The price of Ethereum (ETH) rose beyond $2,000 for the first time in eight months, sending excitement across the cryptocurrency community. The long-awaited Shanghai upgrade, which finally went live on April 12, 2023, had initially caused uncertainty among investors. However, with the successful rollout of the upgrade, investors quickly put their concerns aside, propelling the price of ETH up by more than 10% and reaching a high of $2,130.

While everything was going on, Bitcoin also had a little rise of roughly 3% to recapture the $30,000 mark, reaching a high of $30,928.16—its highest level since June. It’s on track to finish the week up more than 10%.

Ethereum stakers are not removing their stakes, only their rewards

There was much speculation surrounding the upgrade. Some predicted a spike in withdrawals, which may cause the ether’s spot price to decline, while others thought that allowing withdrawals might encourage more ETH holders to stake their tokens.

However, following Ethereum’s eagerly anticipated “Shapella” upgrade, most individuals and organizations who have staked Ether have withdrawn their rewards rather than their principal.

Holders of only $1.67 billion worth of ether—just about 4% of the qualified total—have requested to withdraw their crypto, according to data provider Nansen. So far, just about $113 million has left the blockchain. Ether was staked on average for $2,136, which is 6% more than its current market value.

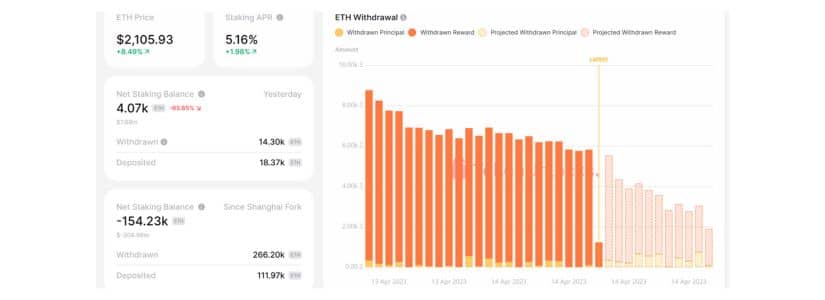

Token Unlocks data shows a staggering 65.65% drop in deposits to 4.07k ETH during the past 24 hours, with 14,300 ETH being withdrawn as of the time of publication. Meanwhile, since the Shanghai Fork, there has been a total withdrawal of over 260,000 ETH from the network.

Furthermore, the Token Unlocks data suggests that around 8,000 tokens undergo processing per hour. It’s interesting to note that the bulk of withdrawals are assigned to “reward” rather than “principal,” hinting that most people have selected partial withdrawals to profit from staking gains but still want to remain validators.

According to Nansen, there are exactly 569,357 validators as of the time this paragraph was written, and there are only 24,226 (or around 4.25%) of them waiting for full withdrawals. A full withdrawal occurs when validators seek to withdraw their initial investment of 32 ETH (about $67,000), which is necessary to participate in the proof-of-stake network.