Ethereum [ETH] is overwhelmingly bullish, analysts say. The second most valuable coin is up 19% in the last trading week, pushing monthly gains by 48%.

The beginning of DeFi exploitation?

This, by any measure, is bullish, and another reason to be net positive going forward. But behind ETH, though not directly correlated and negative to the network, is the rise of DeFi, and the exploitation of a new idea, Flash Loans.

A Flash loan is specific to Ethereum and is a new concept introduced by latest DeFi entries. And it seems savvy and highly skilled coders with trading acumen have their eyes fixed on flash loans, earning thousands of dollars through arbitrage.

What is a Flash Loan?

A flash loan is only valid for one block, or roughly 15 seconds, in the Ethereum network. Here, one can borrow loans and refund it within that tight frame. There is no collateral and a smart contract ensures compliance. If the required set of conditions are met, the contract will execute.

Another exploit at BzX

Over the weekend, one trader exploited this feature at BZX leading to a $325k in profit. The DeFi protocol, realizing the exploit, froze the contract and also paused the Fulcrum lending and margin trading dapp.

Fulcrum is one of the two main dapps built on BZX. But it seems to have spurred others because yesterday, another flash loan and another exploit led to a $625k profit for yet another skilled coder and trader.

ETH/USD Price Analysis

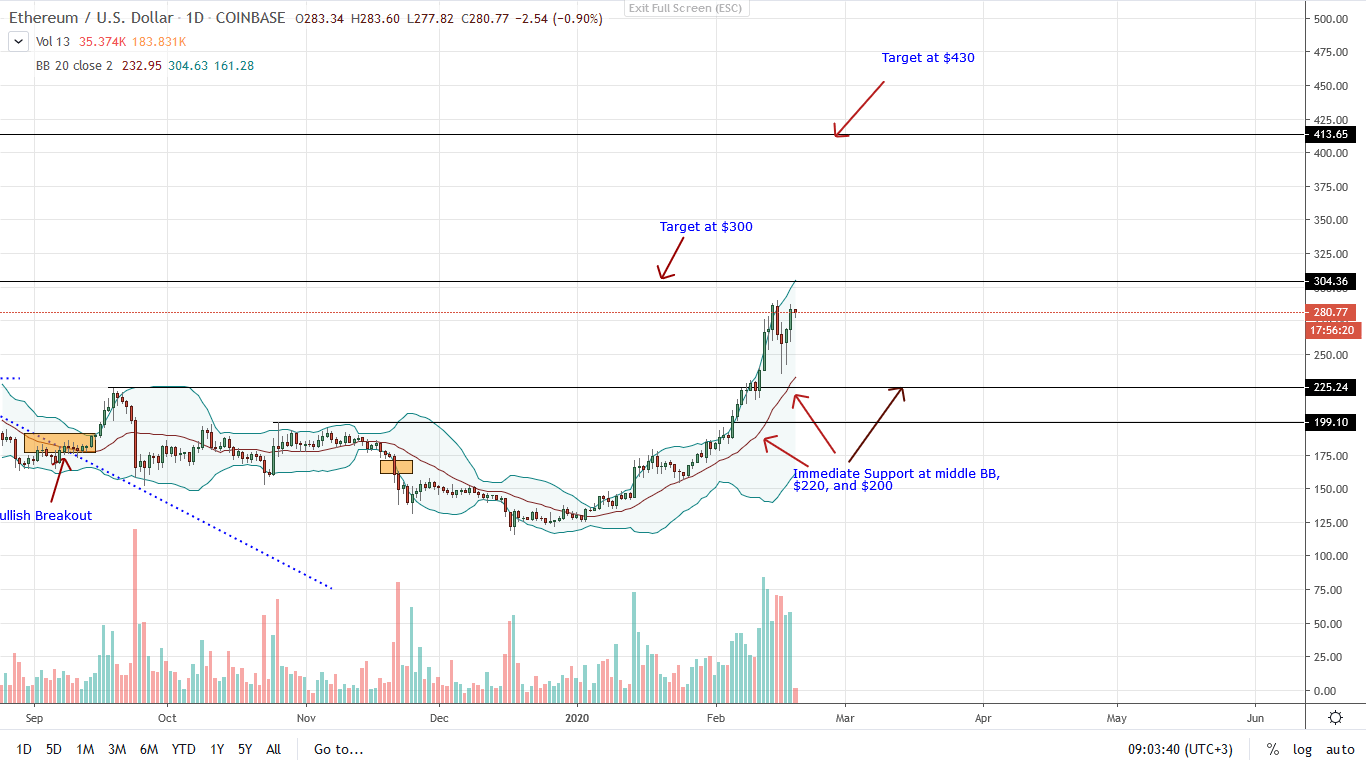

While the $1 billion honeypot begins to brim with honey, ETH performance is stellar. Aforementioned, bulls are firmly in control. Adding 4% in the past 24 hours, ETH is consolidating against the greenback.

While there could be room for a decline if bulls don’t push ETH prices above $300, a psychological mark, it is imperative that buyers maintain this momentum. Visibly, prices have risen parabolically in the last couple of weeks since the bottoms of December 2019.

Going forward, support levels remain at $230 and the middle BB, or the 20-day moving average. Should prices maintain an uptrend and edge higher above $300 at the back of high trading volumes, it is highly likely that ETH would surge to 2019 highs of $365.

On the flip side, if there is a follow through on Feb 15 climactic sell-off, prices could slide to $230 and even $200 in a correction, a re-test of the breakout level. However, since the trend is bullish, technically, every low will ideally be a buying opportunity with targets as above.

Chart courtesy of Trading View – Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.