A number of DeFi platforms are offering NFT loans. In some cases, NFT owners can use the loans to exchange cryptocurrencies or fiat currency for their NFT pieces or collections. It has been identified in several DeFi projects that there is an increasing need to improve the liquidity of NFTs on the market through solutions such as lending, which are being proposed as ways to achieve this objective.

NFTs and DeFi, two aspects of the cryptoverse that have gained a great deal of popularity, are two of the newest trends. As a result of recent headlines concerning the auction of NFT projects for astronomical prices, they have become an interesting topic. Dynamic NFTs are another product of this hype as well.

The term ‘DeFi’ is a term used in the financial industry to refer to decentralized platforms that provide financial products and services to crypto investors without having to rely on the oversight of banks or financial institutions. It is possible with the help of these platforms to lend, borrow, trade, and buy crypto assets in minutes without needing to seek approval from centralized authorities.

Using cryptocurrencies like Bitcoin or Ether, such as DeFi applications are easy to understand when viewed in the context of cryptocurrencies. How do NFTs fit into this picture, considering that they are not divisible and can thus not easily be traded?

NFT loans are the answer to this question. It is possible to acquire loans for valuable NFTs, just as it is possible to acquire loans for a house, car, boat, or stock that is valuable. It is worth noting that this combination of DeFi and NFTs is opening up a whole new world of opportunity for this emerging class of crypto assets.

What Is NFT Lending?

As a general rule, NFT lending consists of borrowers providing collateral for a loan that is funded by another person (or “a lender”) seeking to earn a return on their investment by lending NFT assets.

Investing in NFT-backed loans enables lenders to earn higher returns as compared to traditional peer-to-peer (P2P) loans and regular crypto-backed loans, as the NFT-backed loans are backed by NFTs.

It can be said that NFT lending operates similarly to crypto lending in that cryptocurrencies are used as collateral. In contrast to traditional loans, NFT lending requires borrowers to pledge NFTs as collateral in order to secure their loans.

Several centralized finance (CeFi) platforms, for example, BlockFi or Nexo, are available as the NFT lending platform, which acts like a traditional lender by setting the rates and terms of credit as well as lending components.

The majority of NFT loans, however, are only made available through platforms providing decentralized finance (DeFi), which commonly use smart contracts on the Ethereum network for facilitating the loan agreement, ensuring contractual obligations are met and facilitating the loan process itself. In response to the demand for NFT loans, new platforms like MetaStreet and Arcade are springing up that offer a range of terms and rates to meet the demand.

A new landscape for lending has emerged as a result of NFT lending. As a result, it is likely that the regulations on NFT lending will change over the coming years as the market expands, stabilizes, and becomes more regulated. Take the time to research the risks associated with an NFT lending platform before you decide whether or not you are going to use it.

How does NFT lending work?

It has been possible lately to find platforms that allow holders to obtain help in borrowing funds and setting terms without any intermediaries. Depending on the popularity of the NFT, it is possible for the borrower to expect to get a loan amount of about 50% of the total value of the NFT, with interest rates ranging from 20% to 80%.

It is the simplicity, transparency, and speed with which DeFi protocols are designed that makes them such a great alternative to traditional lending institutions. You don’t have to worry about a centralized authority checking your credit score, verifying your real identity, and spending days or weeks deliberating your application because there is no such authority to do so.

Users of DeFi platforms are able to completely control their funds by utilizing smart contracts, which can be found in their accounts. It is necessary to ensure that all collateral assets are sent to a secure smart contract that acts as an impartial, automated third party that is programmed to facilitate the lending and borrowing process by acting as an impartial, automated third party.

In order to establish what is the fair value of the collateral, lenders take into consideration the asset’s past performance, its sales history, or the floor price of similar NFTs that are similar to the collateral.

Floor prices refer to the lowest offer price for a particular series of NFTs that are part of that series. The borrower’s wallet is connected to the escrow provider by a smart contract, and once both parties agree on the terms of the transfer of the NFT from the borrower’s wallet to the escrow provider, the NFT is moved into the escrow account by the smart contract.

In theory, it sounds simple and straightforward, but there is still a degree of risk associated with the market. It is important to note that the lender has the right to take the underlying NFT by the end of the loan period if the borrower is unable to pay back the loan and interest.

Due to the volatility of the prices, lenders may also be reluctant to accept new NFT projects as collateral because they might end up losing if there is no market demand for the defaulted NFTs in the future.

How Much Money Can You Earn Lending NFTs?

Depending on the type of NFT you are lending and the terms of the loan, that really depends on the situation. When it comes to lending popular NFTs, you can generally expect to earn a decent return on your investment if you do so.

You should, however, remember that there is always a risk of default, so make sure you only lend money you are able to afford to lose and never lend more than you can afford to lose.

There is a possibility that you may consider staking your NFTs if you are looking for a more passive income stream. You can earn interest on your NFTs by staking them, meaning that you do not have to worry about them getting sold or returned if you stake them. In addition to increasing your NFT collection, you will also be able to make some extra income as a result of this.

There is a wide range of rates available on NFT lending platforms. As well as the market conditions, NFTs also have to be taken into account when determining their value. In the case of NFTfi, for example, the borrower does not have to pay a fee. Despite this, the platform takes a 5% cut of the interest earned by lenders when they use the platform.

NFT Lending Platforms

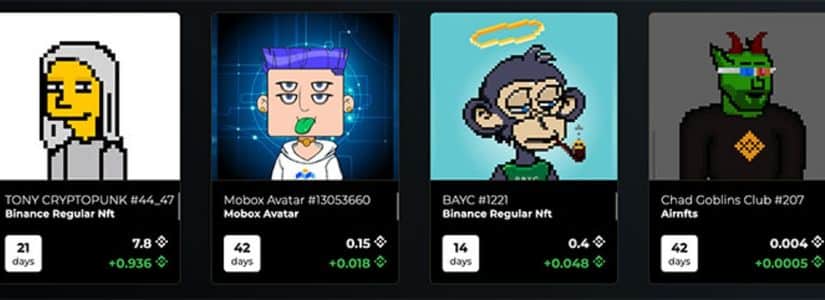

There are currently few DeFi platforms that offer NFT mortgages for permissionless loans in the market, but there is already a handful of platforms that offer support for permissionless loans based on NFT mortgages.

Additionally, there are a few other projects that are looking to accept NFTs as collateral for loans in the near future, such as those making use of the lending protocol AAVE (AAVE). The following are the best platforms for NFT loans that are available at the moment.

NFTFI

In short, NFTfi can be described as a kind of digital pawnshop in which loans are offered against the backing of ERC-721 tokens. A mortgage option is available that allows users to exchange NFTs for a number of cryptocurrencies.

These cryptocurrencies can then be resold for cash. As a result of the value of NFTs that have been placed up as collateral by borrowers, lenders offer them loan proposals based on their value. A smart contract will be created that locks the NFT into a smart contract until the borrower accepts the proposal and is ready to begin repaying the loan.

There is a report that since the platform launched in June 2020, more than $12 million has been transacted on it. A typical loan amount for one month reportedly ranges from $26,000 to $20,000, although it is purported the platform has been able to facilitate loans as high as $200,000. There is generally no more than a 20% default rate, and it varies depending on the NFT.

Website: https://www.nftfi.com/

DROPS

NFT holders need to attach their collection to Drops, which is a DeFi lending platform specializing in providing trustless loans to people without the need to work with intermediates in order to be eligible for a trustless loan.

By attaching their collection to Drops, NFT holders are able to access trustless loans without dealing with intermediaries. Using the lending pool, the user is able to borrow up to 80% of the asset’s value (determined by the floor price) and receive an instant permissionless loan from the lending pool as soon as the request is approved.

Website: https://drops.co/

ARCADE

As an NFT lender, Arcade is targeted mainly at retail investors with a high net worth and institutional lenders. In order to allow loans backed by noncustodial liquid assets to be accessed, a noncustodial liquidity infrastructure known as Pawn Protocol has been developed.

A user of the Arcade app can request a loan using a combination of their assets as collateral. There are several steps the user must take in order to get started with the app, including connecting with their MetaMask wallet, selecting which assets (from a list of supported collections) they want to use as collateral, and then requesting a loan under specific terms.

In order to do so, the platform uses a smart contract that creates a wrapped NFT (or wNFT), which has the role of representing the borrower’s loan collateral and is used when requesting a loan from the platform.

As a smart escrow contract is time-locked to wNFT, it notes when the funding principal is initially sent to the borrower and when it is repaid back to the lender when the wNFT is repaid back to the lender. Each transaction that is completed on the platform earns Arcade a percentage of the sale price.

Website: https://www.arcade.xyz/

STATER

With Stater, borrowers can get loans by using their NFT assets as collateral, and lenders can generate returns by providing liquidity in the ecosystem in order for the lenders to generate returns on their investments.

On the Stater marketplace, borrowers will have the option to list their NFT assets by specifying the asset value, length of the loan, and the amount of the loan (as per the loan-to-value ratio). Depending on the needs of the borrower, loans can be secured with a single asset or a combination of assets (bundle).

In the marketplace, lenders will be able to see all the listed assets of all the borrowers, allowing them to quickly identify packages that they find attractive and provide loans based on those packages.

In addition, they will also be able to view specific game and asset information that will assist them in the due diligence process and the ability to filter specific loan parameters so that they can find the best loan opportunities within the market.

Website: https://stater.co/

Conclusion

Generally speaking, NFT loans are one of the gateways to the NFT/DeFi universe. It is possible that they could be used to create exciting new revenue streams for previously illiquid assets such as NFTs.

NFT loans are designed with the sole purpose of increasing the liquidity of NFTs, thus allowing users to have access to capital for the purpose of spending it on other projects and services.