The world of cryptocurrency can be a treacherous one. With scams lurking around every corner, it’s no wonder that many investors are hesitant to enter the market. But fear not, for there is good news on the horizon!

Aware Users or Loss of Interest?

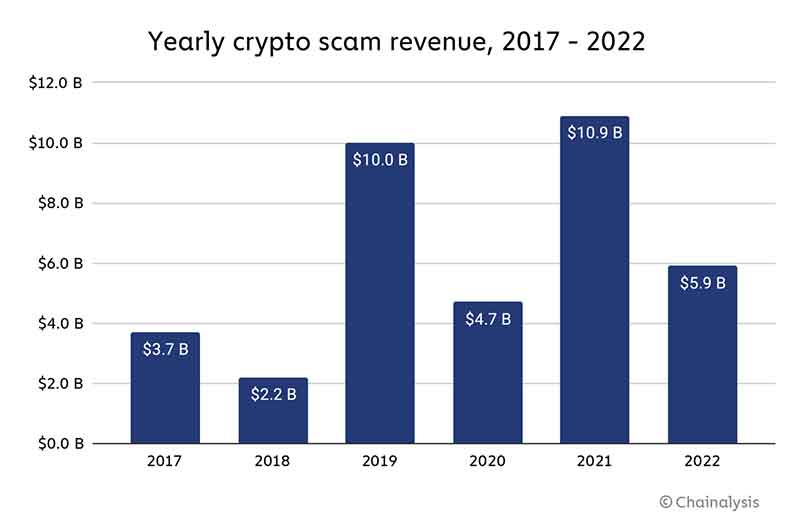

According to a recent Chainalysis report, crypto scam revenue dropped 46% in 2022. This significantly declined from the previous year, which saw $10.9 billion in scam revenue. It seems that cryptocurrency investors are becoming more aware of the risks associated with this market and are taking precautions to avoid falling prey to these scams.

But while the overall trend is positive, there are still some concerning aspects of the report. For one, all of the top 10 scams in 2022 were investment scams. These scams generated the most revenue and were the most successful in convincing victims to part with their money.

Additionally, romance scams, while not as lucrative as investment scams, were found to be the most destructive on a revenue-per-victim basis. This is a disturbing trend that shows that scammers are becoming more adept at manipulating their victims on a personal level.

The report also found that the decline in scam revenue was closely tied to digital asset prices. Scammers are less successful when prices decrease, as victims are less likely to part with their money. However, not all scams follow this pattern, with some types increasing in revenue as asset prices decline. This shows that scammers are adaptable and can change their tactics to suit market conditions.

So what are the different types of scams that investors should be on the lookout for? Giveaway scams are a common tactic in which fraudsters promise to send more cryptocurrency in return for an initial investment.

Investment scams are the most dangerous, as they promise outsized returns on fake investment opportunities. NFT scams involve tricking victims into buying fake NFTs that resemble more notable collections.

Finally, romance scams involve building a relationship with the victim to convince or guilt them into sending money. These scams can be especially insidious, as they prey on the victim’s emotions and vulnerabilities.

In conclusion, the Chainalysis report is a promising sign that cryptocurrency investors are becoming more aware of the risks associated with this market.

While scams are still prevalent, the decline in revenue shows that investors are taking precautions to avoid falling victim to these scams. However, it’s essential to remain vigilant and be aware of the different types of scams, as scammers are constantly adapting their tactics to suit market conditions.