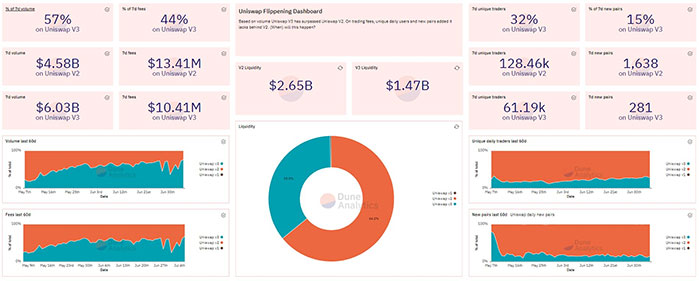

Dexstream released a new Uniswap flippening dashboard showing the state of the DeFi platform in the last week. The data focuses on the migration stats of the platform from V1 to V2 and V3.

According to the latest data, Uniswap V3 is still gaining attraction, and the liquidity on the newest version is getting close to that of Uniswap V2. the seven-day volume of Uniswap V3 is more than all other previous versions, but the V2 is still at the front in seven-day fees, unique trades, and new pairs.

Uniswap on the Path of Evolution

Uniswap V3 is the latest version of the DeFi platform with new features and tools. The platform suggests developers, as well as users, migrate to the latest version to benefit from the new changes. But the decision always comes from the. Although many developers and traders have migrated to the new version, there are still many that prefer the V2 or are in the process of migration. The weekly data from the Uniswap platform shows that still many of the trades happen on Uniswap V2, but the volume is increasing in the Uniswap V3.

According to the latest dashboard from Dexstream, 57% of the trading volume in the last week has happened on the Uniswap V3. But the situation is different in the % of 7d fees report. Still, most of the fees were paid in the last versions (mostly V2). The dashboard shows that $13.41M of fees were paid in Uniswap V2 in the last week. It’s good to say that the trading volume in Uniswap V2 has been $4.58B in the last week.

When we look at the bigger picture, we can see the Uniswap V3 is gaining traction because both the volume and fees have been rising in the new version in the last 60 days. As mentioned above, the new version still has a long way ahead to cover the most liquidity of the platform. The liquidity in the Uniswap V2 is $2.65B, while Uniswap V3 accounts for $1.47B so far.

Unique daily trades is another metric that is good to compare between the different versions of the Uniswap platform. V2 still dominates this metric, and because of more liquidity on this protocol, more trades happen on that. The recent data shows that only 32% of unique trades were managed in V3 in the last week.

Uniswap V3 is behind in new pairs compare, too. The data shows 1,638 new pairs were introduced in V2 in the last week, while only 281 pairs were added to the V3 protocol. It means that V3 still needs more promotion and liquidity to encourage developers to add their tokens (or pairs) to the new version.

If you found this article interesting, here you can find more DeFi News