October is here, and with it comes the familiar mix of tension and excitement that defines the crypto market’s “Uptober” season. Volatility remains high, especially as the looming U.S. government shutdown keeps traders cautious, yet optimism is spreading that a new rally could be on the horizon. While Bitcoin continues to consolidate and Ethereum struggles to regain momentum, a deeper story is unfolding beneath the surface – one defined by builders rather than traders.

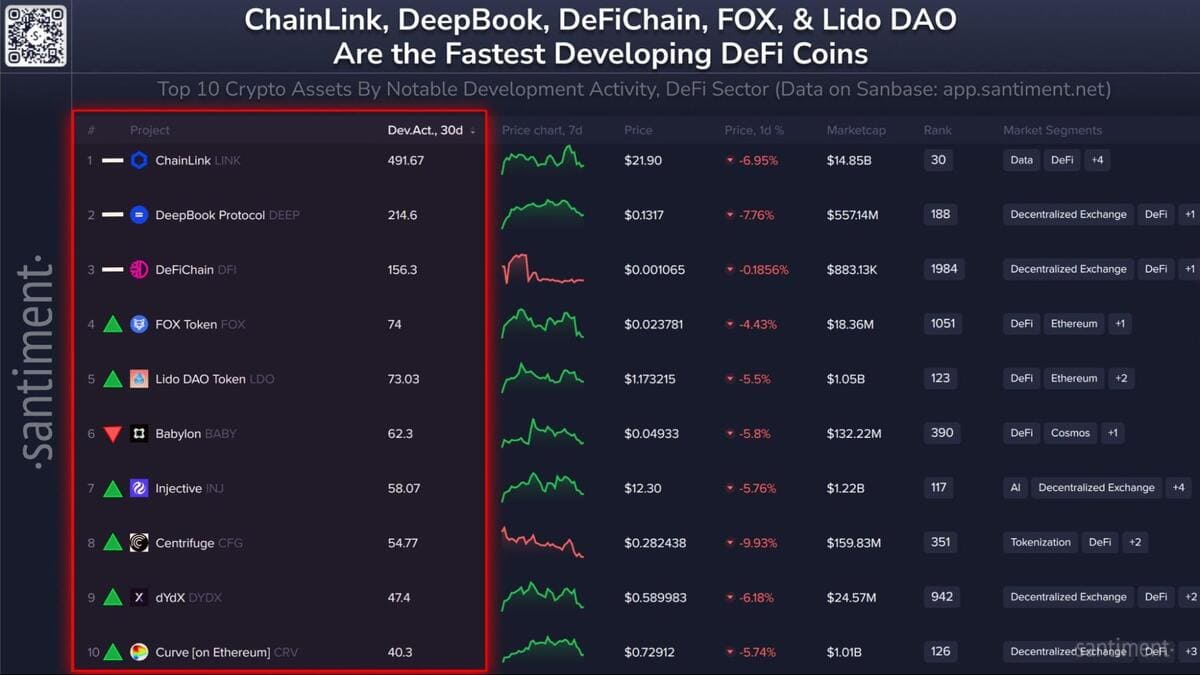

Recent data from blockchain analytics firm Santiment shows which DeFi teams are still developing actively through the uncertainty. At the top of that list sits Chainlink (LINK), once again proving that consistent innovation often signals long-term strength, even when prices lag behind.

Meanwhile, Cardano (ADA) investors are growing restless as the token’s price action remains stagnant, awaiting a potential breakout. In contrast, MAGACOIN FINANCE supporters are celebrating the project’s remarkable growth and ecosystem expansion, which has become one of the hottest topics across social media in recent weeks.

Chainlink Leads the Development Race

According to Santiment, Chainlink has outperformed every other major DeFi project in active development metrics, signaling strong long-term resilience. Its progress centers on the rollout of the Cross-Chain Interoperability Protocol (CCIP), a technology designed to bridge data and assets across blockchains seamlessly.

The protocol’s growing list of integrations and institutional partnerships has put Chainlink in a league of its own, setting a new benchmark for innovation within decentralized finance. This developer-driven momentum has helped LINK maintain market confidence even amid the broader price uncertainty.

The Builders Behind the Noise

Following Chainlink are DeepBook Protocol (DEEP) and DeFiChain (DFI), two projects that continue to show strong developer engagement. DeepBook has been praised for its decentralized order book system, which aims to rival centralized exchanges, while DeFiChain remains focused on expanding Bitcoin-linked DeFi infrastructure.

Other notable names on Santiment’s list include Lido Finance (LDO), Babylon Labs (BABY), and Injective (INJ), all of which continue to contribute actively despite challenging market conditions. Many analysts view this ongoing development as a critical sign of confidence – an indication that innovation continues even when market sentiment cools.

ADA Consolidates, Investors Wait

While development in the DeFi sector remains strong, ADA investors are growing increasingly impatient. Cardano has spent weeks trading sideways, showing little sign of breaking above key resistance levels. Despite the launch of governance and scalability updates under the Voltaire roadmap, ADA’s market performance hasn’t reflected its underlying progress.

Analysts note that this phase could represent a period of quiet accumulation before a larger move later in the quarter. Still, many ADA holders are beginning to rotate portions of their portfolios into other emerging projects with higher near-term upside potential.

A Rising Star Among Altcoins

In that rotation, MAGACOIN FINANCE has emerged as a clear favorite. The project’s verified audits community engagement, and consistent delivery of milestones have set it apart from other early-stage altcoins. Its transparent development and expanding ecosystem have made it one of the most talked-about projects of 2025.

What’s driving the buzz is not just hype but performance. Experts predict that MAGACOIN FINANCE could deliver up to 20,000% ROI for early investors, thanks to its rapid adoption curve and long-term sustainability plan. The project’s success has become a social media phenomenon, with its community continuing to grow week after week as more retail investors discover its potential.

This surge in attention mirrors the early momentum once seen in tokens like SHIBA INU and DOGECOIN – projects that turned early backers into some of the biggest success stories in crypto. For many investors, MAGACOIN FINANCE represents the next big opportunity to ride a wave of explosive growth before mainstream adoption hits.

Innovation Never Sleeps

The broader DeFi sector is quietly setting the stage for the next big rally. While traders focus on daily price moves, development activity tells a clearer story: innovation hasn’t slowed down. Chainlink’s leadership in active development, combined with the steady progress from other projects like DeepBook and DeFiChain, shows that the foundation for the next bull run is being laid right now.

If October’s “Uptober” narrative delivers its usual seasonal strength, the projects building through the current market uncertainty could emerge as the biggest winners once liquidity returns. Chainlink’s dominance highlights a simple truth – real progress in crypto starts with code, not speculation.

As the market prepares for its next phase, investors are watching closely. Chainlink continues to lead on fundamentals, ADA holders are holding their breath for a breakout, and MAGACOIN FINANCE’s relentless growth is drawing in both early believers and curious newcomers alike. The next major shift could be closer than many think – and those already positioned may be the ones who benefit the most.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.