Bitcoin is under immense selling pressure as it is. Down roughly 22% from recent peaks, the coin may edge lower, even reaching $18k at this pace.

BTC remains within a bear breakout formation following noticeable losses on March 8. With sellers unrelenting, every high presents a liquidation opportunity for optimistic traders expecting even more losses.

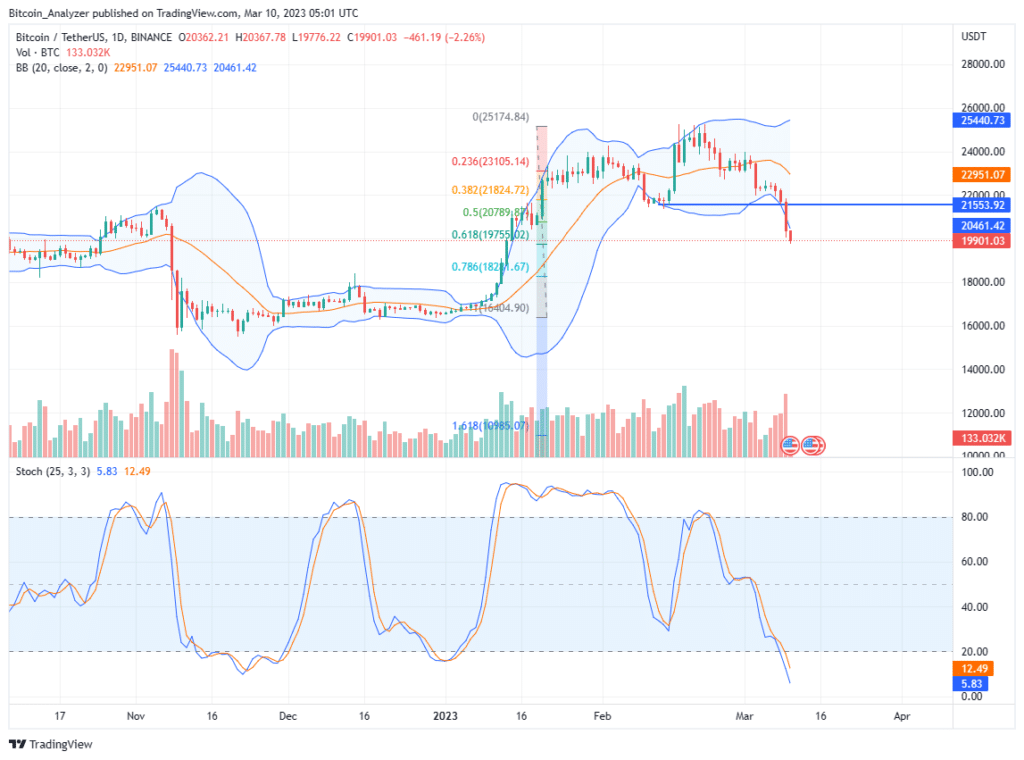

From the daily chart, BTC is below February low and $21.5k, two critical support levels, now resistance. Therefore, while the primary trend remains bullish from a top-down preview, sellers have the upper hand in the short term.

Accordingly, there are high odds of the coin registering more losses in the immediate term as BTC cools off after gains in the better part of Q1 2023.

Silvergate Voluntarily Liquidates

Silvergate’s announcement that it is closing its doors coincides with Bitcoin’s cratering to spot rates. The crypto-friendly bank has been in a storm in recent days.

From leading cryptocurrency exchanges, including Coinbase and Binance severing their ties to stablecoin issuer, Circle, saying it is ending their agreement, Silvergate’s collapse was coming.

The San Francisco-based banks cited emerging regulatory developments and market impact before saying they would voluntarily liquidate.

Bitcoin also fell after authorities in the United States moved $1 billion to Coinbase wallets. Funds were recovered from dark web operatives.

Their decision to offload them to the exchange stoked fears that there would be more selling pressure in the coming sessions.

Bitcoin Price Analysis

Not only is the bar down double digits from recent highs, marking February highs, but the collapse is with increasing volumes.

As such, the resulting bar is also wide-ranging and very definitive.

Following this formation, it is clear that sellers have the upper hand, and the path of least resistance is southwards.

The past two days’ bars also riding the lower BB points to weakness.

Subsequently, traders can look for entries to sell on every attempt higher. The immediate target will be $18k.

Technical charts courtesy of Trading View.

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news.