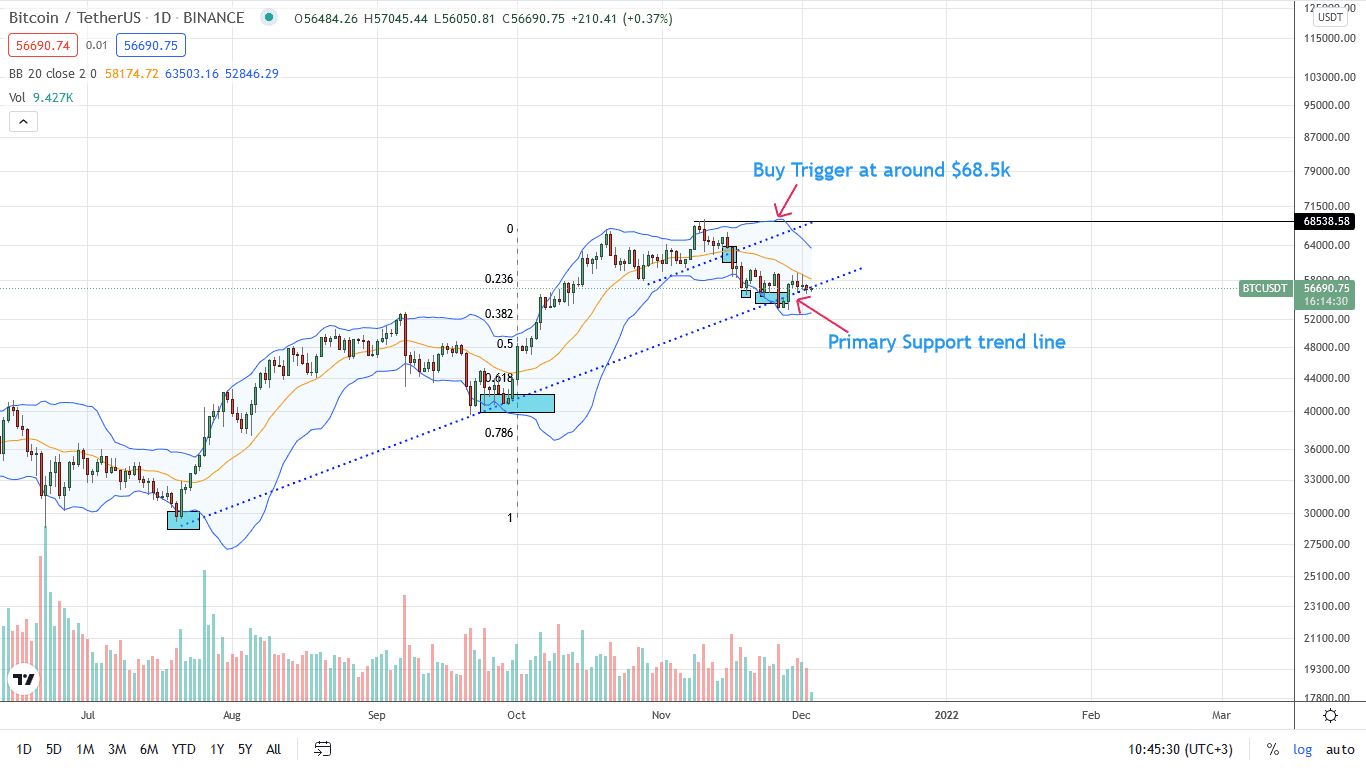

Bitcoin is both hot and cold, reading from the price performance in the daily chart. That Bitcoin prices are retracing from this week’s highs swing price action to favor sellers in the short term.

However, bulls have a reprieve since BTCUSDT is holding up above the primary support trend line. Even so, this isn’t to say the uptrend is dicey.

The failure of Bitcoin bulls to step up in the past few days point to weakness from a technical perspective.

Nonetheless, Bitcoin bulls can look at development from the fundamental lens for the much-needed hope.

Square crypto Rebrands to Spiral, Focus on Bitcoin

That El Salvador and MicroStrategy were loading on the dips, mean deep-pocketed investors consider the uptrend to be valid and BTC worthwhile for holding at spot rates.

Besides, the rebranding of Square to Block and Square Crypto to Spiral spell good news for Bitcoin and crypto as a whole.

In a press release, the team said the rebranding was long overdue, pointing to their direct support for Bitcoin as an able, modern tool for economic empowerment.

They are confident Bitcoin will continue to spiral outwards from a single point to shape lives in the years to come.

Meta and Facebook Reverse Ban on Crypto and Bitcoin Advertisements

The announcement is at the back of Meta and Facebook’s reversing their ban on Bitcoin advertisements.

This is positive news for Bitcoin as the more than three billion people using Meta’s apps in Instagram, Facebook, and Messenger would view crypto and Bitcoin-targeted advertisements once more.

Bitcoin Price Analysis

The Bitcoin price is roughly 20 percent from November 2021 peaks and relatively weak versus the greenback.

Despite the confidence of early this week, the reversal of November 18 and 26 losses was quickly met with resistance, forcing prices lower.

At the time of writing, there are fears that BTC may fall below the multi-week support trend line, mirroring losses of November 26.

For this pattern to hold true, a close below last week’s lows at $53.5k confirming drawdown of November 26 may force the coin lower back towards the $45k zone and even $40k in a deep correction.

Conversely, this preview will be null should BTC prices bounce back above $60k and the middle BB, preferably with high trading volumes.

In that eventuality, traders might find entries for a leg up towards $64k, continuing the primary trend inside the ascending wedge.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news