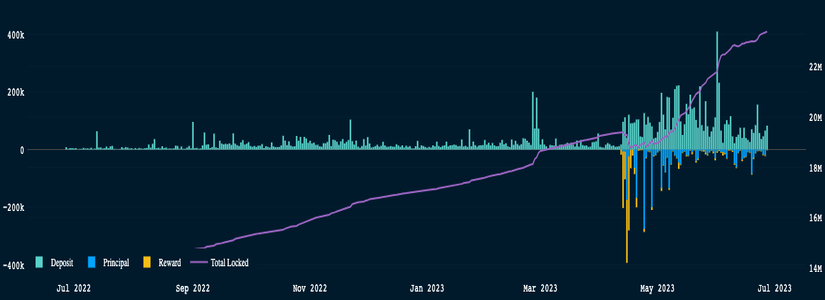

Since the launch of the Shapella upgrade, the volume of staked Ethereum (ETH) has continued to increase and has now crossed the 23 million mark in June. As per the data shared by Nansen, a total of 23.3 million ETH was staked on June 27, which accounts for approximately $43.1 billion. At the same time, the total number of staked Ethereum represents almost 20% of the total supply of $220 billion. When a comparison is made, it becomes clear that Solana currently has a staking ratio of almost 70.58%.

The staking phenomenon is classified as the process of validating transactions on the Ethereum blockchain. When it comes to earning a validator status and securing the network, users are bound to stake a certain number of Ethereum tokens and earn rewards for doing so. The Ethereum blockchain launched the Shapella upgrade back in April, and it allowed validators to withdraw staked Ethereum on the Beacon Chain. Since then, the number of staked Ethereum tokens has been rising considerably.

The Shanghai upgrade allowed users to stake and unstake depending on their will, and this has enabled the Ethereum network to swiftly catch up to rival chains such as Solana in terms of the native token being staked on the network. The growing numbers perfectly visualize the ideal health of the Ethereum network.

ETH Staking Catches the Attention of Regulators

Despite the continuously increasing numbers of staked ETH tokens on the network and the overall popularity, the concept of staking has gained the attention of regulators within the broader market. Currently, the future of ETH staking is a matter shrouded in mystery as the SEC is tightening rules for crypto firms that offer crypto staking services.

In February this year, Kraken got into a settlement with the SEC for approximately $30 million and also shut the doors on its crypto staking services for US-based customers. The SEC argues that the staking service qualifies as being a security, and highlighted how Kraken should have gotten itself registered prior to offering the service. Just recently, the SEC took similar action against Coinbase for offering staking services, citing the same reasons. As of now, the US market is home to a great percentage of node validators on the Ethereum chain, housing almost 48% of all validators.