TL;DR

- Jupiter (JUP) powers Solana’s top DEX aggregator, offering instant, low-cost swaps through the most liquid pools and a 1.35 billion token supply that cements its market position.

- Beyond swaps, Jupiter delivers advanced DeFi tools, limit orders, DCA, TWAP, cross-chain bridges, perpetual trading, plus a SOL-backed debit card, reducing slippage and unlocking institutional-grade strategies.

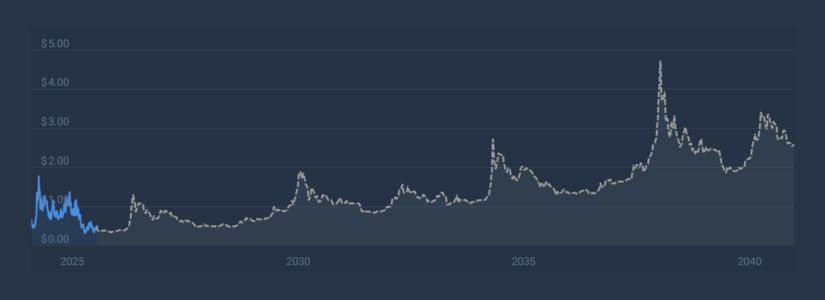

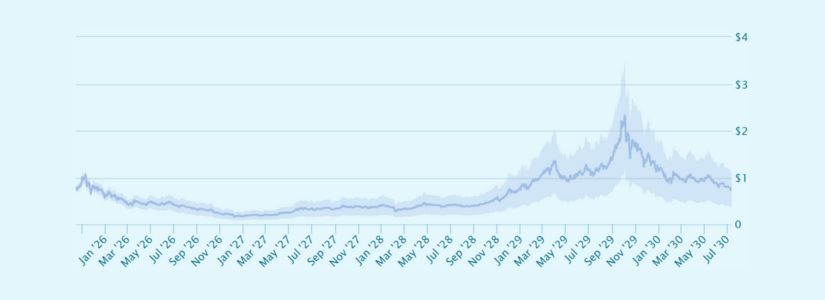

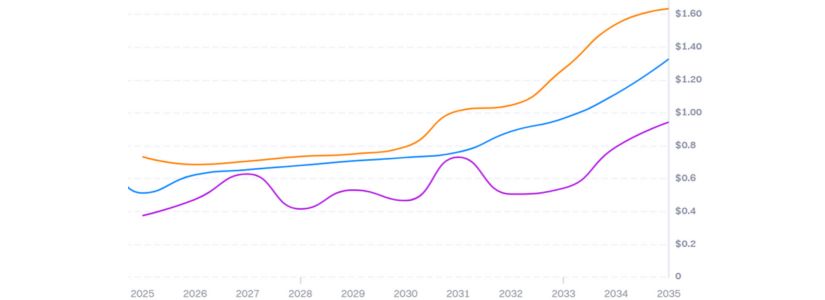

- 2025–2030 forecasts span conservative to ultra-bullish: JUP may trade from $0.35–$1.06 in 2025, peak near $12 in 2028, hit $2.33 in 2029, and average $0.72 in 2030 under various market scenarios.

Jupiter (JUP) has quickly become a cornerstone of the Solana blockchain, offering a DEX aggregator that routes trades through the most liquid pools. Thanks to Solana’s lightning-speed throughput and minimal fees, Jupiter users enjoy virtually instant, cost-efficient swaps. With a circulating supply of 1.35 billion JUP tokens, the platform holds a strong market position, one built on the promise of seamless, cross-protocol liquidity and optimized trade execution.

A Suite of Advanced DeFi Tools

Beyond simple token swaps, Jupiter sets itself apart with an arsenal of DeFi products designed for both newcomers and power users. Limit Orders allow traders to set precise entry and exit points without manual monitoring, while Dollar-Cost Averaging and Time-Weighted Average Price features automate exposure over time.

The platform’s Bridge Comparator simplifies multi-chain transfers, and Perpetuals Trading brings derivatives to the Solana ecosystem. These tools combine to reduce slippage, maximize efficiency, and unlock strategies traditionally reserved for institutional desks.

Security, Accessibility, and Real-World Utility

Built atop Solana’s Proof of History and Proof of Stake framework, Jupiter benefits from a robust consensus mechanism that timestamps events and secures the network through staked collateral. This dual-layer approach underpins every swap, limit order, and liquidity pool, ensuring user funds are protected.

In a bid to blend DeFi with everyday payments, Jupiter recently partnered with Sanctum to launch a SOL-based debit card, empowering holders to spend digital assets at merchants worldwide.

Price Prediction Approach

This article dives into Jupiter’s future value by combining quantitative and qualitative measures: historical price trends, on-chain metrics, macroeconomic indicators, protocol upgrades, and regulatory developments.

We’ll chart potential scenarios from 2025 through 2030, identifying catalysts that could propel JUP to new highs or headwinds that might stall its ascent. Whether you’re a seasoned trader or a long-term investor, our in-depth analysis will provide the insights you need to navigate Jupiter’s next frontier.

Jupiter JUP 2025 to 2030 Price Prediction

Potential 2025 Price Predictions for Jupiter

According to CoinCodex’s outlook for 2025, JUP is poised to trade within a relatively tight channel ranging from $0.35 to $0.51. For the year, their model projects an average annualized price of $0.39, which translates to a modest return of about 0.83% from current levels.

In contrast, CoinDataFlow paints a significantly more bullish picture for JUP by the end of 2025. Their forecast spans from $0.47 at the low end up to $1.06 at the high end, implying that Jupiter could more than double today’s average price. If Jupiter actually hits their upper target, investors would enjoy a potential gain of roughly 104.7%.

Youtubers Price Prediction for JUP

Crypto Spotter, a popular YouTube channel about cryptocurrencies, shared a video discussing the potential and “realistic” price movements for JUP in 2025, answering the question about the token’s potential to reach $20.

Market Sentiment Trends for Jupiter in 2026

Gate.io’s 2026 outlook for JUP paints a cautiously optimistic picture, with historical price action suggesting a trading range between $0.47 on the downside and $0.68 at the upside. Their model calculates an average price of $0.62 for the year, implying a 20% return on investment relative to today’s levels.

In stark contrast, DigitalCoinPrice offers a much more conservative, or even bearish, prediction for JUP by the end of 2026. Their forecast suggests that JUP may struggle to hold above $0.00255, with a likely trading floor between $0.00215 and $0.00255. The most probable closing price in their view centers around $0.00245.

Bullish 2027 Price Targets for Jupiter

According to Changelly’s technical analysis, JUP is poised for a steady uptrend in 2027, trading within a relatively narrow corridor. Their experts anticipate JUP will bottom out around $1.21 and rally as high as $1.46, with an average price settling at roughly $1.24 over the year.

Alternatively, a more bullish camp envisions JUP breaking into entirely new territory by the end of 2027. Under this scenario, natural market cycles and episodic corrections give way to renewed investor enthusiasm, lifting the average JUP price to about $4.37 and pushing the peak as high as $5.75.

2028 Market Sentiment and Investor Confidence for Jupiter

With Solana’s scaling upgrades fully live by 2028, JUP could effortlessly process transaction volumes far beyond today’s benchmarks. Under this scenario, JUP’s price may climb steadily from around $0.84 at the start of the year to a peak of $0.95 as traders reward the protocol’s unmatched speed and liquidity.

Riding the wave of the Bitcoin halving, JUP could experience a dramatic rally, pushing its value well past current levels. In this optimistic forecast, JUP could be priced around $12.00 by the end of the year, showcasing the influence of the overall market as well as the token’s own DeFi functionality on Solana.

2029 Price Range Analysis for Jupiter

JUP’s price outlook for 2029 remains broadly positive. Analysts forecast an average trading price of roughly $0.92 over the year, reflecting steady demand for JUP’s DeFi utility on Solana. Early-year volatility is expected, with prices dipping to around $0.66 in January before gradually picking up steam.

An alternative, more aggressive scenario emerges from recent experimental simulations, which project a staggering 346.39% gain for JUP across 2029. In this bull-case model, JUP would soar to $2.33 at its highest point. The token is anticipated to find lower support near $0.73.

2030 Conservative Price Prediction for Jupiter

Following the steady bullish sentiment carried over from previous years, Jupiter’s price in 2030 is broadly expected to oscillate between $0.466 at its lowest and $0.79 at its peak. Analysts peg the average trading price for the year at approximately $0.72.

In contrast, a separate group of technical analysts employs a more conservative model, anticipating that JUP may cross the $0.00521 threshold in 2030. Under this framework, the token’s floor is set near $0.00476, with a maximum of around $0.00546.

Conclusion

Jupiter’s powerful DEX aggregation, comprehensive DeFi toolkit, and ironclad security framework have solidified its role as a cornerstone of Solana’s liquidity landscape. 2025–2030 forecasts span a wide spectrum, from modest channels around $0.35–$0.51 to potential peaks above $12 in extended bull runs, underscoring how network upgrades, macro catalysts, and market sentiment will shape JUP’s journey.

The Price Predictions published in this article are based on estimates made by industry professionals, they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.