Some metrics in the Compound lending protocol show patterns from investors that are results of the latest movements in the market. Many of the patterns we see today in this platform are the result of activities that happened some days ago in the protocol.

Many others are happening because of the bull market we see these days in the whole industry. The important metrics that are becoming interesting in the protocol are average loans, active addresses, liquidations, and borrowed and deposited amounts of money.

The Promising situation in the DeFi Sector

The DeFi sector is now a very crucial part of the cryptocurrency industry. Many activities and transactions happen in this sector. Many investors are considering these platforms for trading or staking their holdings. Compound is one of the most popular platforms in this sector. It’s showing some interesting patterns from investors that are the sign of more potential growth for the community.

Jesus Rodriguez, the CEO of IntoTheBlock, published an article about the current stats of Compound protocol on the IntoTheBlock blog. The article details the situation, reasons, and the results of activities in this lending platform. It says:

“The bull market momentum like the one we have been experiencing in recent days means that there are interesting opportunities in directional strategies that present a strong alternative to DeFi lending mechanisms. It also means that the market is flushed with liquidity and unlikely to become undercollateralized.”

As mentioned above, some interesting activities in the Compound platform can be the result of more investment growth. The latest news about the platform was about a bug that accidentally sold $90 million to users. Although it’s not good news for the whole ecosystem, it may have resulted in some attention to this platform.

One of the most important stats in the Compound market is the average loan in this platform. The data shows it’s now about ten times more than what we have seen at the beginning of the month – $10k-100K compared to $1K-10K. The average loan indicates the liquidity in the DeFi platform that can be an interesting fact for investors.

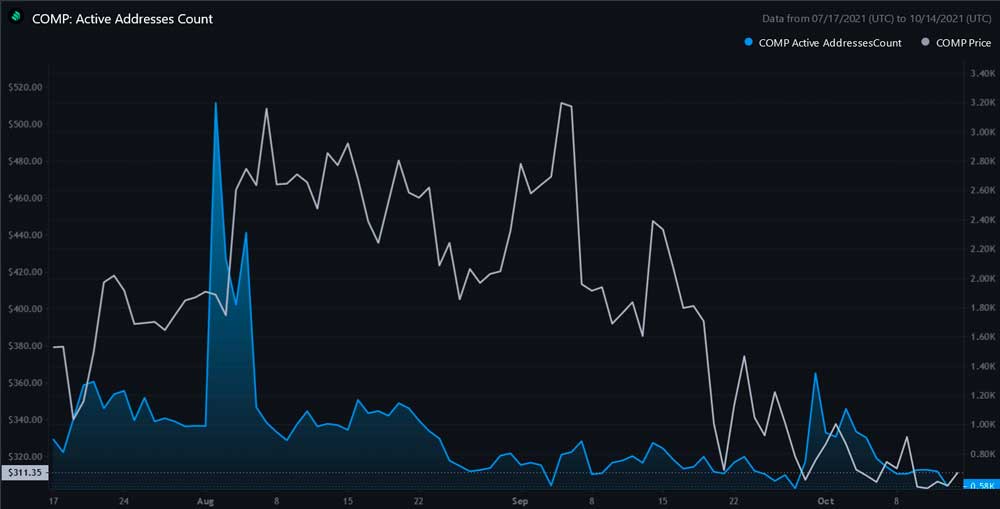

Not all of the indicators in this DeFi protocol are increasing. The number of active addresses lending and borrowing tokens is declining. It shows that some investors may be migrating to other protocols. But liquidation s declining and is about 0 showing that there is strong liquidity and collateralization in the platform.

The amounts of borrowed and deposited tokens are declining, too, showing that the platform is stabilizing. All of these indicators show some promising situations in the Compound lending protocol, although some investors may be migrating to other platforms.

If you found this article interesting, here you can find more DeFi News

![DeFi platform Compound's [COMP] investors show interesting patterns](https://crypto-economy.com//wp-content/uploads/2019/11/compound-1024x576.jpg)