DappRadar’s latest report shows a situation for the Ethereum NFT market that’s not promising.

Many of the analyzed projects in this report have experienced a decrease of 59.60% in USD value. The overall value of analyzed projects has fallen from $9.3 billion to $3.7 billion.

Promising Red Market

NFT projects are still big drivers of the dApp industry. Many projects and collections launch blockchains every day. Ethereum is the market-dominant here and has the largest market cap in terms of NFT collections.

Although we have seen some signs of recovery in the market, the NFT sector still needs some time to show a green situation. On the other hand, many new projects and use cases are emerging. Besides, many of them are going to blockchains other than Ethereum.

Trading volume hasn’t been bad for the NFT sector in 2023. But there is still a long way ahead to conclude. According to the report, in 2023, NFTs generated $870 million in trading volume. $587 million of this came from collectibles which shows users and investors are still attracted to this part.

Investors are always looking for new trends and opportunities in the market. Checks and the Memes OE are some of the good examples that show the market is still optimistic about them. On the other hand, blue-chip collectibles yield the highest value in the sector.

But the situation has been attractive for some of the projects. Yuga Labs is currently the leader of the NFT industry. On the other hand, there has been many failed projects with sharp declines in 2022. In fact, most collections showed losses at the end of the year. Otherdeeds experienced the largest decline. The project experienced an 86.15% decline in its market cap.

Azuki, Pudgy Penguins, and Degen Toonz Collection were some of the projects that performed well. The appreciation rates of 113.89%, 260%, and 204%, respectively, showed great growth for them.

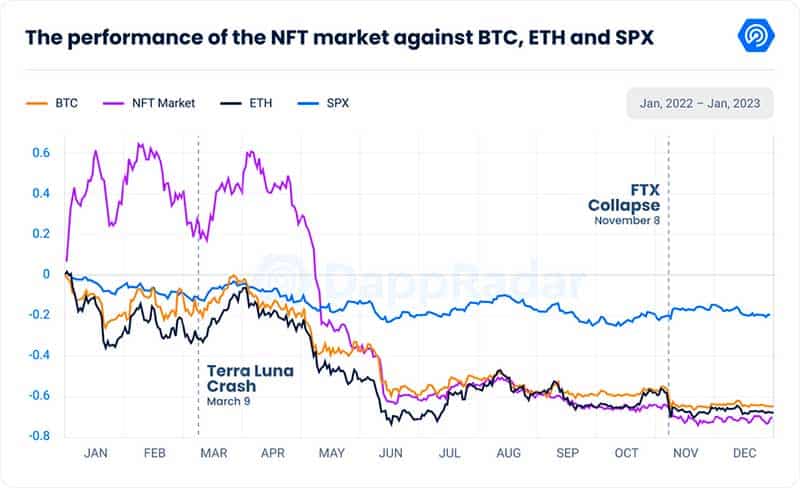

Many believe that the crypto industry and products like NFT can’t recover afte the Luna collapse. But NFT collections launched after the collapse managed to increase their market cap. For example, The Potatoz with 134.68%, Renga with 211.63%, DigiDaigaku with 209.88%, and God Hates NFTees with 1,653.28% were the biggest winners.

The report concludes that 2022 was a good year for some projects. Dapp Radar says:

“The success of these collections can be attributed to the perfect timing of their launch, their ability to maintain momentum, and the partnerships they formed.“

Community building and focusing on launching an NFT project are the most critical factors that result in a project’s success. The market has volatility, but navigating the challenges can surely result in big wins.