Latest Ethereum [ETH] News

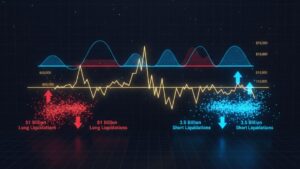

After 15 long months of relentless bears and distribution, the crypto community is recovering. Yes, it is not like Ethereum [ETH] doubled but there is a relieve in that prices are above important liquidation levels. Besides, there are torrents of articles out there as analysts try to figure out exactly why the markets is rallying. While there is a contagion effect from the king of cryptocurrencies, we must also admit that despite fading novelty especially in the dApp sector, Ethereum is a go-to smart contracting platform.

There was a successful Metropolis and with a freeze ahead of proof-of-stake, scarcity will ultimately fuel demand and with meteoritic rise of Bitcoin, ETH pump is likely to be accelerated. Apart from Metropolis and Bitcoin and all this interest around prices, let’s also not forget that Ethereum 2.0 test-net has been released. It’s a huge stride towards proof-of-stake via Serenity and Nimbus, the development team that released this upgrade, admitted of challenges but nonetheless launched it within the set time frame:

“We did it…we have a Nimbus-to-Nimbus test-net running, not just in a simulation on a single machine, but with a remote bootstrap node and people connecting to it – even from outside of Status. This is a major milestone in the development of Ethereum 2.0, and while stability issues persist and bugs will happen, the fact that we now have a Beacon chain synchronizing across nodes that aren’t necessarily local to each other is a big deal.”

ETH/USD Price Analysis

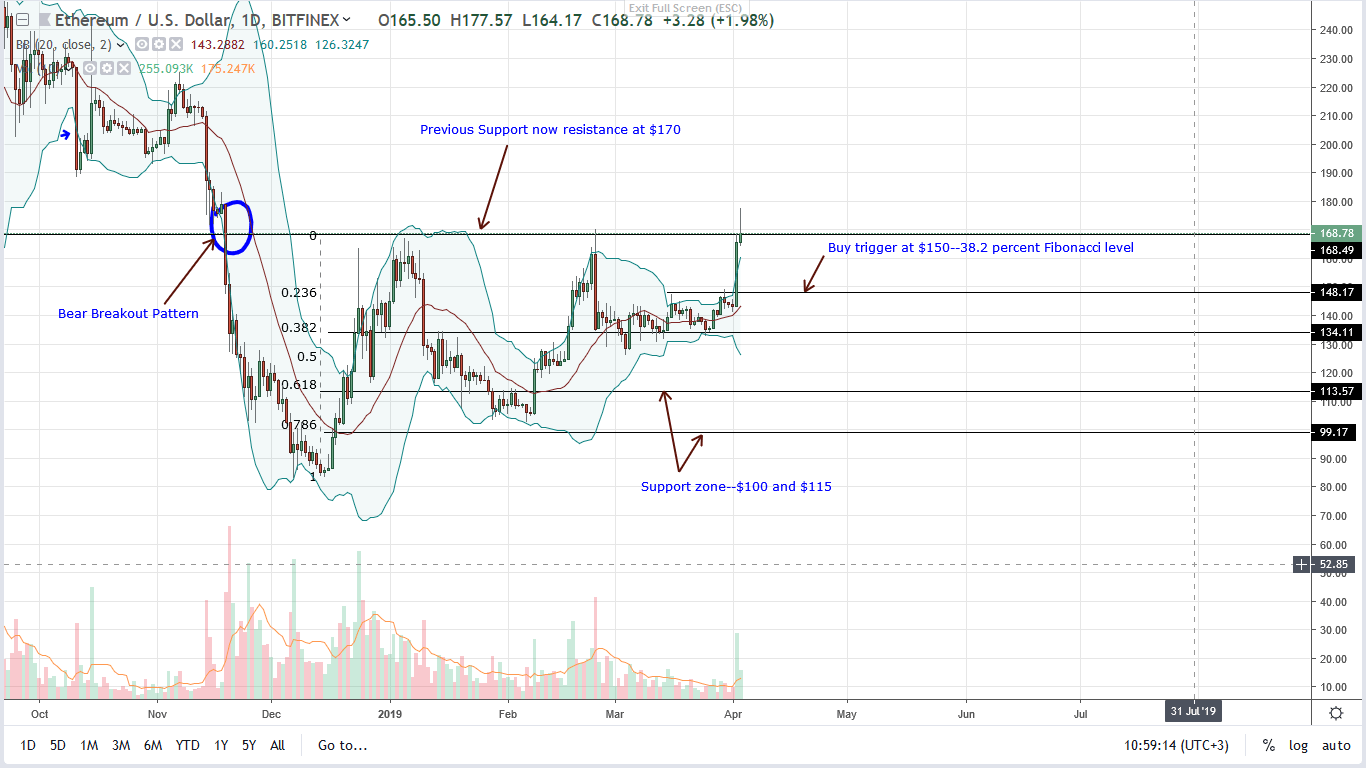

At the time of press, Ethereum [ETH] prices are over-extended, up 24.5 percent from last week’s close and 11.6 percent from yesterday’s close. This means, the coin is trading above a temporary resistance line at $150 translating to longs for risk-off, aggressive traders.

If anything, the trader’s cause of action in the next few days is to search for undervaluation opportunities in lower time frame anywhere between $150 and $160, load up and aim for $200. On the other hand, and as reiterated in all our last ETH/USD trade plan is to wait for a firm break above $170—last year’s support now resistance, nullifying the bear slide of Q4 2018 and setting the tone for the next wave of higher highs towards $250 and even $300.

The reason for this caution is that Apr-2 bull bar, despite being wide-ranging had low participation—254k which is less than half of Feb 24—880k but still above recent averages of around 110k and more than Mar 5 of 302k.

All Charts Courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.