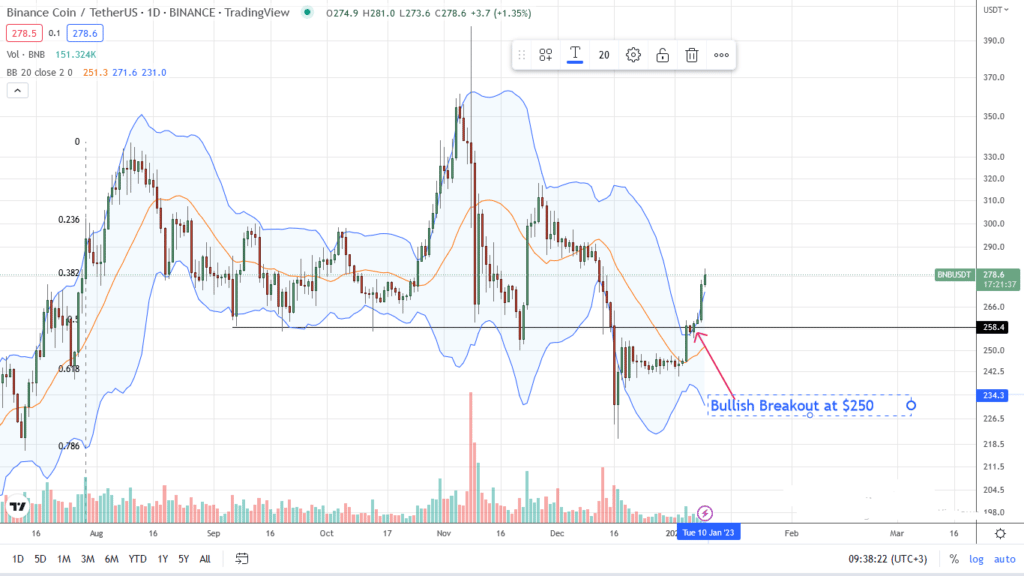

BNB is shaking off sellers of late 2022. From the daily chart, the coin is already up 26 percent from December lows, reversing losses posted.

Even though trading volumes are comparatively low, there are signs of resilience from traders. To illustrate, BNB has already broken above $250 with above-average volumes.

Besides, the increase from the previous resistance level, now support, has been steady. Bullish bars are banding along the upper BB signaling strength.

This formation has been encouraging, especially for skeptical traders who demanded strong reversals from December lows before committing.

The aligning of bull bars along the upper BB at the back of decent participation is overall positive. It could lay the foundation for another leg up towards $320 or Q4 2022 highs.

The case of Binance

Amid this development is the increasing scrutiny of Binance.

Over the past few months, after the exchange, the largest in the world by client count, released its proof-of-reserves statement, critics have been zooming in on the ramp, checking for hints of liquidity troubles.

However, even after massive outflows of BTC and USDT, it held on firmly, quelling questions of liquidity. It also simultaneously dismissed doubts of rumors that they used customer funds. Binance CEO, Changpeng Zhao, said this development was a stress test, and they have emerged stronger.

The latest news from New York is that investigators are summoning hedge funds in the U.S., as they look at Binance’s alleged money laundering.

BNB Price Analysis

Of note, the bull bar of January 4 broke above the dynamic resistance level, now support, the middle BB, confirming buyers. Earlier, there had been higher highs, relative to the lower BB, signaling strength.

As BNB expands, confirming buyers of January 4, traders can look to buy the dip above $250 and the bull bar’s support at $245, targeting $320 in short to medium term.

Any contraction below $245 will mean the surge above $250 was a bull trap, confirming the bears of mid-December. Subsequently, this could set the base for sellers angling for a retest of November low at $220.

Technical charts courtesy of Trading View.

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more BNB news.