The crypto market is bouncing back as investors are moving back into high-performing assets. Ethereum (ETH) leads the recovery with a strong touch at $4,700, after a week of strong inflows and renewed institutional demand. Analysts have noted that the liquidity rebound, coupled with the rise in ETF behavior, is providing renewed investor confidence across major asset classes.

However, while Ethereum makes headlines, MAGACOIN FINANCE has slowly made its way into the centre of the market. The project has since raised more than $15.5 million in total fundraising, with investors from the dominant ecosystems such as LINK and AVAX flocking in. Analysts describe it as one of the most promising altcoin opportunities heading into 2026, signaling widening momentum across the crypto landscape.

Ethereum Gains Strength as Market Liquidity Expands

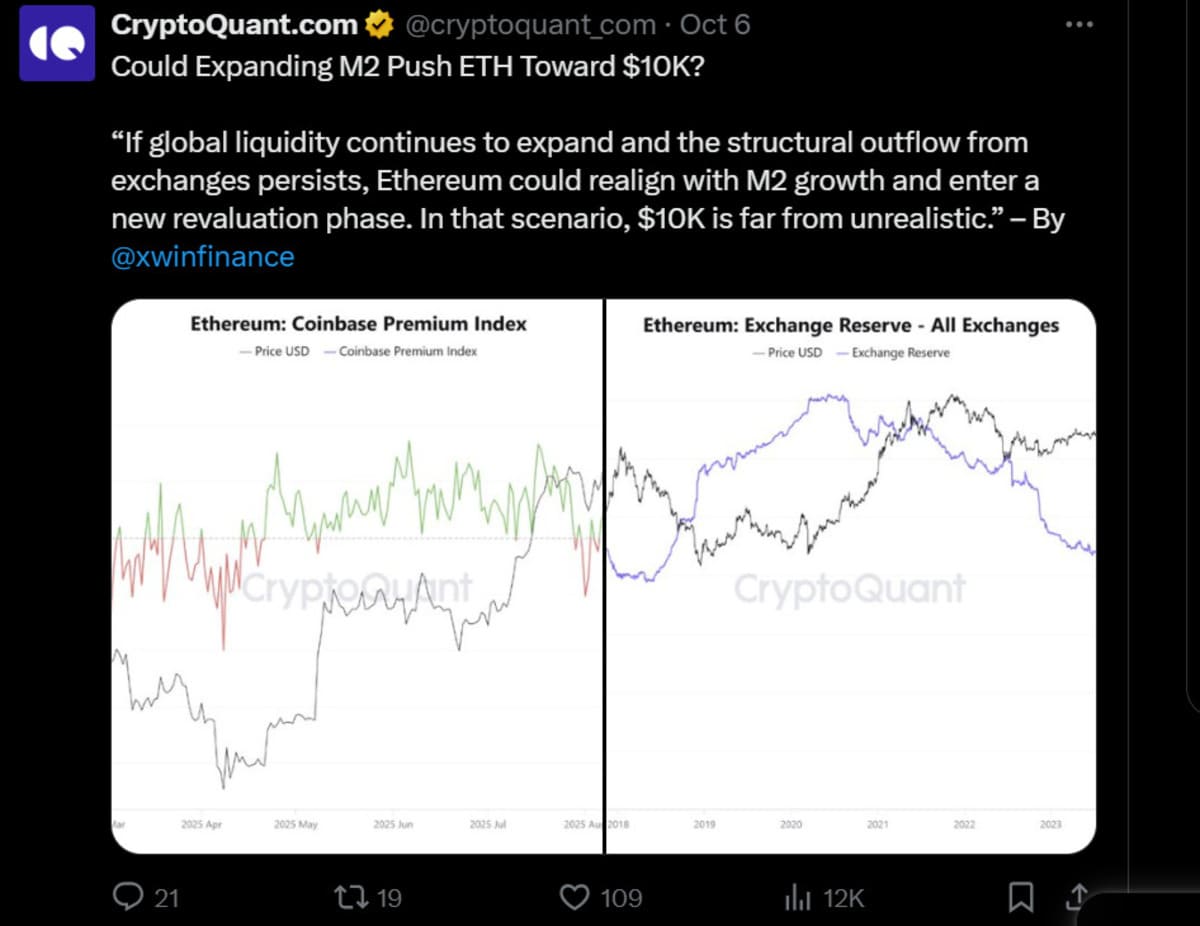

Ethereum is testing $4,700 on its recovery in October, showing fresh momentum. Analysts from XWIN Research believe that ETH could move to $10,000 if liquidity growth continues. They noted that the M2 money stock has grown for three years, and it has fueled demand for digital assets.

Source:X

Bitcoin was the first to respond to this “wave of liquidity” by increasing by more than 130% since 2022. Ethereum is up about 15% during the same time period, but analysts believe the gap will narrow. Ethereum exchange balances have shrunk to 16.1 million ETH, down 25% from 2022, indicating a decreased selling pressure.

Ethereum Market Outlook Remains Bullish

Ethereum’s rally started with the ‘Uptober’, backed by strong U.S.-listed Ethereum ETFs inflows. Over the last six sessions, ETH ETFs received close to $1.47 billion, as the token pushed above crucial resistance levels.

The market cap has reached the $565 billion mark, and daily trading volume exceeds $46 billion. Institutional confidence is picking up, with firms like SharpLink announcing more than $900 million in unrealized ETH profit.

Source: CoinMarketCap

Technically, Ethereum has broken above the descending channel and created a new ascending structure. Resistance is also around $4,700, and strong support is around $4,100-$4,200. A move above $4,700 could open a door to $5,000 as well. The RSI near 50 indicates no major selling pressure, and potential gains are possible.

MAGACOIN FINANCE Surpasses $15.5M in Presale Momentum

As the ecosystem of Ethereum solidifies, focus is going towards growing altcoins. MAGACOIN FINANCE has surpassed $15.5 million in total funding, emerging as one of the fastest-growing crypto projects this quarter.

Its transparent roadmap and emphasis on real-world blockchain utility have drawn investors. Analysts attribute MAGACOIN FINANCE’s growth to its disciplined approach, constantly updating and engaging its community. This model has attracted new attention as investors seek reliability and innovation in the next generation of projects.

The project’s utility and sustainability-oriented approach has placed it amongst the best crypto presales for 2025. MAGACOIN FINANCE’s success underscores a shifting market demand for tokens that are designed for long-term utility as opposed to speculative ones.

Why LINK and AVAX Investors Are Joining the MAGACOIN FINANCE Presale

Investors from LINK and AVAX ecosystems are increasingly joining the MAGACOIN FINANCE presale. Many are diversifying holdings to gain early exposure to a project showing measurable traction before broader market discovery.

Analysts explain that holders of these assets are shifting small allocations into MAGACOIN FINANCE to balance established positions with new-cycle potential. They view the project’s structured rollout and steady community participation as signs of long-term durability.

This move underscores a growing trend in crypto investing — pairing blue-chip stability with early-stage growth opportunities. MAGACOIN FINANCE fits that profile, combining consistent market visibility with a roadmap that aligns with the next bull-market phase.

Final Take

Ethereum’s test of $4,700 confirms that institutional interest remains strong. Analysts expect ETF inflows and broader liquidity expansion to sustain its upward trajectory toward $5,000.

Meanwhile, MAGACOIN FINANCE continues to attract new investors from established networks, including LINK and AVAX. Its rising participation and $15.5 million milestone highlight growing belief in projects that combine solid structure with scalability.

As Ethereum anchors the rally and MAGACOIN FINANCE defines new momentum, both assets are shaping the tone for Q4 and beyond. Analysts see them as key drivers of the next crypto expansion heading into 2025.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.