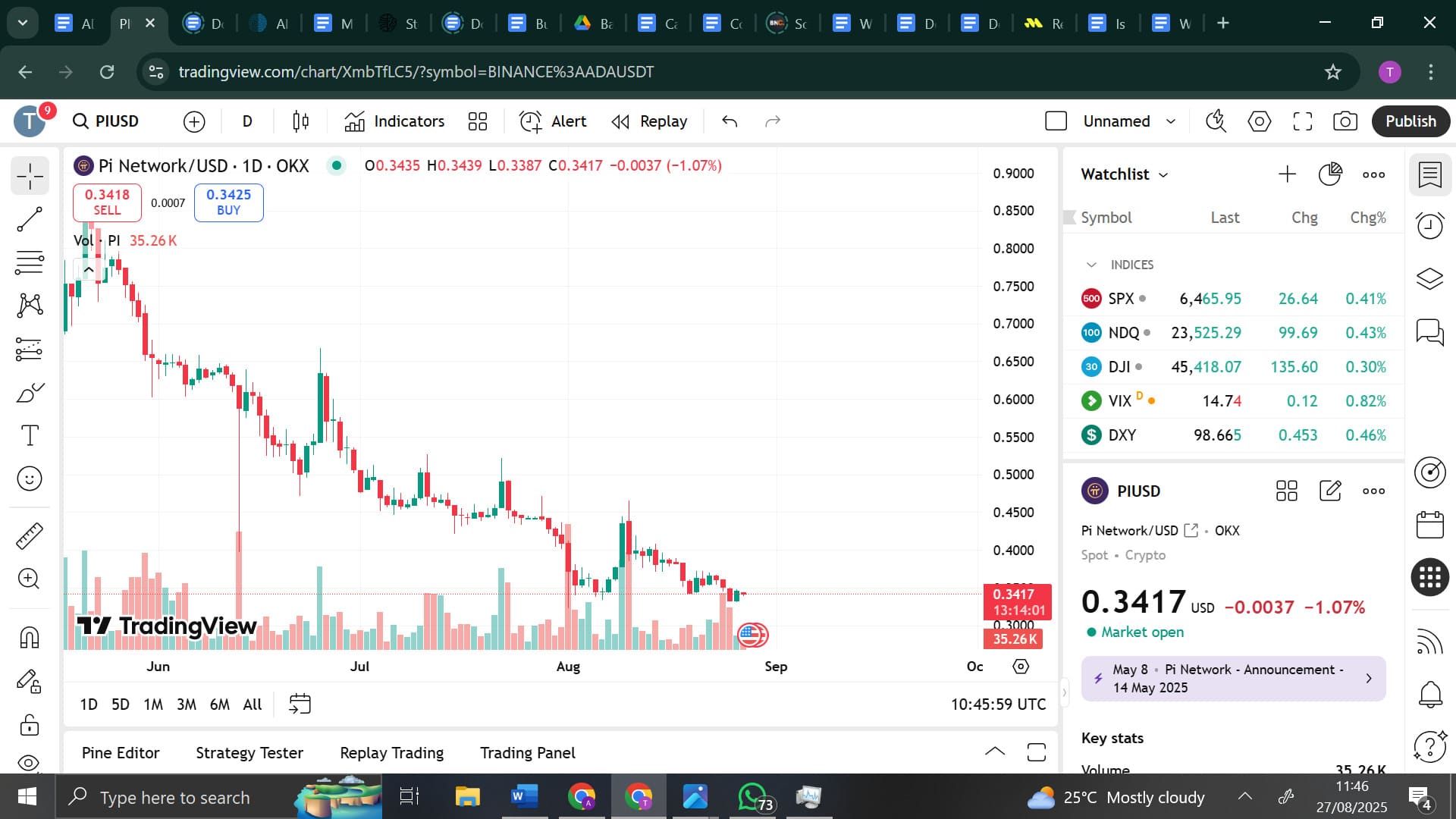

The Pi Network and Pi coin have been facing turbulent times this August, as the token continues to slide within a well-defined descending channel. After peaking in mid-July, Pi coin has seen persistent selling pressure, causing the price to test a recent all-time low of $0.322 on August 1.

Currently, the token is hovering around $0.340, struggling to regain traction as market sentiment remains fragile. Meanwhile, investors looking for stronger fundamentals and real-world adoption are increasingly eyeing projects like Remittix, which is gaining attention for its upcoming catalysts.

Pi Coin Price Faces Steep Headwinds

The pi coin continues its downward trajectory, largely dictated by the descending channel that has contained the token’s movement since May. This formation, marked by a series of lower highs and lower lows, has reinforced a bearish market bias. If the pattern persists, Pi coin could retest the $0.322 support, testing investor patience further.

Key indicators point to continued pressure:

- RSI at 38: well below the neutral 50 level, signaling strong bearish momentum.

- MACD lines coiling: suggesting indecision among traders and lack of directional conviction.

- Volume trends: declining daily volumes, highlighting weakening buying interest.

For traders hoping for a rebound, the immediate resistance lies at $0.400, a level that pi coin must overcome to signal a potential recovery.

Despite price struggles, Pi Network still maintains a moderate level of network engagement. Transactions have remained active, though not at levels strong enough to offset the downward pressure. Analysts point out that the lack of significant adoption and limited real-world utility has kept Pi coin confined to a narrow range.

At the same time, the broader market volatility has amplified the weakness in Pi coin, leaving retail holders cautious. Without fresh catalysts or institutional interest, short-term recovery appears uncertain.

Why Investors Are Looking Beyond Pi Coin

While Pi Network navigates its challenges, attention is slowly shifting to projects offering tangible utility and clear growth pathways. Remittix is emerging as a standout in this space, with a proven track record of strong fundraising and token distribution.

Key Remittix Highlights

- Established real-world PayFi utility for crypto-to-fiat transfers

- Upcoming CEX listing reveal at $22 million milestone

- Strong community and institutional interest supporting adoption

- Wallet beta launch set for Q3 2025, enhancing usability

- Continued growth momentum, offering asymmetric upside potential

These milestones hint at why investors are viewing Remittix as a potential 8,000% growth candidate in 2025, especially compared to the stagnation seen in Pi coin.

Conclusion

While Pi Network and pi coin struggle to break free from bearish constraints, Remittix continues to chart a path toward tangible adoption and strong upside potential. Traders seeking asymmetric growth are keeping a close eye on Remittix, especially with the beta wallet launch and upcoming CEX listing signalling further momentum.

Explore Remittix and stay ahead of the crypto curve:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.