The Bitcoin price is on a roll. Two things happened this week: One, prices not only rose above $20k, but the resulting rally pushed prices to $23.6k on Dec 17. Second, the rally made many traders millionaires; graduating some whales to the billionaire status.

Analysts are confident that this year’s rally is markedly different from that of 2017. Gauges can be from just how stable prices were when the BTC/USD price fell from $19.8k, cratered to around $17.8k before rallying back.

Institutional Demand, Targets at $400k

The shakeout and the stability of prices above $19k before the rally to spot rates pointed to institutional, deep-pocket support potentially from whales and institutions.

A look at the Grayscale Bitcoin Trust shows that, despite the high premium, investors are unfazed. Confident, some traditional funds have filed with the SEC seeking crypto exposure.

According to Guggenheim Partners CIO Scott Minerd believes the Bitcoin price is undervalued even at over $22.5k. He points to the incessant money printing from the FED and central banks, the fixed supply of Bitcoin, and the coin’s relative value to gold.

In recent times, BTC’s store-of-value trait has been deemed more superior than clunky physical gold, and could well replace the central bank-favored coin in years to come.

Millionaire Traders

With “rock fuel” from institutions, including PayPal and Square’s CashApp, futures traders are making a killing.

As per the Binance Futures leaderboard, one trader just made over $13.6 million in the last 24 hours. The top-10 traders are making well over $1.1 million per day as BTC soared to all-time highs.

Bitcoin Price Prediction

At the time of writing, the Bitcoin price is up 25 percent in the last week of trading.

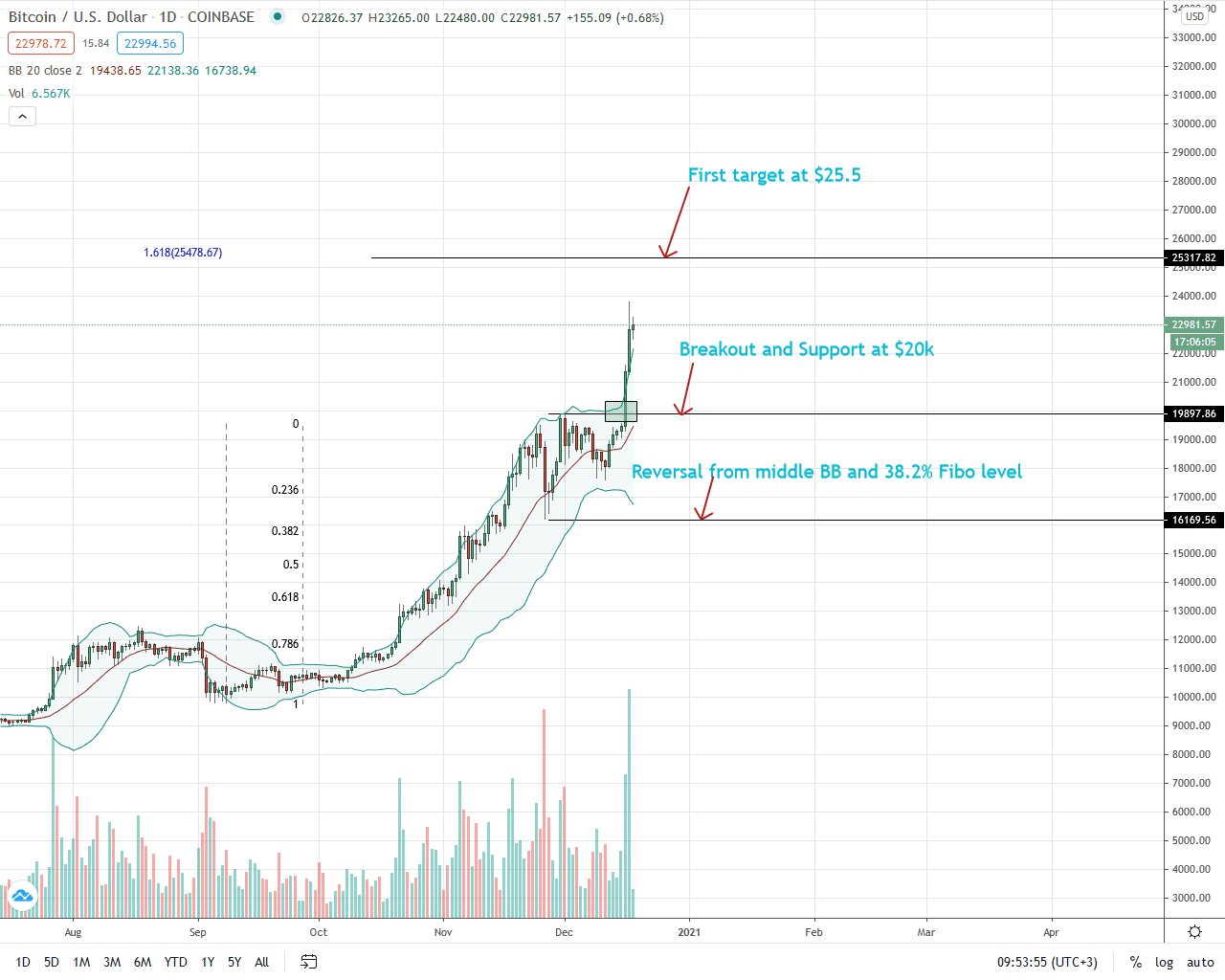

From the chart, the path of least resistance is upwards. Specifically, the BTC/USD pair is within a bullish breakout pattern.

Clearly, from the chart, every high above $20k is a loading opportunity with first targets at $25.5k. This is the 161.8 percent Fibonacci extension level of the September to November 2020 trade range.

While the uptrend is firm, prices are being rejected in smaller timeframes. Dec 17’s bullish but long upper wick points to possible liquidation in lower timeframes.

Still, the banding along the upper BB—and the divergence between the upper and lower BB, suggests high upward momentum and volatility.

In case of a contrarian, immediate support will be 2017 highs of around $20k. Trend continuation, however, will pump BTC to $25.5k.

Often—and based on historical charts, a reversal from the 38.2 percent Fibonacci retracement—based on September to November 2020 trade range, leads to a really above the range’s high (20k) towards the 161.8 percent Fibonacci extension level ($25.5k), as aforementioned.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Bitcoin news