The Decade of Cryptocurrencies

This decade saw Bitcoin carve out its market share from the rigid traditional players wary of change and ready to “attack” encroachers.

But with the success of Bitcoin, Ethereum developers, including Vitalik Buterin and five others, introduced a smart contracting platform that enabled tokenization.

Ethereum proved a case, and although many other platforms have cropped up promising speed and scalability, developers are loyal to the Ethereum.

Platform Improvement

Hard at work, all eyes are focused on Ethereum 2.0 and that also means a discourse on the best way forward. The activation of Muir Glacier hard fork, and the postponement of the Difficulty Adjustment by four million blocks less than a month after implementing Istanbul has been a cause of furor, an opportunity for bashers to let loose and criticize the network.

Still, even if Ethereum is a “science project,” the last decade was a success. For perspective and for comparison, ETH outperformed Amazon and Netflix, two of the top performing FAANG stocks. This is a direct hint of how potent Ethereum is and what the cryptocurrency space at large promise in the long term.

Regulator Policies will either break or make Ethereum and Crypto Projects

Under-explored because of regulatory challenges, Ethereum is at a critical phase that will most likely see the second most valuable coin pump to new highs.

Events in Q1 2020 will define the gradient of that trajectory and how the team handles the platform’s transitioning.

ETH/USD Price Analysis

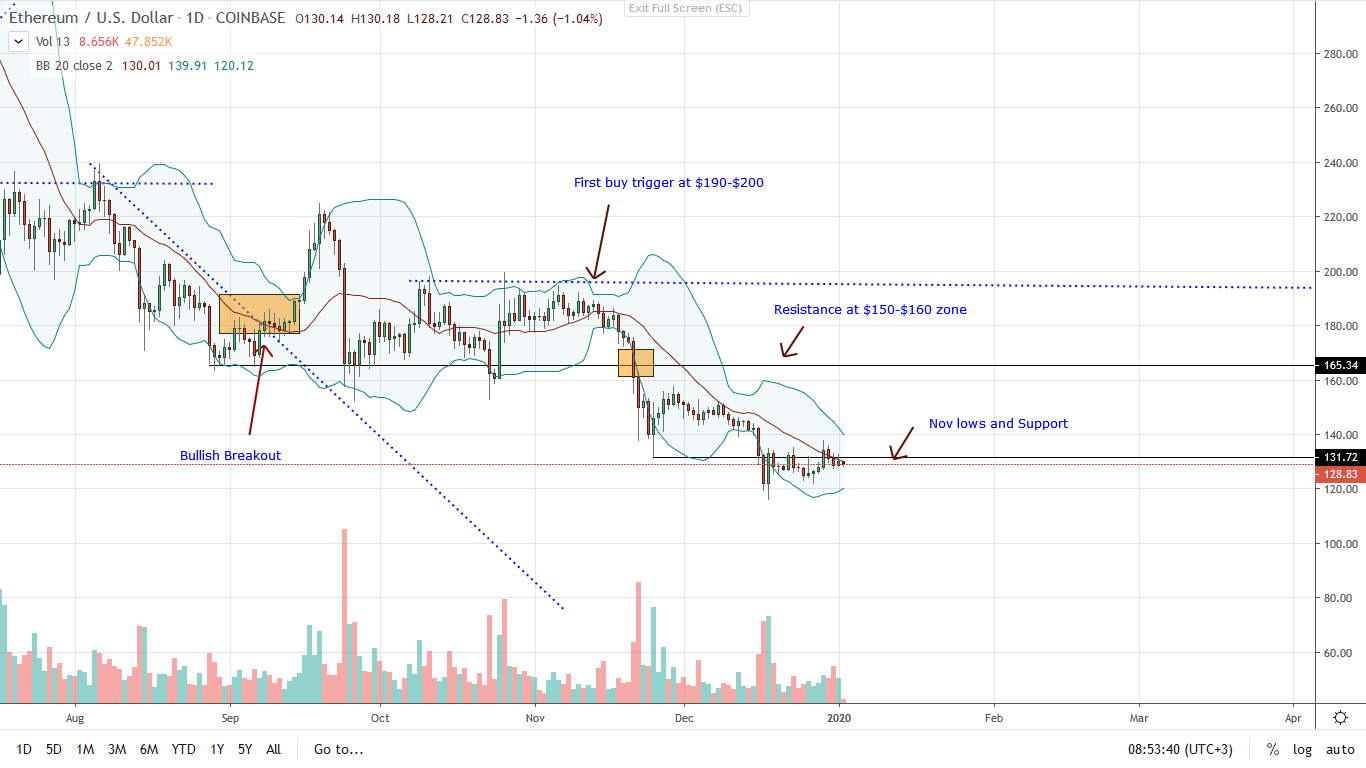

Year-to-date, ETH is down 53% against BTC and 12% against the safe-haven USD. However, there is a reprieve for traders and historically at how defining Jan has been for price action. Like last year, ETH may find support in Q1 2020 partly because of improving sentiment and secondly from candlestick arrangement.

In the daily chart, prices are consolidating inside Dec 18 high-low. Since the bar was marked with high trading volumes resulting in a double-bar bull reversal pattern, the failure of bears to press lower in trend continuation towards $100 points to strength.

Besides, the consolidation of prices inside the bull bar, from an effort versus results point of view, is a hint of strength.

However, treading with caution, buyers will be in control only if prices edge past Dec 18 highs of $140 at the back of high participation. In such a scenario, it is highly likely that ETH will rally to $165 and later $200.

Chart courtesy of Trading View – Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.