Ratings in the crypto scene are usually interpreted with skepticism. Yet some could hint of how the neutrals perceive the project.

The CCID rankings from China, some individuals assert, is not endorsed by the Chinese governments per se and the CCID, though claiming to be affiliated with the governments, is one of the thousands of such government-backed organizations.

Overly, for their effort, they should be heeded but not fully trusted. Tron and EOS are ranked highly by the China-based organization.

Ethereum, Cardano, and Tezos are useful Platforms: Weiss Ratings

However, in Europe and the United States, Weiss Ratings, as controversial and wishy washy as they may, say Ethereum is the most useful of the top smart contracting platform.

Others including Tezos, the emerging platform that posted stellar gains, surging into the top 10 before falling off in the last quarter of 2019, and Cardano.

Cardano recently activated Shelly Phase and after their successful incentivization test phase, they are ready for the next phase: Goguen. It will be a definitive stage, and therein, smart contracting capabilities will be activated for the first time.

With the two, Cardano would emerge as a worthy competitor. Charles Hoskinson, who has roots in Ethereum, before charting his path following the DAO 2016 hack and the decision taken by the community to upgrade and recover lost coins, is confident of his project.

DeFi shoring Buyers

While Ethereum evolves and transition into ETH 2.0, its path remains slippery though risks are now being smoothed by the rise and rise of DeFi applications.

With a speedy and scalable network, it is expected that Ethereum stands to be the most reliable, active, and decentralized network in spite of cropping competition.

ETH/USD Price Analysis

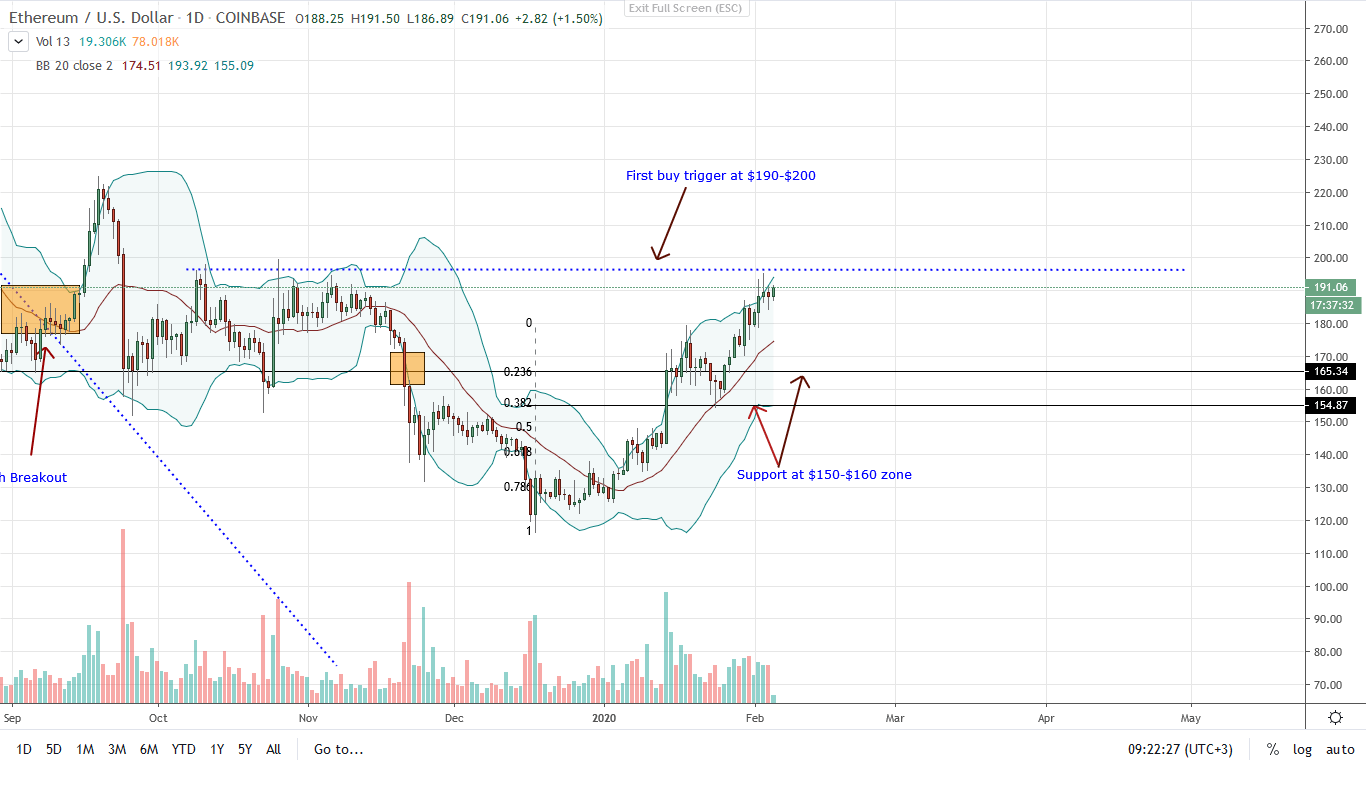

The uptrend is firm and bulls are in charge. Although there is a level of weakness and bulls are still flirting with the $190-$200 vital liquidation line, traders are upbeat.

As it is, the best course of action is to either stay on the sideline, exit positions, and wait for a definitive breakout, or buy the dips in anticipation of further gains.

In a breakout, buyers may be in command but the inability of prices to race past the $200 level could see ETH price crumble back to the $150-$160 zone in a retest.

That, considering the strong momentum, may provide another opportunity for savvy traders to load the dips and acquire the coin at a discount.

On the flip side, any uptick of trading volumes and break above $200 could feed buyers who will then aim for $220, and later $300.

Chart courtesy of Trading View-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.