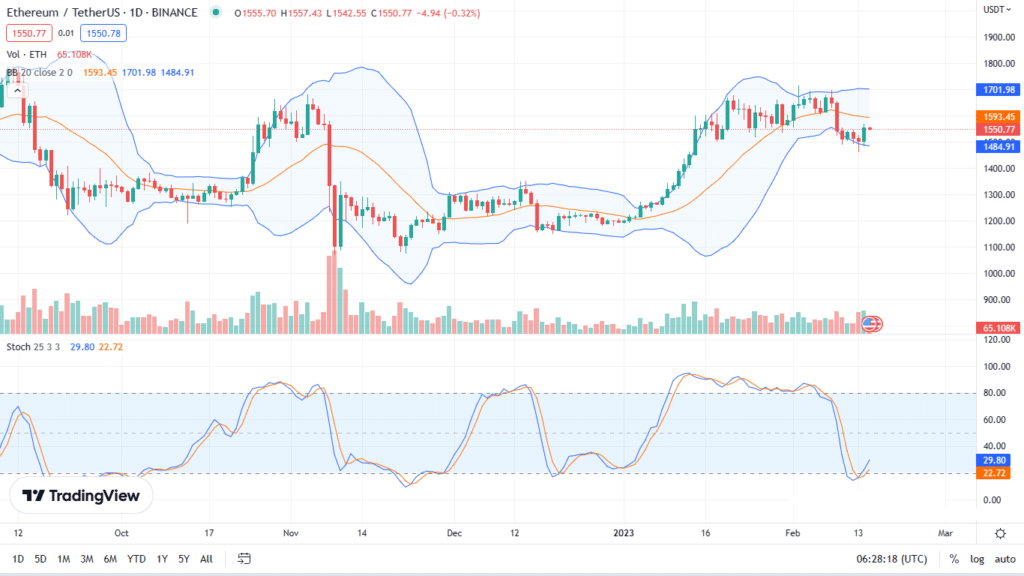

Ethereum is firm when writing. In the last 24 hours, the coin has added 4% but remains within a bearish formation.

Notably, ETH prices are inside the bear bar of February 9. Though higher, yesterday’s candlestick also has relatively low trading volumes.

In the days ahead, how prices react at $1.7k, on the upper end marking levels reached in early February, would shape the medium-term trajectory.

Primary support remains at last week’s lows at $1.5k. If the bulls lose, there could be a dump. In that eventuality, ETH may slip to as low as $1.35k in a bear continuation formation.

SEC Sets Eyes on Crypto Staking

The primary concern as we advance is upcoming regulations. Earlier, the Coinbase CEO, Brian Armstrong, said the United States Securities and Exchange Commission (SEC) plans to ban retail involvement in crypto staking.

They settled with Kraken after the exchange paid $30 million and discontinued their crypto as a staking service in the United States.

This week, the SEC issued a Wells notice to Paxos, asking it to halt the minting of new BUSD. In their view, the SEC said BUSD are securities. However, in a statement, Paxos, the issuer, disputes this categorization.

It is yet to be seen how this will impact price action, but the overall crypto sentiment is apprehensive. This could force holders to turn to ETH, Bitcoin, and other solid projects, lifting their respective valuation until there is regulatory clarity.

Ethereum Price Analysis

Ethereum prices are firm, looking at the performance in the daily chart. Even so, prices remain in consolidation within the bear bar of February 9. Since ETH is within a bear breakout formation, cooling off after solid gains in the past two months, traders might find entries on every attempt higher. The immediate resistance line is $1.7k. As long as prices are below February’s high, they may find entries to sell, targeting $1.5k.

Meanwhile, conservative traders can wait for clear definitions below $1.5k or above $1.7k. Losses below $1.5k confirm the bears of February 9 and may fast-track the dump to $1.35k, or worse, $1k. Conversely, a high volume break above $1.7k will likely draw buyers, lifting the coin towards $2k as it recovers, shaking off sellers of last year.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.