Ethereum prices, like the rest in the crypto sphere, are steady, soaking selling pressure and trading above key support lines.

While January 30 saw sharp price dips, the path of least resistance remains northwards, and traders remain upbeat.

It is yet to be seen how traders will react to upcoming fundamental factors, especially the United States Federal Reserve announcement on interest rates and their medium-term monetary policy.

For how trends are, sellers are back-peddling after wreaking havoc in 2022, forcing ETH to drop by more than half, below the $1k level.

ETH is bottoming up from November lows, adding roughly 50%. Still, the coin must break above immediate resistance levels and confidently shake off sellers for buyers to chart a new path.

Will Ethereum Become Ultrasound Money?

Buyers are generally bullish on what lies ahead for ETH. Top of the list is the gradual decrease in the network’s inflation, outstripping supply. This development could see ETH emerge as a store of value, better than gold and Bitcoin.

It would cement Ethereum’s position as a smart contracting platform but make ETH a coin for consideration amongst institutional investors. Should the Securities and Exchange Commission (SEC) of the United States also declare the coin as a commodity, like BTC, then as Ethereum moves to become ultrasound money, the coin’s uptrend could outpace BTC.

Before this, traders are watching the upcoming Shanghai Upgrade, which allows ETH stakers to withdraw their coins from the Beacon Chain. Whether this will impact prices will be seen in mid-February.

Ethereum Price Analysis

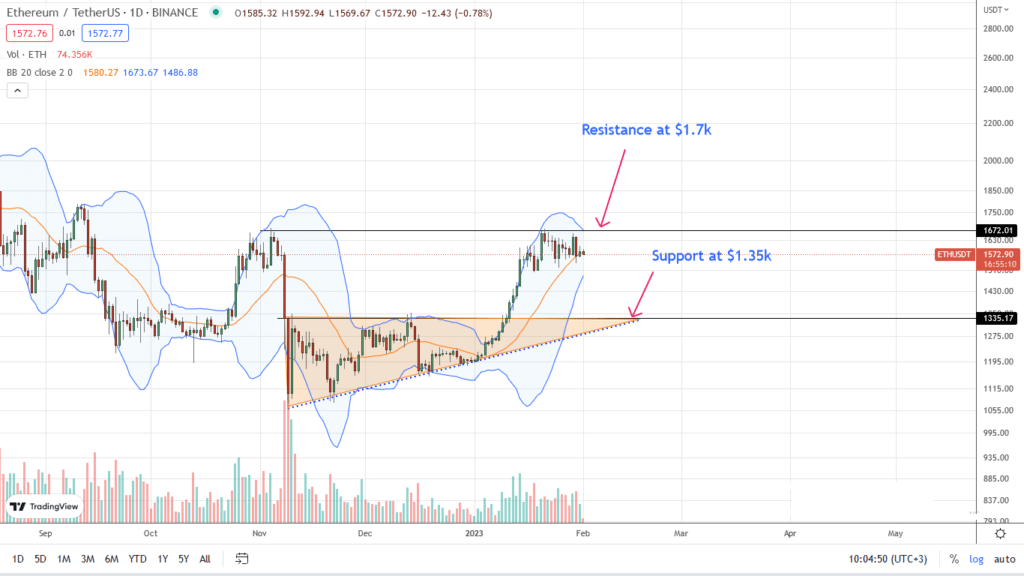

There is a bull flag in the daily chart. ETH prices are tracking lower as the upside momentum wanes.

As things stand, the primary resistance is $1.7k. The middle BB and $1.5k are support levels on the lower end.

For the uptrend to be valid, traders must hold prices above $1.5k. This will allow risk-off traders to accumulate on dips, targeting $1.7k.

Meanwhile, risk-on traders can wait for trend definition above $1.7k or below $1.5k. In either case, the breakout should be with expanding volumes.

If sellers take charge, ETH may retest $1.35k in a retest. Conversely, gains will confirm buyers of January, setting the ball rolling for $2k.

Technical charts courtesy of Trading View Disclaimer: Opinions expressed are not investment advice. Do your research.