the discovery cut-off date.

SEC’s Case Against Terraform Labs

Do Kwon’s legal woes stem from the collapse of the Terra Money ecosystem, which occurred in May 2022 and led to substantial losses of a total of billions of dollars for investors. The SEC’s case generally revolves around allegations that Terraform Labs, under Kwon’s leadership, misled investors about the security of TerraUSD and Terra’s stablecoin, UST.

For now, the SEC’s request for Kwon’s testimony remains in limbo, with the court yet to decide on its viability given the logistical challenges presented by Kwon’s current situation in Montenegro.