Ethereum has recovered strongly off the $3,400 capitulation low to regain levels above the critical $4,000 point, marking a shift in market sentiment. The shift comes after a heavy sell-off rocked the wider crypto market earlier in the month, leaving investors cautious but optimistic. Bitcoin’s steady performance above $112,000 has anchored the confidence across the altcoins, in which Ethereum has rebuilt its technical structure and attracted renewed accumulation.

Analysts believe that if Ethereum can maintain the momentum above the $4,000 zone, it could retest higher resistance zones around $4,500 as a significant comeback ahead of Q4. Meanwhile, emerging projects like MAGACOIN FINANCE are starting to draw investor attention amid this stage of recovery, and it shows a renewed appetite for early opportunities in the market.

Ethereum Technical Setup Shows Early Signs of Strength

Ethereum’s technical chart has seen much improvement after months of heavy consolidation. The asset has reclaimed its 100-day moving average and retraced back inside its previous trading channel in a signal that the recent bearish cycle may be over. The daily RSI has also turned upward, forming a clear bullish divergence, which is a technical sign that selling pressure is easing.

Source: TradingView

Currently, ETH is consolidating just below the $4,300 resistance zone, which stands as a crucial resistance for the next leg up. A confirmed close above this level would probably trigger a rally towards $4,500 – $4,700, completing the structural recovery. However, analysts warn that any sustained fall below $4,000 could be an invitation for short-term weakness and retest the $3,600-$3,400 demand zone.

On-Chain Data Points to Accumulation and Liquidity Tightening

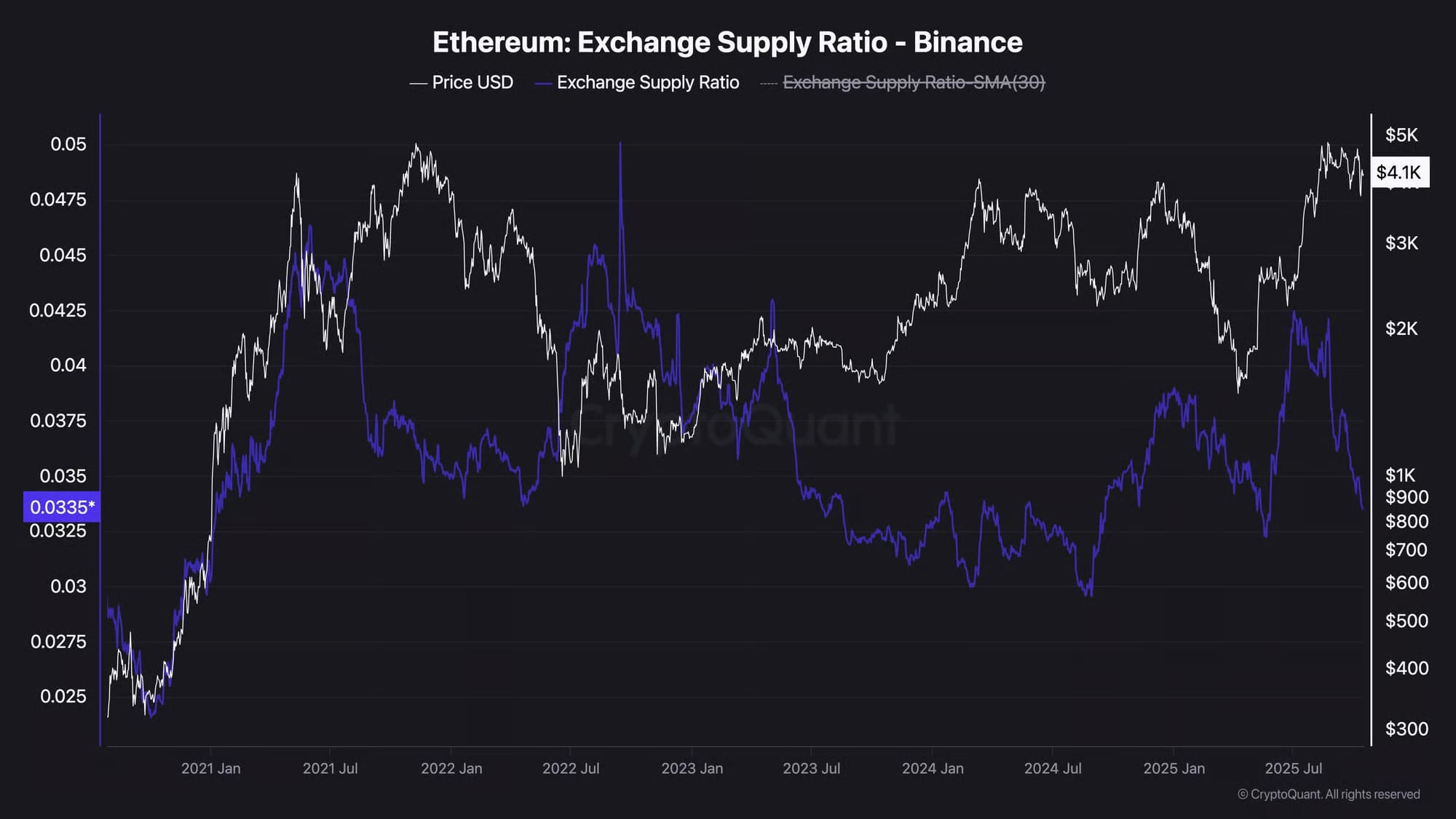

Recent on-chain data from Binance revealed a significant decline in Ethereum’s exchange supply ratio, which is now close to 0.33, the lowest since May. This metric measures the amount of ETH that is still available for trade on the exchanges, and the decrease implies that holders are putting coins into long-term storage.

Source: CryptoQuant

Such behavior reflects rising conviction by both retail and institutional participants. Fewer tokens in exchanges means less selling pressure and tighter liquidity in the market, a condition often preceding price appreciation. Analysts believe that this trend implies real accumulation, rather than short-term speculation, evidence to claim that Ethereum’s rebound has underlying structural strength.

Bitcoin Stability Reinforces Market Confidence

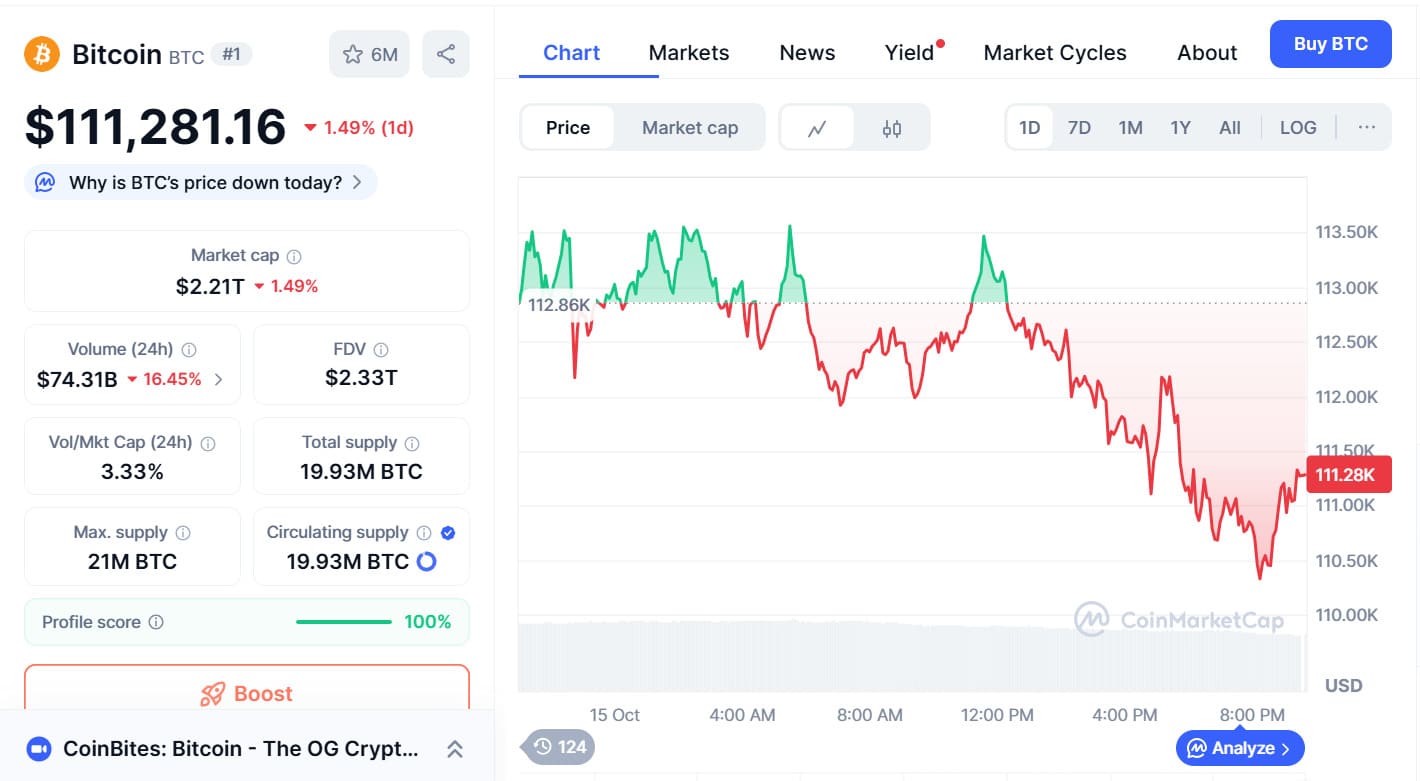

Bitcoin’s ability to hold above $112,000 continues to stabilize sentiment across the market. After briefly hitting $126,000 last week, Bitcoin price experienced heavy liquidations, with more than $19 billion worth of leveraged positions wiped out. Despite all this, the cryptocurrency quickly rebounded, holding key support around $111,500.

Source: CoinMarketCap

Data from Bitwise Asset Management shows corporate interest in Bitcoin is growing. A total of 172 public companies now hold the asset, a 38.7% increase from the previous quarter. Collectively, these firms hold more than 1.02 million BTC, which is about 4.9% of the total supply. This increasing institutional participation signals confidence that Bitcoin will continue to serve as an integral store of value within digital assets, something that also benefits Ethereum, shoring up investor faith in the overall market.

Momentum Extends to Emerging Presales

MAGACOIN FINANCE is currently in its presale phase, and analysts are calling it one of the standout opportunities for early investors. The project’s strength lies in its ability to merge utility with presale momentum, creating a balance between practical use and market excitement. Unlike typical short-term presales, MAGACOIN FINANCE has built a functional ecosystem designed for long-term adoption, blending investor incentives with real-world use cases.

Its audited smart contracts and transparent security framework have earned credibility among both retail and institutional participants. The presale has gained traction globally, with participation increasing rapidly as new stages roll out. Analysts note that this pattern resembles the early development curve of major crypto launches that later delivered exponential returns.

With its emphasis on verified security, community growth, and tangible functionality, MAGACOIN FINANCE has emerged as a presale that combines vision with execution. The project’s momentum suggests that investors are seeking projects with both innovation and long-term value as Ethereum and Bitcoin consolidate their leadership positions.

Conclusion

Ethereum’s recovery above $4,000 marks a critical turning point as it prepares to test the $4,500 resistance zone. Technical indicators, on-chain accumulation, and Bitcoin’s steady hold above $112K together create a backdrop of improving confidence heading into year-end.

At the same time, new entrants like MAGACOIN FINANCE are attracting capital from investors looking to position early in high-utility presales. The combination of established market stability and rising innovation underscores a broader recovery trend, one that could define the next phase of the crypto market’s resurgence.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.