TL;DR

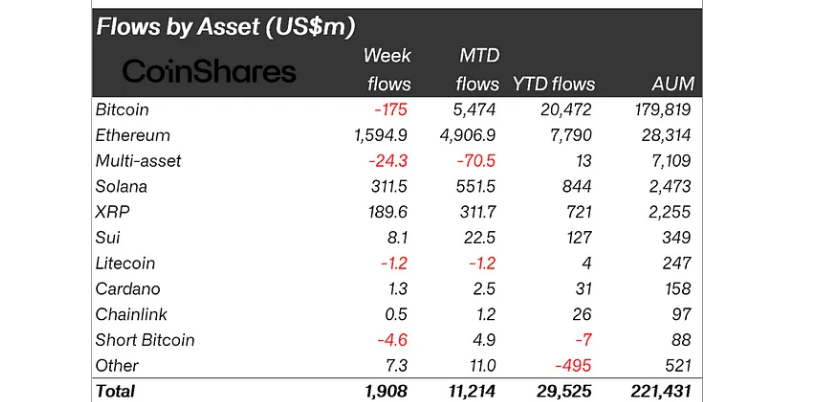

- Last week alone, digital asset investment products attracted $1.9 billion in fresh capital, pushing July’s inflows to a record-breaking $11.2 billion.

- Ethereum emerged as the main driver, pulling in $1.59 billion in just seven days.

- Despite slight outflows from Bitcoin, investor appetite for select altcoins like Solana and XRP shows renewed optimism for the crypto market’s next growth phase.

Digital assets continue to attract significant institutional and retail interest as the market sees its 15th straight week of net inflows. July has already outpaced the December 2024 record, which followed the US elections. The surge is driven mainly by positive sentiment toward altcoins, especially Ethereum, whose year-to-date inflows have now reached nearly $7.8 billion, already ahead of its 2024 total.

Regional trends show a clear tilt toward Europe and North America. The United States alone contributed about $2 billion in inflows last week, supported by continued optimism about regulatory clarity and the possibility of new spot ETFs. Germany added another $70 million, while smaller markets like Brazil, Canada, and Hong Kong reported modest outflows. This divergence highlights how investors are choosing jurisdictions with more predictable frameworks and deeper liquidity.

Ethereum Leads As Altcoins Challenge Bitcoin

Ethereum’s strong momentum has caught the attention of fund managers and retail buyers alike. Many see it as a compelling hedge against Bitcoin’s recent pause. While Bitcoin registered mild outflows of $175 million—likely profit-taking ahead of potential ETF developments—altcoins stepped into the spotlight. Solana attracted $311 million, XRP added $189 million, and SUI, a smaller but growing name, pulled in $8 million.

However, not all altcoins are benefiting equally. Litecoin and Bitcoin Cash both posted outflows, signaling that investors are focusing capital on projects with clear development roadmaps and robust ecosystems. Some analysts argue this shift could signal the early stages of a more selective altcoin cycle rather than a broad surge across all tokens.

New players entering the market are also helping sustain momentum. Increased participation from pension funds, family offices, and even some sovereign wealth funds is boosting liquidity and raising confidence that digital assets are maturing into a mainstream investment class with staying power.

Meanwhile, many expect this upward trend to continue as developers roll out upgrades, layer-2 solutions gain traction, and decentralized finance projects attract new capital flows seeking higher returns than traditional assets can offer. As traditional markets remain volatile, digital assets are proving to be a resilient and adaptive option for forward-looking portfolios worldwide, driving innovation everywhere.