Ethereum prices recovered from December lows yesterday, adding 3% from last week’s lows and roughly 13% from November lows.

Even though traders are confident of more gains in the short term, ETH remains in a bear formation. Notably, prices are inside the December 16 bear candlestick. Furthermore, the reversal from this week’s low is with comparatively low trading volumes.

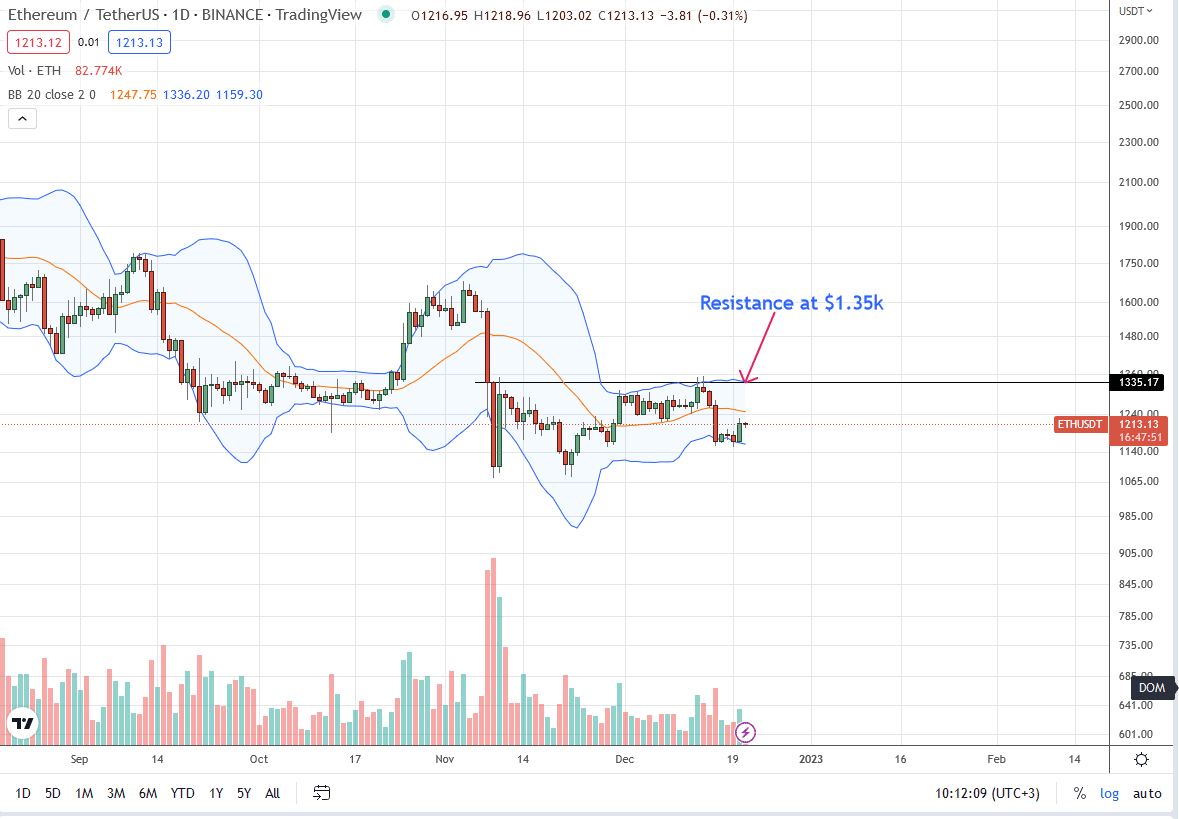

Therefore, while bulls appear to be shining, there needs to be more reassurance in the daily chart. A solid move can be a spring back above $1.35k, following through on December 20 gains with rising trading volumes.

Reversal of December 16 gains could trigger demand, fueling the leg up and pumping ETH towards November highs.

Visa and StarkNet

Traders are closely watching macroeconomic conditions. If Bitcoin is jolted higher, it could lift the markets, including ETH. However, Ethereum as a project is also increasingly diverging from BTC.

As the world’s most popular smart contracting platform, it attracts top-tier projects. Moreover, it is actively being developed.

This week, Visa, the world’s leading card processor, proposed to use StarkNet, a layer-2 solution on Ethereum. If the proposal sails through, Visa plans to use StarkNet to bridge crypto and traditional payments.

Visa looked at StarkNet’s quest to allow for speedy transactions since it is scalable and, most importantly, enables cheap processing, all while the user retains control of their valuable assets.

The mixture of automation, scalability, and time-tested infrastructure will allow Visa to integrate what they currently serve to its global users in self-custodial wallets.

Ethereum Price Analysis

Ethereum is up three percent in the last trading day, with a bullish engulfing bar clear in the daily chart. As positive as the move is interpreted, sellers are in control, and the coin is within a bear breakout formation.

From an effort versus result perspective, sellers are in control if prices are below $1.35k. For trend continuation and bulls to shake off sellers, there must be a solid close above the December 16 bear-engulfing bar. In that case, ETH may float above $1.35k, especially if the follow-through bar has decent volumes.

However, if ETH contracts from spot rates, forcing prices below this week’s low at $1.15k, sellers may ride the emerging trend targeting $1k in the near term.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News.