The Ethereum price continues to maintain its uptrend, albeit with reduced momentum. The $600 level seems far-fetched, but analysts are confident of more upside.

Analysts’ Optimism

Taking to Twitter, one analyst said he projects the ETH/USD pair to rise to a conservative $1,200 in 2021, saying the year will be huge for crypto, and specifically Ethereum.

However, others are more optimistic, not only expecting the ETH price to rally above its all-time high of $1,400 but to rise to over $10k in the next few years. Specifically, when this lofty target will be reached is tentative. Still, that appears to be the consensus by most commentators.

Anchoring their hopes on the success of a parallel blockchain that right the wrongs of Eth1, not only are they predicting new highs above $640 but a retest of the $1k.

Nonetheless, how the ETH/USD pair will soar to these prices is also dependent on how smooth the transition is, the dominance of the smart contracting platform, and whether Ethereum will continue to be the home of DeFi.

Institutional Demand

Meanwhile, in anticipation of better prices, institutions, as the managing director of Grayscale said, are flowing in, ramping up the purchase of ETH shares.

For each share bought, an investor willing to gain exposure of ETH compliantly and securely via an SEC-reporting company gets a 10th of a full ETH as they pay a huge premium averaging 120 percent.

Presently, the amount of ETH under management in Grayscale now exceeds $1.6 billion as more coins continue to be bought regardless of the high premium.

Ethereum Price Analysis

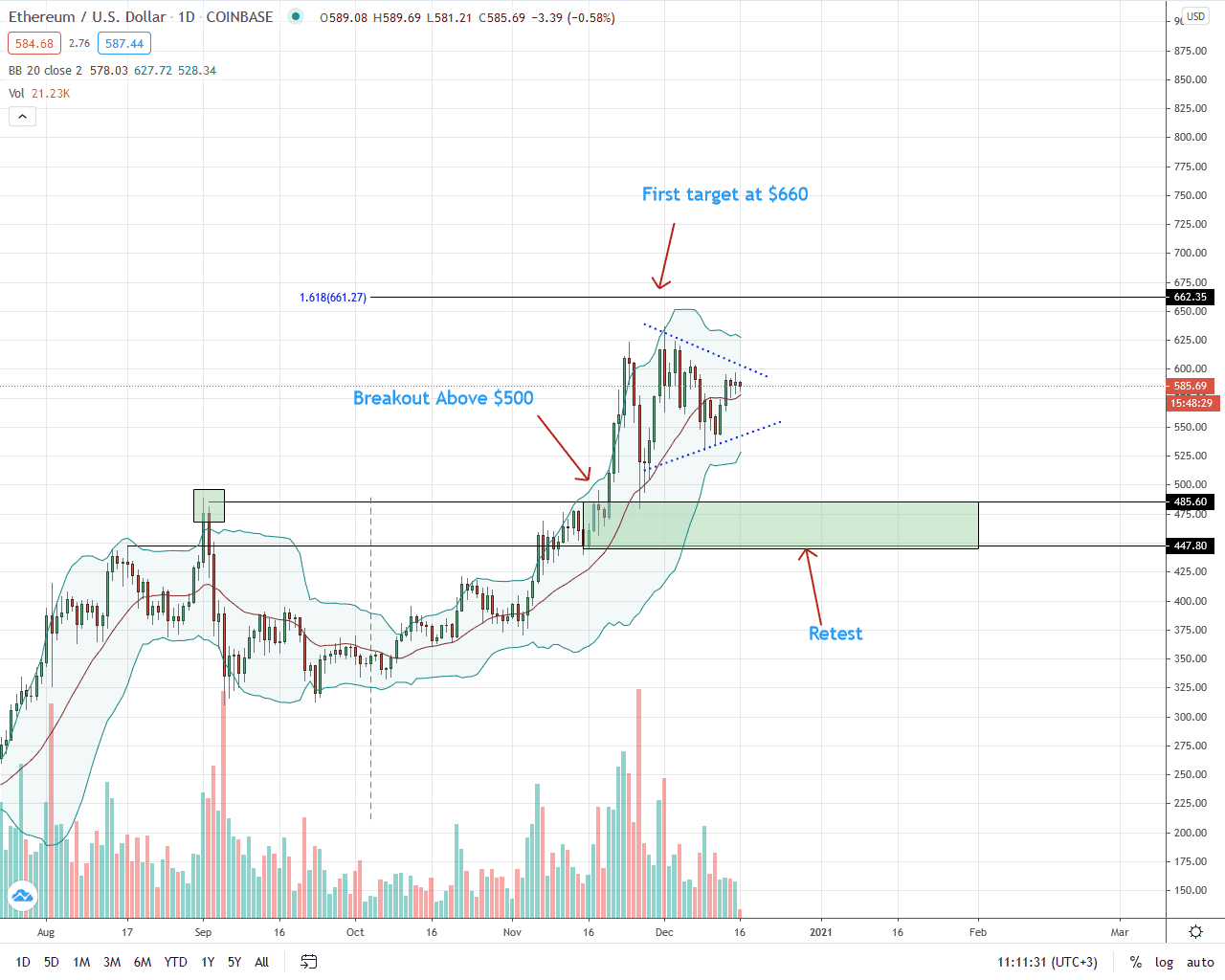

At the time of writing, the Ethereum price is range-bound, trading inside a bull flag. Week-to-date, the coin is at break-even with the greenback but still trailing BTC within the same period.

From the daily chart, prices are trending above the 20-day moving average albeit with below-average trading volumes. The immediate resistance line is $640—the Dec 1 highs, while support lies at $530—the Dec 9 lows. As long as prices are oscillating inside this zone, buyers are in control. As such, every low is potentially a loading opportunity.

A break below the lower support line and $530 could see the ETH/USD pair slide back to the $450 and $480 support zone in a retest of Aug 2020 highs.

Conversely, gains above $640 may spark more demand, pushing prices to $660—the 161.8 percent Fibonacci extension level of the July to September trade range.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ethereum News