PancakeSwap has released version 3 of its Market Maker Platform on the BNB chain and Aptos with the aim of improving performance and lowering fees. The recent upgrade emphasized the great importance of capital efficiency and even has a change in how liquidity providers would be able to allocate capital on different price intervals. As long as the previous update of PancakeSwap is concerned, liquidity from providers was distributed consistently along the price curve of different trading pairs.

🥞it’s #PancakeSwapv3 Day. Tell us how excited you are!🥳🎉😍 https://t.co/6i3MK27OOU

— PancakeSwap🥞Ev3ryone's Favourite D3X (@PancakeSwap) April 3, 2023

However, the recent v3 upgrade offers liquidity providers the opportunity of selecting custom price ranges to provide more liquidity. Furthermore, the provision empowers these liquidity providers by offering significant control over capital investments to higher volume trading ranges. Similarly, the newest release also includes the provision of four additional tiers of 0.01%, 0.05%, 0.25%, and 1%. The addition of these new tiers is a considerable change from the standard 0.25% of v2.

Each of the token pairs would have individual liquidity pools for each tier. Currently, PancakeSwap believes that asset pairs would be drawn to tiers where the incentives of liquidity providers and traders would, later on, align. The approach would be regarded as an effort to perfectly balance the lowest possible trading fees, while still incentivizing the liquidity providers at the same time.

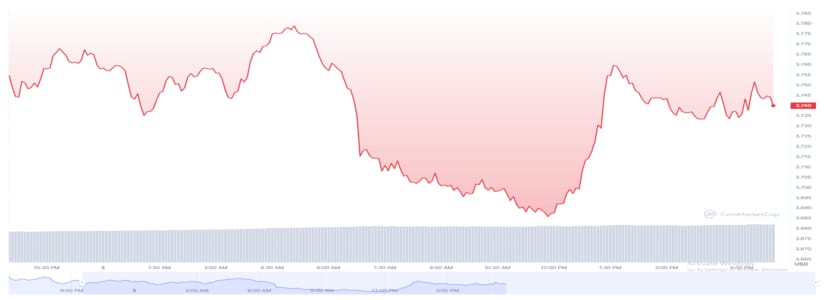

Unfortunately, the v3 update did not excite the community this time. The native token, CAKE, is currently trading in the red for approximately $3.74 after experiencing a decline of almost 1.32% in the previous 24 hours. At the same time, the total market cap of the token is $684 million.

The PancakeSwap Team Continues to Make Moves

PancakeSwap has come a long way over the years and is committed to serving its customers in the best possible way. Currently, the firm caters to a great percentage of the DeFi user base, and it accounts for more than $2.5 billion locked. At the same time, the firm is also actively serving more than 1.5 million unique customers.

The platform also revealed additional features that are still under development, including a “trading rewards program” that is bound to offer traders exclusive benefits. At the same time, the position manager feature aims to improve the overall user experience when depositing tokens as liquidity.