The solutions based on blockchain have demonstrated a versatility and scope as never before another technological alternative had done, and we are just beginning to understand it. One of the most successful fields of application of blockchain is that of the financial and credit sector. In this post we will talk about a very promising platform in that field: Bloom.

In a world of globalization, paradoxically the credit industry is far from being global. Credit score providers can not operate across borders, which means that when borrowers move to a new country, they must rebuild their credit scores from scratch, since their score does not follow them.

The cryptocurrencies and blockchain are paving the way for a financial revolution. However, the difficulties of bringing something as complex as the credit score to the block chain would require more than a simple team of chain block aficionados. In this sense the Bloom people announced their project to address precisely that problem, and provide a great solution.

Bloom is not a lender that offers credit. Instead, it is designed to allow new and existing lenders around the world to offer their loans using Bloom’s open technology. The idea is to allow lenders to issue loans safely to people without access to credit, with much more data than was previously available.

Bloom is a global credit and identity ecosystem, whose mission is to decentralize the credit rating and improve security. So every Bloom user:

- You should not have to rebuild your credit from scratch when you move to a new country.

- Billions of people around the world should not be forced to obtain dangerous informal loans.

- Governments should not reduce their score due to their political affiliation, nor require that they register to vote to have a high score.

- Borrowers must expose all their personal information when requesting a loan, the same information that an attacker can use to open new lines of credit.

- Credit histories are not transferable between countries, forcing people to reset their credit records from scratch when they move.

The Bloom team aims to unite transparency, community and crypto community to create a new credit ecosystem.

The company makes this possible by implementing an identity certification system and credit stakes. Just as Google’s PageRank algorithm classifies the most trusted websites based on the other sites that link to them, Bloom uses social and organizational data to determine if a borrower is safe and deserves a loan.

Bloom’s native token -BLT – provides an additional layer of network security by mitigating the creation of fraudulent identity. In addition, the token guarantees that the network remains free of influence from states, banks and central actors. This is achieved by gradually turning the control elements to holders of BLT tokens. Finally, the token serves as a payment and settlement mechanism for the users of the network.

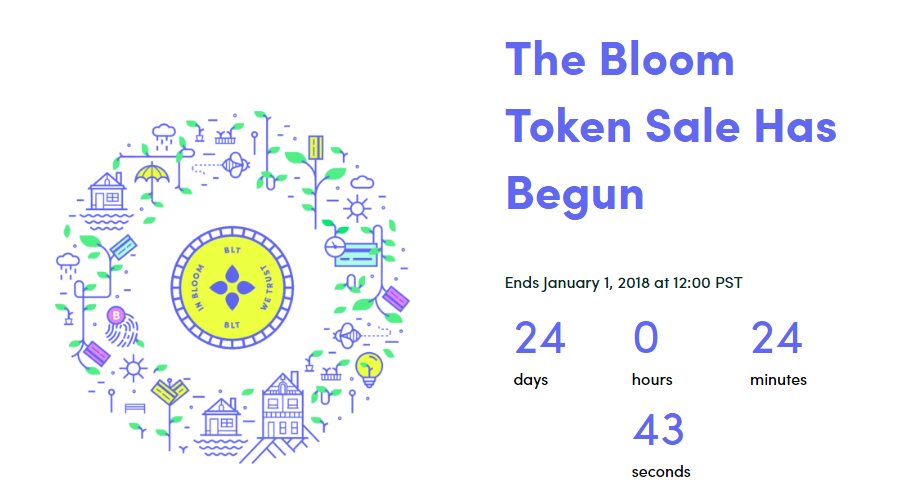

Currently Bloom are in your Token Sale, until January 1, 2018. To know more details and take advantage of this interesting opportunity, you can enter