American Bitcoin Expands Treasury Beyond $445M With $163M BTC Purchase

TL;DR American Bitcoin increased its reserves with the purchase of 1,414 BTC, bringing the total to 3,865 BTC and surpassing $445 million in value. The company

TL;DR American Bitcoin increased its reserves with the purchase of 1,414 BTC, bringing the total to 3,865 BTC and surpassing $445 million in value. The company

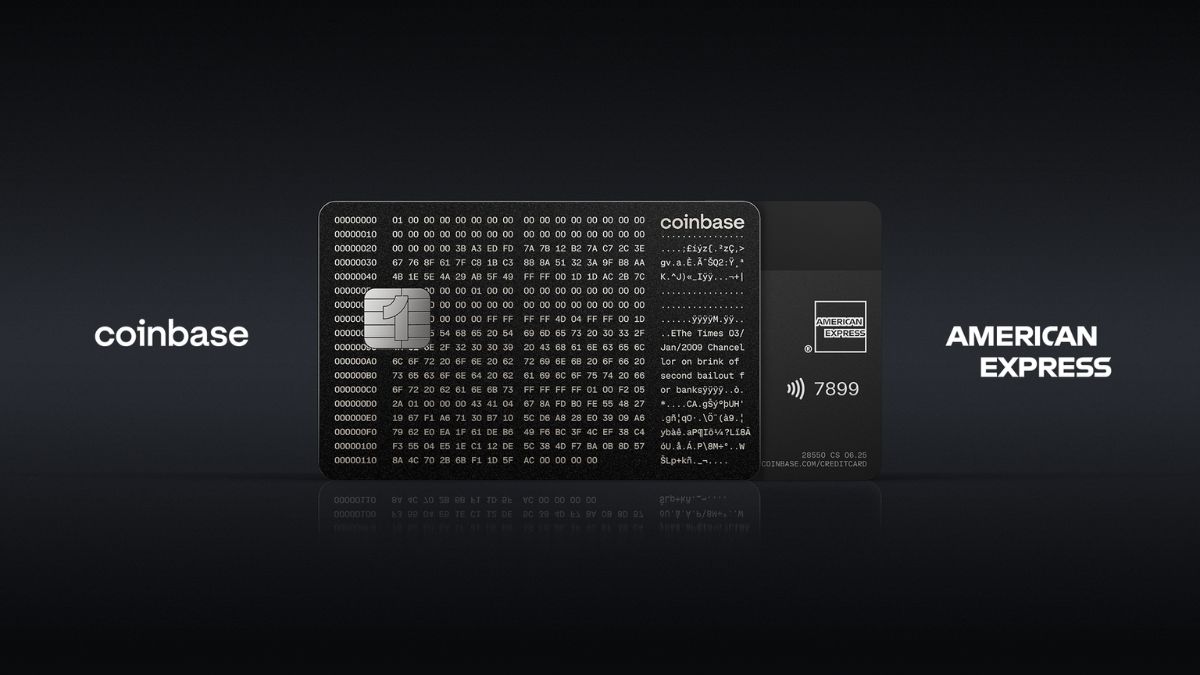

TL;DR Coinbase has removed the waitlist for the One Card, giving access to hundreds of thousands of users in the United States. The card, developed in

TL;DR The NHL signed multiyear agreements with Kalshi and Polymarket, becoming the first major U.S. professional league to allow the use of its branding. The contracts

TL;DR Nearly half of U.S. retail crypto investors have never earned yield, prioritizing safety and ease of withdrawal. Among those generating returns, 97% use centralized exchanges

TL;DR The U.S. Department of Justice has filed the largest forfeiture action in its history, valued at $15 billion in Bitcoin. The funds are linked to

TL;DR Stablecoin ratings: S&P Global and Chainlink launched onchain Stablecoin Stability Assessments, rating coins from 1 to 5 based on peg strength. Institutional adoption: Chainlink’s DataLink

TL;DR Democratic proposal: Senate Democrats introduced a plan allowing the Treasury to create a “restricted list” of risky DeFi protocols, imposing KYC rules and penalties on

TL;DR Legislative milestone: The Senate is advancing the Financial Innovation and Technology for the 21st Century Act, a sweeping proposal designed to clarify crypto oversight by

TL;DR New York Access: Coinbase staking is now live in New York, expanding availability to 46 states and signaling progress in a tightly regulated market. Regulatory

TL;DR Crypto markets are entering a week filled with key U.S. economic events that could shape the direction of Bitcoin and altcoins. Between October 7 and

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy