Ethereum headlines this week reveal three pivotal developments. Developers confirmed the Fusaka testnet upgrade activation for October 1, setting the stage for mainnet scalability adjustments. At the same time, co-founder Jeffrey Wilcke shifted $6M worth of ETH, sparking speculation, while whales snapped up $1.6B in Ether. And in a landmark move, REX-Osprey unveiled the first Ethereum ETF staking product in the U.S., potentially reshaping institutional investment strategies.

These institutional and technical developments are accompanied by the continued success of meme-based retail games such as BullZilla (BZIL) and the proof that crypto still constitutes a two-sided ecosystem: innovation at enterprise levels, on the one hand, and speculative retail, on the other.

Fusaka Testnet Upgrade: October 1 Activation

At the 221st Ethereum ACDE meeting, developers confirmed that Fusaka’s first public testnet upgrade will go live on October 1. While four client teams are still finalizing their versions, the upgrade is crucial for Ethereum’s scaling roadmap.

The highlight: the default block gas limit will rise to 60 million gas, significantly boosting network throughput. Meanwhile, the EthPandaOps team plans to launch a Holesky shadow fork to stress-test the upgrade.

This marks another milestone in Ethereum’s post-Merge journey, demonstrating the community’s push toward greater scalability without sacrificing decentralization or security.

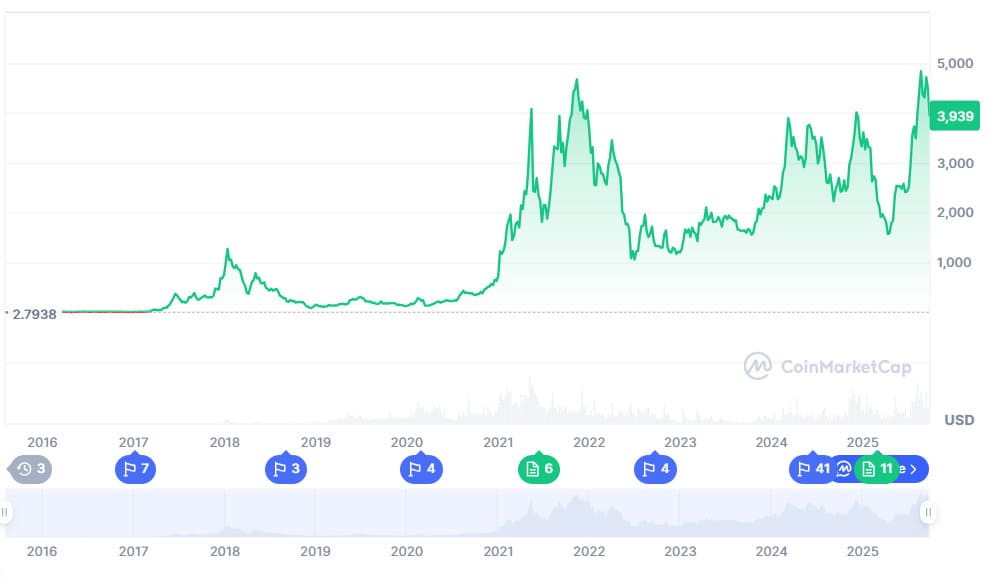

Ethereum Co-Founder Moves $6M ETH, But Whales Buy $1.6B

Ethereum co-founder Jeffrey Wilcke transferred 1,500 ETH (≈$6M) to Kraken, triggering speculation about a possible sale. While sending funds to exchanges often signals selling intent, Wilcke has a history of moving funds between wallets for reasons beyond liquidation.

The real headline, however, comes from whale accumulation:

- At least 15 wallets accumulated over 406,000 ETH (≈$1.6B) in just two days.

- Acquisitions came via major platforms like Kraken, Galaxy Digital, BitGo, and FalconX.

Despite ETH dipping below $4,000, whales are seizing the chance to buy at discounted levels. This buying spree underscores long-term confidence in Ethereum, even in bearish market conditions.

Ethereum ETF Staking: A Game-Changing Innovation

REX-Osprey has launched the first Ethereum ETF with staking rewards in the U.S., a groundbreaking product that combines regulatory compliance with Ethereum’s proof-of-stake yield.

Why It Matters:

- Institutional Appeal: Firms can convert passive ETH exposure into yield-generating validator positions.

- Market Potential: Analysts expect staking ETFs to drive massive demand, creating potential supply squeezes.

- First-Mover Edge: Unlike Bitcoin ETFs, this Ethereum product delivers utility beyond mere price exposure.

Challenges remain, particularly around SEC approval and regulatory clarity. Still, ETF staking could transform Ethereum from a speculative instrument into an income-generating pillar of institutional finance.

BullZilla Presale: Retail’s Counter-Narrative

While Ethereum makes strides in institutional adoption, retail investors continue to pile into speculative, meme-driven opportunities like BullZilla ($BZIL). Currently priced at $0.00009241 in Stage 4 (Red Candle Buffet), BullZilla has sold more than 29 billion tokens and raised over $670,000.

BullZilla ($BZIL) Presale Snapshot

| Metric | Value |

| Current Stage | 4th – Red Candle Buffet |

| Current Price | $0.00009241 |

| Tokens Sold | 29 Billion+ |

| Presale Raised | $670,000+ |

| Token Holders | 2,000+ |

| ROI to Listing | 5,600%+ |

| Early ROI | 1,500%+ |

| Upcoming Price Surge | +7.20% |

BullZilla’s mutation mechanism raises prices every $ 100,000 raised or every 48 hours, creating constant upward momentum. While Ethereum staking ETFs represent compliance-driven innovation, BullZilla epitomizes retail investors’ hunger for exponential returns.

Conclusion: Ethereum at a Crossroads

Ethereum is proving itself as both a technological leader and a financial innovator. With the Fusaka upgrade boosting scalability, whales reinforcing long-term confidence, and ETF staking bridging traditional finance with blockchain, ETH is entering a transformative era.

Simultaneously, such meme projects as Bull Zilla point to the desire of retail to speculate and get quick profits. All these forces indicate a shifting equilibrium between institutional and community-based hype, a dichotomy that remains informative of Ethereum to this day.

For More Information:

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions

What is the Fusaka testnet upgrade?

Ethereum’s upcoming testnet upgrade, raising the block gas limit to 60M gas, is scheduled for October 1.

Why did Jeffrey Wilcke move ETH to Kraken?

He transferred $6M worth of ETH, though it’s unclear if it was for selling. Historically, he has shuffled funds between his various accounts.

How much ETH did whales buy recently?

At least 15 wallets purchased 406,000 ETH worth $1.6B in the past two days.

What is Ethereum ETF staking?

A regulated ETF product allowing investors to earn staking rewards while holding ETH exposure.

Why is ETF staking significant?

It bridges traditional finance with Ethereum’s proof-of-stake, potentially boosting institutional inflows.

How does BullZilla differ from Ethereum ETFs?

BullZilla is a speculative meme coin presale, while ETFs provide regulated yield-based exposure for institutions.

What risks face Ethereum ETF staking?

Regulatory hurdles, SEC approval, and execution challenges.

Glossary

- Fusaka Upgrade: Ethereum testnet upgrade raising gas limits.

- Gas Limit: Maximum computational effort per block on Ethereum.

- Shadow Fork: A test fork simulating Ethereum mainnet conditions.

- Whale: Investor controlling massive cryptocurrency holdings.

- Proof-of-Stake (PoS): Ethereum’s consensus mechanism where validators stake ETH.

- Staking Rewards: Yield earned by validating transactions on PoS chains.

- ETF (Exchange-Traded Fund): A fund traded on exchanges like stocks.

- Mutation Mechanism: BullZilla’s system of raising presale prices every $100K or 48 hours.

- ROI (Return on Investment): Profit relative to initial investment.

- SEC: U.S. Securities and Exchange Commission.

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.