TL;DR

- SEC Chairman Gary Gensler calls for transparency in cryptocurrency markets.

- It highlights the need for cryptocurrency exchanges to register and comply with the same regulations as traditional financial institutions.

- It focuses on the importance of disclosing climate and cybersecurity-related risks, as well as uncertainty over Ether’s classification.

Transparency in financial markets is essential for their efficiency and to protect investors.

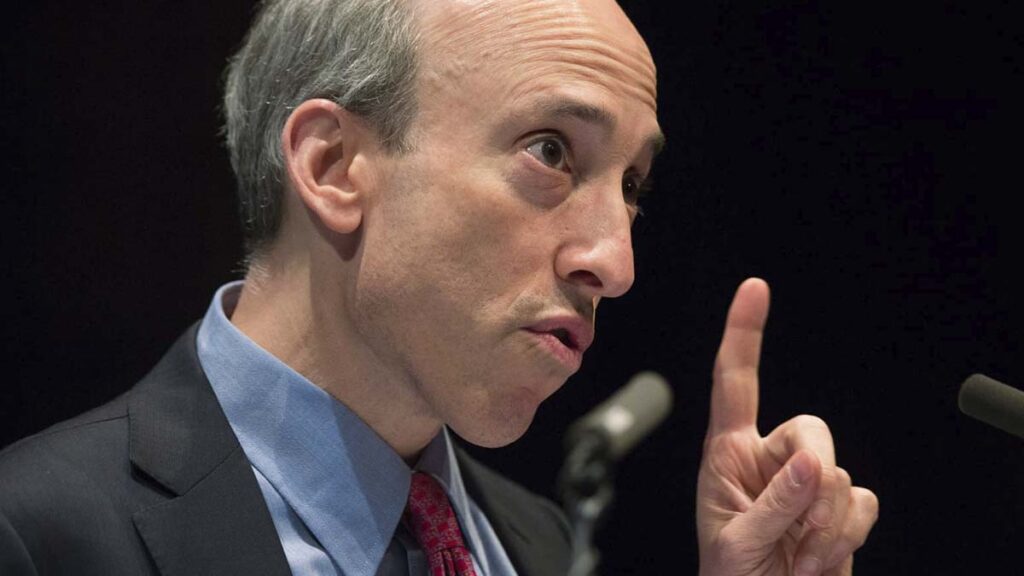

This is the position reiterated by Gary Gensler, chairman of the Securities and Exchange Commission (SEC), during a lecture at Columbia Law School.

Gensler highlighted the need for cryptocurrency exchanges to register with the SEC and comply with the same rules as traditional financial institutions.

The SEC has cracked down on major cryptocurrency companies, such as Coinbase and Kraken, for allegedly operating without proper registration.

Gary Gensler stressed that these types of actions are necessary to ensure that the cryptocurrency market operates fairly and transparently.

In addition to the need for registration, Gary Gensler stressed the importance of disclosing climate and cybersecurity risks.

Gary Gensler mentioned that the SEC adopted rules for companies to disclose climate risks

This reflects the regulator’s commitment to addressing emerging risks in financial markets.

Gary Gensler also highlighted the importance of collaboration between the SEC and the Commodity Futures Trading Commission (CFTC) in regulating cryptocurrencies.

He acknowledged the CFTC’s role as a derivatives regulator and noted the importance of working together to effectively regulate digital assets.

However, uncertainty remains over the classification of certain cryptocurrencies, such as Ether.

While CFTC Chairman Behnam has asserted that Ether is a commodity, the SEC’s stance on this matter remains less clear.

This lack of clarity can have significant implications for market players and highlights the need for greater regulatory clarity in the cryptocurrency space.

Gensler’s statements highlight the SEC’s commitment to transparency and regulatory compliance in the cryptocurrency market, while also underscoring the importance of collaboration and the need to address regulatory uncertainty in the cryptocurrency space.