Crypto.com coin (CRO) has shown an incredible month in price jumps, and it seems the uptrend isn’t going to end soon. Many metrics show the momentum is still high for the blockchain and its native token. Besides, the marketing activity is very significant and can help the CRO token move to higher price lines. On-chain activity is another important metric that is rising and can help the token move higher in the price chart, too.

The latest analysis by Santiment shows that the uptrend for CRO coin may not be ending soon. According to the latest tweet:

“#CryptoComCoin is up a staggering +404% the past month, and it appears it’s still seeing some impressive on-chain activity. The asset has surpassed 9,000 daily $CRO active addresses yesterday and is now seeing the 7th most activity among #ERC20.”

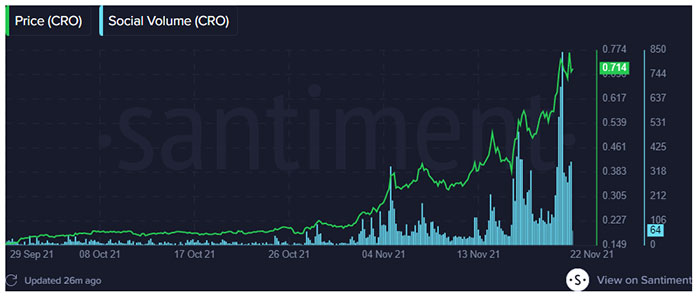

High on-chain activity means more people are using the native token and can be a promising fact. But there are some metrics showing not a fully promising future for CRO. According to the detailed analysis by Santiment, the token may be fading away from the crowd’s attention. The social volume chart for this token shows a downtrend movement shaping. But SV isn’t always a sole reliable metric. Sometimes a jump in this metric comes with price corrections, but it’s not always true. In fact, the downtrend may be the start of another leg up for the token.

When you compare the charts of CRO and SOL, you see a similar pattern in the social volume metric. Solana experienced a considerable jump in SV that was followed by a downtrend and moved the price lower, too. It may happen to CRO, too.

Another important metric in CRO charts is the exchange inflows. When this metric rises, we can expect people selling their tokens and the price to go down. It can become true for CRO, too.

As mentioned above, on-chain activity can be important in analyzing CRO. The data shows that DAA has seen a considerable jump. Compared with other ERC-20 tokens with more than 4400 DDAs in the last week, CRO is showing a surprising pattern. It doesn’t seem sustainable.

In simple terms, CRO is showing good patterns in some metrics. It may result in more ATHs for the token. But every ATH comes with profit-taking, selloffs, and price correction. After all, we can expect the Crypto.com token to start corrections in the price chart soon.