TL;DR

- Nike has been sued through a $5 million class action lawsuit following the unexpected shutdown of its NFT subsidiary, RTFKT.

- Investors allege that Nike executed a “rug pull,” negatively impacting the value of the acquired digital assets.

- The lawsuit could also set a precedent in the ongoing legal debate over whether NFTs should be considered securities in the United States.

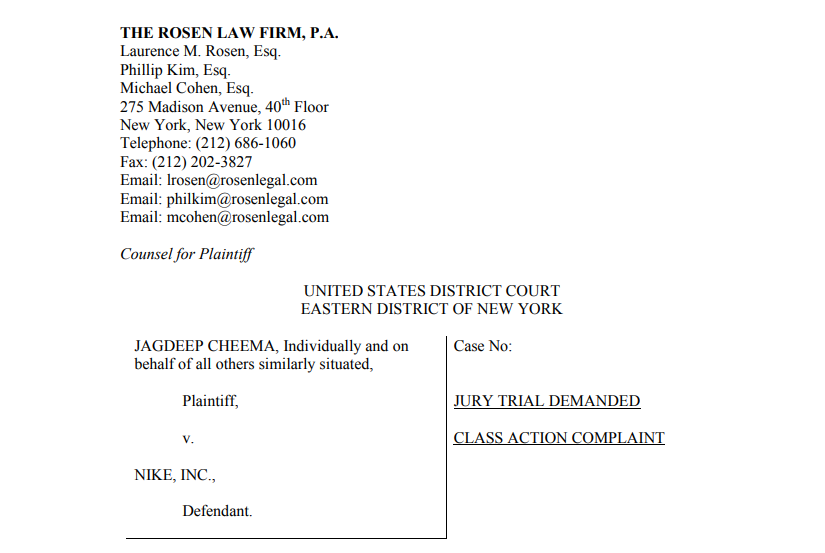

Nike, one of the world’s sports giants, has been hit with a class action lawsuit by a group of NFT buyers following the sudden closure of its RTFKT division in early 2025. The lawsuit, filed in New York, seeks $5 million in damages, accusing Nike of executing a “rug pull” and selling unregistered securities. The investors, led by Australian Jagdeep Cheema, argue that the company leveraged its reputation to promote the sale of these digital assets without providing adequate legal protections, leaving thousands of users with devalued collections.

The plaintiffs claim they would never have invested in Nike and RTFKT NFTs had they known they were unregistered securities or that there was a risk of abrupt cancellation. The platform’s collapse not only affected prices but also functionality: after the shutdown, several NFTs stopped displaying their images due to technical issues with the provider Cloudflare, further increasing uncertainty around the assets’ value.

The Controversy Grows: Are NFTs Considered Securities?

One of the core issues in the lawsuit is whether NFTs should be treated as financial securities, a question that still divides regulators and courts across the United States. If this interpretation is confirmed, the digital asset industry could face significant regulatory changes. However, from a pro-crypto perspective, legal challenges like this can be seen as an opportunity to strengthen the ecosystem’s foundations, demanding greater transparency without stifling innovation.

Nike acquired RTFKT in 2021 in what was then considered a visionary move toward the future of digital art and gaming. The crypto community celebrated the mass adoption of blockchain technologies by major brands. However, the closure of RTFKT has left a bitter taste for many users who had trusted the potential of these initiatives. Although some digital content has been restored, doubts persist regarding the centralized management of digital assets and the urgent need for more decentralized and enduring solutions.

The Crypto Industry Learns

Despite these setbacks, the crypto sector continues to demonstrate its adaptability. Far from collapsing under adversity, the community keeps pushing forward, developing new ways to ensure digital ownership and user autonomy. Cases like this only reinforce the importance of decentralized storage models, audited smart contracts, and projects that truly empower creators and collectors alike.