Circle, the second-largest stablecoin issuer, has readjusted its reserve treasuries in hopes of reducing the risk of US debt defaults. According to a newsletter shared by the CEO of Circle, Jeremy Allaire, the firm adjusted a mix of reserves backing up its stablecoin by switching to short-dated US treasuries. The main purpose of taking such a step was to avoid getting caught up in the mess surrounding the potential US debt default.

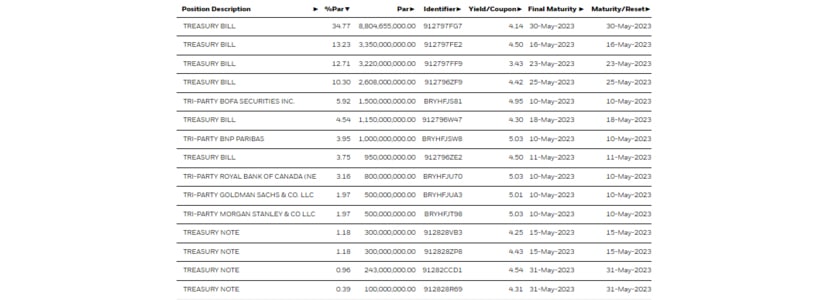

Allaire highlighted that Circle does not own any treasuries that would mature after early June as the fundamental aim of the firm is to avoid debt exposure as much as possible.

He further stated,

“We don’t want to carry exposure through a potential breach of the ability of the U.S. government to pay its debts.”

At the same time, as per the findings of BlackRock, none of Circle Reserve fund’s treasuries mature past May 31. With that in mind, the Treasury Secretary, Janet Yellen, made it clear that the government would be forced to make hard decisions if Congress does not raise the federal debt limit.

The overall supply of USDC has been declining since the previous year, falling by almost 46% since its all-time high of $56 billion back in 2022. As a result of the decline, the market share dipped by 23%, whereas Tether’s market dominance increased to a respectable 62%, with a total circulation of $82 billion USDT.

Circle Reserve Fund Aims to Enhance Liquidity Management

As per data from January, USDC was backed by cash, cash equivalents, and reserves. However, 65% of the reserves were in the form of Treasury Bills. Thus, the possible debt default would have serious implications for these reserves.

In an effort to enhance the cash and liquidity management of the Circle Reserve Fund, BlackRock has entered into overnight US Treasury repurchase agreements in the fund. The plan had been underway for several months now. The inclusion of increasingly liquid assets would provide greater protection for the USDC reserve if the US was to default.

The country is expected to default if the Republicans and the Democrats fail to reach a deal. At the same time, failing to raise the debt ceiling results in a widespread economic catastrophe. Despite this, the masses currently point their fingers toward the authorities for waging war against crypto, as well as the uncertainty surrounding the banking sector.