50 years ago in an essay for The New York Times, American economist Milton Friedman expressed a controversial statement that still rings true today. Titled ‘The Social Responsibility of Business Is to Increase Its Profits,’ Friedman argued that ‘greed is good.’ But is it always? A broader look at the DeFi horizons shows that what may be profitable now may be disastrous long-term.

Following the market correction earlier this month, several local exchanges in China had trouble transferring assets to customers attempting to withdraw. The situation escalated around September 6 when Chinese traders started a coin withdrawal campaign with the goal to transfer cryptocurrencies to safer decentralized exchanges.

Reported by Chinese crypto-journalist Colin Wu, exchanges quickly retaliated after the campaign. Combined with statistics that showed high interest in DeFi and yield farming in China at the time, exchanges decided to bring back users by listing all kinds of tokens. Traders could find the very same tokens on DEXs, however, CEXs provided lower fees and higher liquidity.

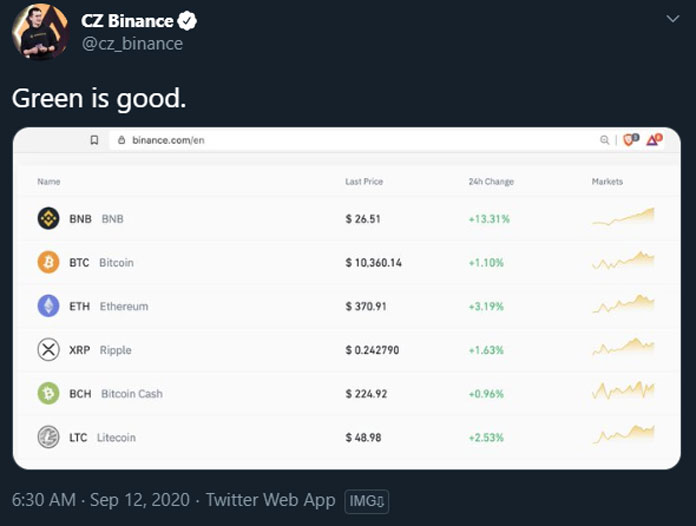

At that time commences the point where greed is in fact, not good. What happened in China last week now occurs with exchanges based in the western hemisphere this week. Exchanges such as Binance are listing DeFi and yield farming tokens left and right without any consideration.

Most of these projects only handled internal audits, leaving them vulnerable to manipulation. Moreover, Binance took the stance that users should take caution in this new free market and that exchanges should have no responsibility at all.

Zero responsibility, really?

Naturally, a free market in a fresh unregulated industry does not work very well. By listing various DeFi tokens, exchanges give them legitimacy and significant price boosts. Therefore, we have a situation where the same assets transfer from one project to another. That all sounds great in the mind of a profitable trader, but I want to repeat the most important point again, greed is not good.

At the end of a line following a new token listing lies a new community of ‘bagholders.’ If whales and ‘small fish’ profit from these listings, inexperienced new traders will take the fall 99% of the time. With decimated portfolios, they lose trust in the sector and mostly decide to never return as they lack any capital to continue their crypto career. In that respect, greed is in fact not good as the current situation can continue for only so long.

Green or greed?

Green or greed?

That also leaves us with the question of, how can we let once-respected exchanges take a completely amateur stance during this DeFi bubble? Taking a look at my Crypto Twitter timeline, I see daily listings from all sorts of exchanges. Sometimes, I have to look twice at the tokens since I really cannot comprehend how the exchanges stooped that low.

The same exchanges may argue their free-market stance under the guise of decentralization, but who are they kidding? How can a centralized exchange push for decentralization only when it suits them?

The irony in this whole situation reached such high levels that Binance attempts to create the CeDeFi sector. You read that right. Centralized decentralized finance. In any other moment in the past two years, investors would have laughed at the notion. Nevertheless, greed can disguise even the worst of oxymorons through PR and marketing.

Four months into the DeFi bubble, it is too late to fix the market

The DeFi industry enjoyed its exponential growth starting in June. In only three months, investors locked 10 times more assets than previously. However, a ‘healthy correction’ occurred at the end of August. Now, we face the same old problems of high gas fees and exit scams. This leaves us with the answer to where the market will go next.

When and how low is still up for speculation, but one thing is for sure, Bitcoin will not enter a bull run this year. Is it predetermined by the global economic situation or by greedy DeFi investors? We will never know. All that is left to do is spectate the craziness within the crypto community and watch investors go from being profitable to being in ruins. Remember, greed is ‘good.’

If you found this article interesting, here you can find more DeFi News