According to a recent Reuters report, the class action litigation against cryptocurrency behemoth Coinbase, Coinbase Global, and CEO Brian Armstrong, claiming unregistered securities offerings, was turned down in the United States District Court for the Southern District of New York on February 1.

The lawsuit, which was filed on March 11, alleged that 79 of the tokens offered on the cryptocurrency exchange were securities being sold without the appropriate broker-dealer registration and that clients were also not aware of the consequences.

However, U.S. District Judge Paul Engelmayer concluded that users of the Coinbase and Coinbase Pro trading platforms had not shown that the business had sold or owned the 79 tokens that they exchanged.

Customers stated that other sites frequently matched buyers and vendors. Coinbase, however, served as an “intermediary.” They argued that by doing this, it became the “actual seller” of the tokens. The plaintiffs further stated that the current method allowed Coinbase to earn transaction fees while avoiding transparency requirements.

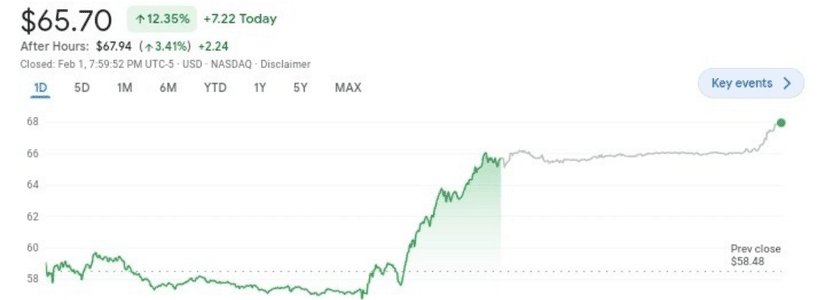

Coinbase stock price soared as judge ruled favorably

The judge decided that the rules of the exchange’s user agreement “flatly contradict” the accusations in the case. In addition, the trading platform did not actively solicit investors, according to Judge Paul Engelmayer.

Furthermore, he made it clear that Coinbase had no direct involvement in the transactions, despite the fact that it is claimed to have promoted tokens by outlining their “purported value proposition” and participated in “airdrops” to increase trade volume.

The judge asserted in his ruling,

“These activities of an exchange are of a piece with the marketing efforts, materials, and services that courts… have held insufficient” to qualify defendants as sellers.

The court opined that the allegation under the Exchange Act presumed the presence of a contract involving a prohibited transaction. Observing that only the user agreement was accountable for that claim and that it “did not necessitate unlawful activities,” he rejected that assertion. Throughout the analysis, the court referenced relevant case law.

Moreover, the judge dismissed federal securities law claims with prejudice, meaning they cannot be brought again.

Following the news, Coinbase’s stock price responded favorably by rising dramatically. COIN surged by 12.35% during the closing hours of Wednesday’s trading period and rose to $65.70. During the after-market trading hours, it added another 3.41% to its gain.