Latest Ethereum [ETH] News

Well, there is nothing as damaging and even deflating to the crypto community like a hack, a digital thuggery or simply put, theft. It seems they are becoming increasingly sophisticated and with revelations that some of these malicious groups are sponsored by rogue governments, it’s chilling to the end user. After Cryptopia lost a considerable amount of ETH and their failure to recover translating to zero haircuts meaning there is no recompense for customers, Dragon Ex hack may turn out to be another loss for the crypto community.

What’s worse is that every hack is accompanied by tough talk, promise of collaboration but whenever there is infiltration forcing an exchange to withdraw services, subscribers better expect the worse. In the case of Dragon Ex, they were breached on Sunday but they bought time and it wasn’t until Monday when they acknowledged that user funds were gone but “would take responsibility.”

All in all, every loss, every breach intensifies call for crypto regulation now that these exchanges operate from different jurisdiction with applying rules. So far, there has been no word from the Singaporean authorities and neither is the exchange updating users on the extent of the damage. But as always, the buck stops with the owner. Caution must prevail and we shall lay emphasis on due diligence and the need of storing coin’s private keys in cold wallets—not exchanges.

ETH/USD Price Analysis

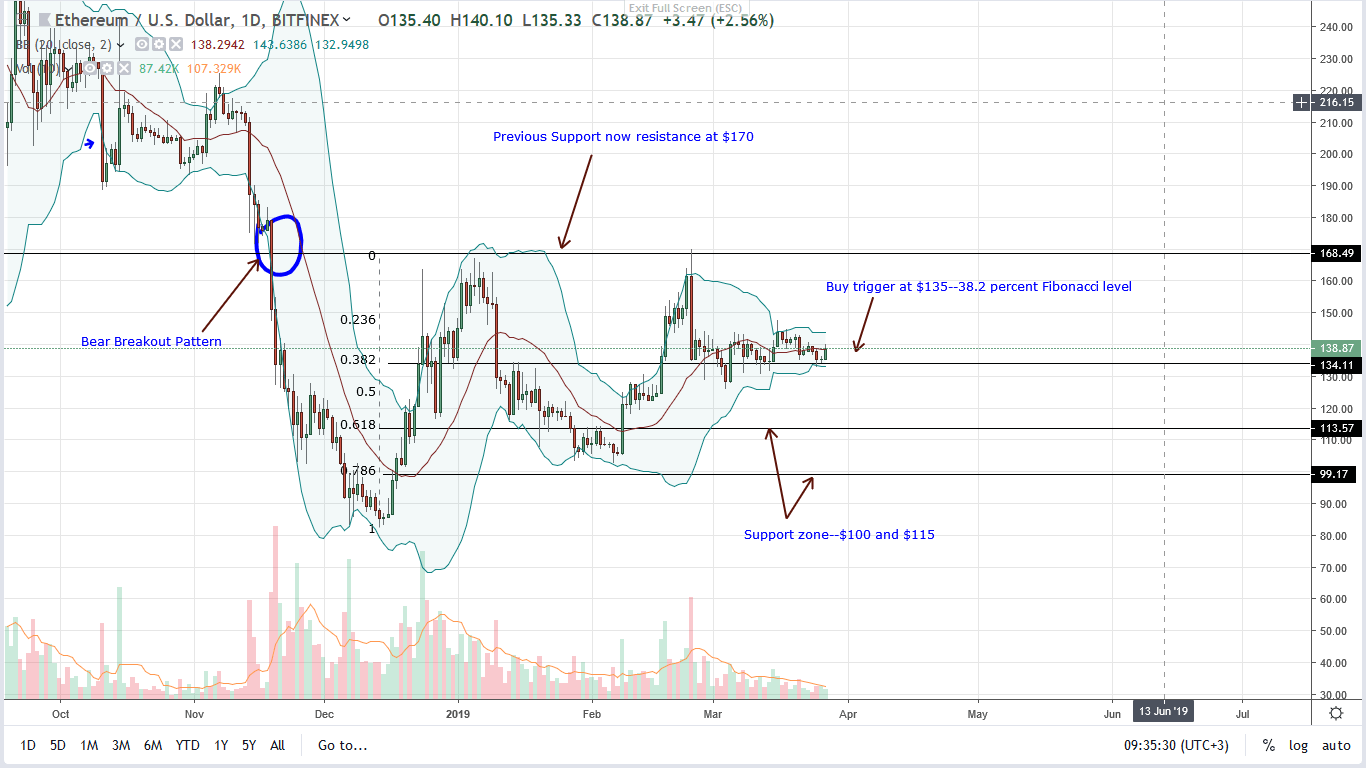

Nonetheless, it won’t be until after there is a breakout from the congestion between Mar 15—27 that we shall recommend buyers to load up when prices are satisfactorily trending above Mar 21 highs of $150.

On the other hand, risk-averse conservative traders should wait for a close above $170 complete with high transaction volumes above 880k of Feb 24. But the path to $170 must be confirmed by an up-thrust above $150 with volumes above Mar 21 highs exceeding 302k of Mar 5.

If that happens, then the double bar bull reversal pattern of Mar 4-5 would be confirmed and for every dip, there should be an opportunity for aggressive traders to load up with targets at $170.

All Charts Courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.