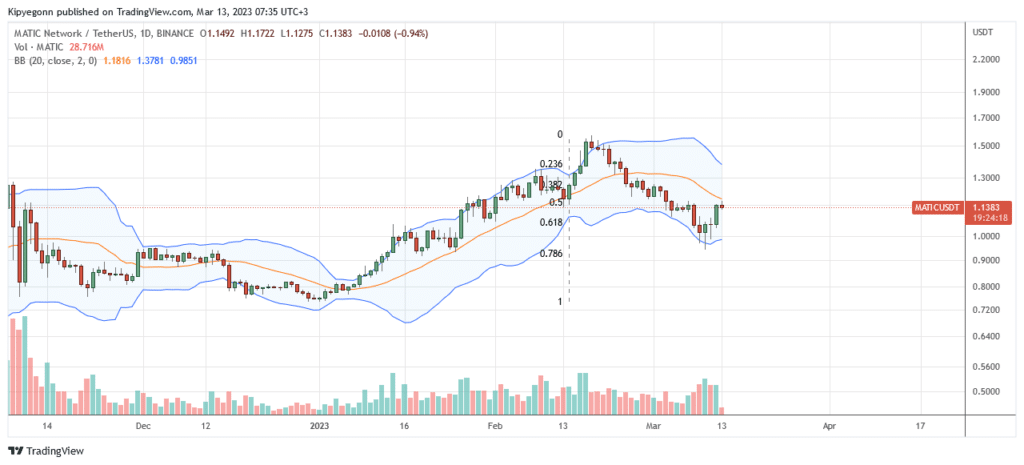

Polygon prices are roughly two percent week-to-date but up 7% in the past 24 hours. Like the rest of the crypto market, the coin is reversing losses, soaking selling pressure, and rejuvenating holders. Although there have been steep falls in the past few trading days, the path of least resistance remains northwards. Notice that MATIC prices have support at around the 61.8% Fibonacci retracement line following the retracement from February highs.

Mastercard Artist Accelerator Launch

There are several factors supporting Polygon and MATIC prices. For instance, the continued failure of CeFi platforms, including crypto-friendly banks like Silvergate and Silicon Valley Bank (SVB). Silvergate and SVB’s collapse triggered last week’s losses as USDC, a stablecoin by Circle, de-pegged, fell to as low as $0.88 versus the USD. Considering Polygon’s high throughput and low fees, projects are migrating to the platform, seeking to build their DeFi solutions while remaining compatible with the more active Ethereum ecosystem.

Last week, the Mastercard Artist Accelerator was launched on Polygon. The program aims to harness web3 and blockchain technologies, arming five emerging artists with the required resources as they forge their paths in the digital economy. According to Ryan Watts of Polygon Labs, the objective is to “offer emerging artists powerful new opportunities to gain more recognition, visibility, and control over their work” using, among other tools, NFTs.

Polygon Price Analysis

Changing hands at around $1.14, the token has support at $0.90, the 78.6% Fibonacci retracement level. As prices expand, traders can watch how prices react at $1.20, a buy trigger line flashing with last week’s high.

If the current recovery is with higher participation, building on the weekend’s gains, traders can align with the primary trend of December to February. In that case, they may look for buying opportunities targeting $1.55 in a bullish continuation formation.

Conversely, if there are unexpected dips from spot rates as bears of last week flow back, any drop below $0.90 may see MATIC crash to as low as $0.75, marking December lows. Such a bear breakout would initiate a selloff that may push MATIC to fresh 2023 lows.

Technical charts courtesy of Trading View.

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Polygon news.