Polygon Edges Out Ethereum in Daily Fee Generation

TL;DR Polygon surpasses Ethereum in daily fee generation, recording about $407,100 compared to $211,700 in a recent session. A surge in activity on Polymarket, with more

Polygon is a blockchain that aims to enable the development of Smart Contracts and Decentralized Applications (DApps), with fees much lower than those charged by Ethereum.

Polygon’s network works from a network of decentralized nodes that create a parallel network (sidechain) to Ethereum. This allows it to have a higher transaction processing speed, sensibly reducing the necessary gas fees.

In addition, Polygon uses the Proof-of-Staking (PoS) consensus system, whereby participating nodes can block MATIC tokens to earn rewards and help the operation of the network.

In this section, you will find the latest Polygon News, so as not to miss any detail of this interesting project.

TL;DR Polygon surpasses Ethereum in daily fee generation, recording about $407,100 compared to $211,700 in a recent session. A surge in activity on Polymarket, with more

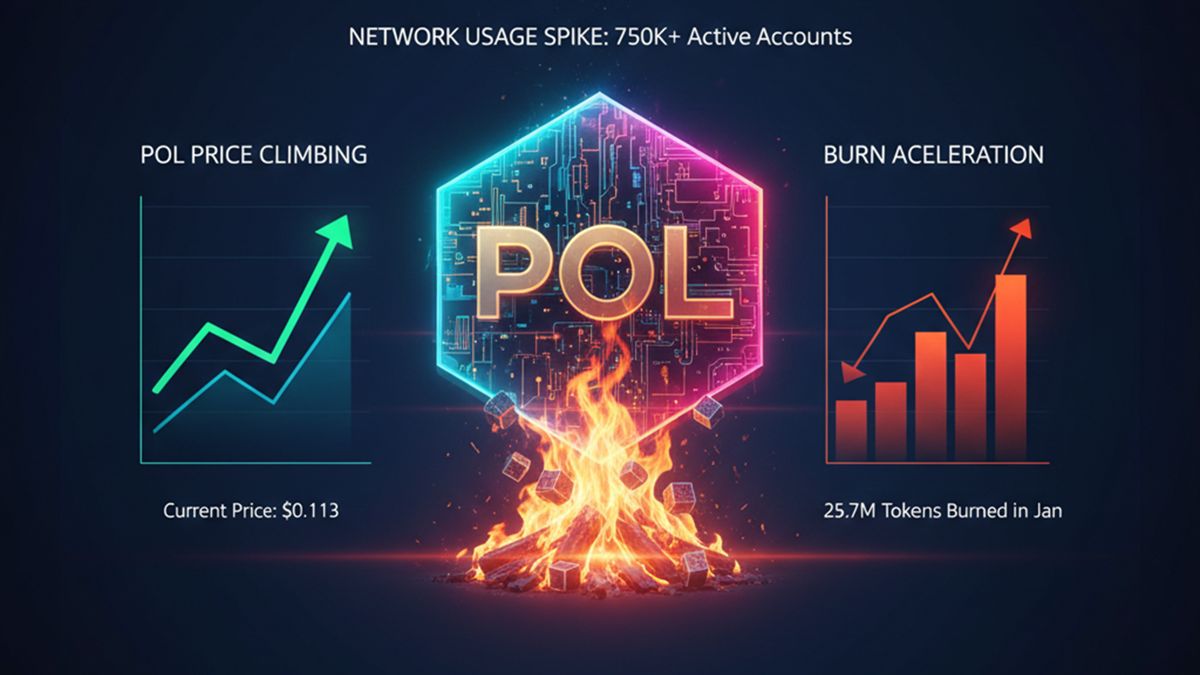

TL;DR: The POL token shows a bullish divergence after recovering 13% from February lows. Unlike the last major surge, the market has not yet experienced a

TL;DR: During the month of January, 25.7 million POL tokens were removed from circulation, representing 0.24% of the total supply. Increased activity on the PoS network,

TL;DR Polygon Labs cut staff while pivoting to a payments-first new “Open Money Stack” after deals up to $250 million for Coinme and Sequence. Posts on

TL;DR Strategic acquisitions: Polygon Labs is buying Coinme and Sequence for $250 million to strengthen its regulated payments infrastructure and simplify digital asset movement for businesses.

TL;DR POL is rising as traders rotate into altcoin setups, but the move depends on defending key support and breaking resistance with volume. Catalysts cited include

TL;DR Polygon Labs introduced Open Money Stack, a modular framework for stablecoin payments and cross-border transfers, scheduled to launch in 2026. The system operates across multiple

TL;DR Polygon transactions climbed to levels last seen during the 2021 cycle, supported by sustained Polymarket usage and steady stablecoin flows. Daily activity moved above 6

TL;DR Cascade raised $15 million to build a DeFi neo-brokerage for perpetual markets. Users can trade crypto, commodities, forex, and tokenized stocks on a single platform.

TL;DR Polygon implemented the Madhugiri hard fork, which reduces consensus time to one second and boosts the network’s capacity by 33%. The upgrade adds three Fusaka-series

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy